With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers show that Novo Nordisk, the leading producer of diabetes-care products, exhibits EVA Monster characteristics and is thus worthy of your attention. The company’s shares are available directly on Nasdaq Copenhagen under the ISIN code DK0060534915. On American OTC markets, the ADR uses the ticker symbol NVO.

Based in Denmark, Novo Nordisk is a global healthcare company that researches, develops, manufactures, and markets pharmaceutical products. With a heritage dating back over 100 years, Novo was the first company to industrialize insulin production. The firm has remained the leading producer of diabetes-care products up until today. It also pioneered GLP-1 therapies initially for diabetes care and essentially created a brand new industry by extending the application area to obesity treatment. The company was founded in 1923 and is headquartered just outside Copenhagen, Denmark.

When dissected by therapeutical areas, diabetes care generates ~80% of Novo’s sales. Within this category, GLP-1 treatments are the most significant. When blood sugar levels start to rise after someone eats, these drugs stimulate the body to produce more insulin, which in turn helps lower blood sugar levels. Importantly, GLP-1 therapies have proven effective in treating chronic obesity, mainly through the side effect of helping to curb hunger. Besides GLP-1 treatments, the firm also produces traditional insulin derivatives.

Overall, Novo accounts for just under one-third of the global diabetes market, holding undisputed leadership positions in both the traditional insulin and novel GLP-1 therapeutic areas. As for insulin, only two competitors (Sanofi and Eli Lilly) can match Novo’s global presence, rendering the market an essential oligopoly, while the GLP-1 diabetes care market is a duopoly (with Eli Lilly being the rival).

Since its very beginnings, Novo Nordisk has always been controlled by a foundation through a dual-class share structure, which today has a ~28% economic ownership stake in the business, yet possesses over 77% of the voting rights. While this means outside shareholders have little say in how the company is run, we deem the arrangement a net positive. Like in the case of luxury brands, we believe this structure can solidify Novo’s long-term competitive position instead of maximizing short-term profits. The foundation has ensured that the firm’s primary focus remains on investing in R&D to improve people’s lives. As long as that is the case, commercial benefits will naturally follow.

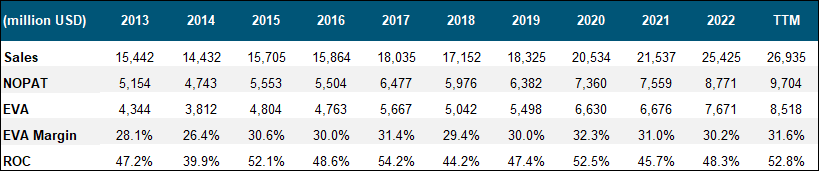

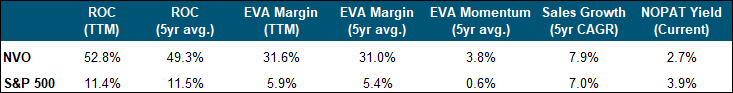

All things considered, we believe that Novo’s competitive advantages in diabetes and obesity care are the key factors supporting a wide moat around its business. On the quantitative front, the numbers speak for themselves. Novo boasts a mouthwatering EVA Margin north of 30% and a return on capital consistently over 45%, indicating a durable pricing power that is second to none in the pharmaceutical industry.

As for the future, the underlying drivers for growth are firmly in place, with a vast and underpenetrated total accessible market and secular forces supporting a long runway for profitable growth. The global population is aging and becoming increasingly overweight, which provides an unfortunate yet powerful tailwind to Novo’s operations in the coming decades. On top of that, access to treatment remains meager, with only ~15% of the 500+ million people affected by diabetes receiving proper care. The situation is even worse in the area of chronic obesity, where just ~2% of the estimated 650+ million people get medical treatment for the condition. While the traditional insulin business may stagnate in the foreseeable future, GLP-1 treatments will likely continue thriving for years.

Turning to capital allocation, the reinvestment rate sits near 25%, which mostly comprises capitalized R&D expenditures and manufacturing capacity expansions. Novo is very inactive on the M&A front, emphasizing in-house innovation with its insulin and GLP-1 franchises.

Capital distributions are nearly equal in proportion between dividends and share repurchases. Regarding the former, unlike most European companies, Novo boasts a 27-year immaculate dividend history. The payout ratio has historically averaged 50%, which signals unquestionable safety. On the buyback front, the firm has reduced its share count by ~20% over the previous decade. Unfortunately, repurchases seem rather automatic than opportunistic.

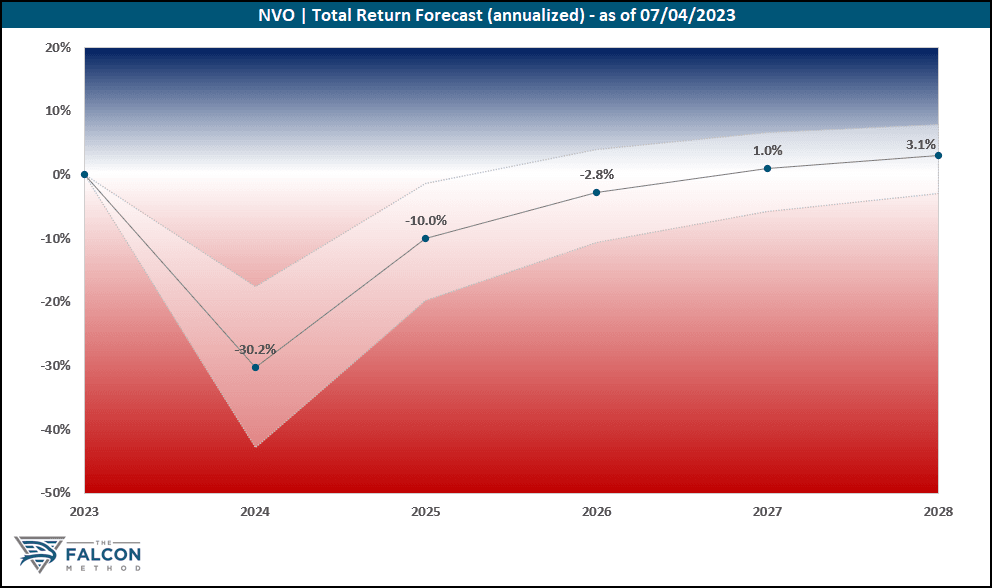

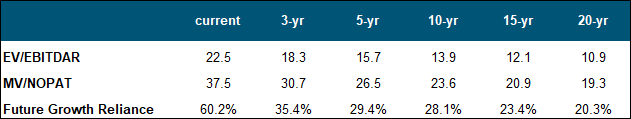

When it comes to the stock’s valuation, the rapid growth of GLP-1 therapies, further fueled by the enormous hype around the company’s weight loss drug Wegovy, has led to extremely upbeat market sentiment. While it’s plausible, it remains tough to determine whether the firm has embarked on a steeper growth trajectory, which would justify a higher fair FGR range going forward. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

While Novo’s business appears far superior to the market from both a quality and growth angle, there have been some occasions in the past when the market priced in minimal EVA growth. Even though waiting for a similar valuation might be far-fetched, today’s market-relative NOPAT yield seems paltry. No matter the angle we look at it, the stock appears to be priced for near-perfection at this point, and the valuation component acts as a significant headwind to the otherwise spectacular fundamental return potential. The “Key Data” table and the 5-year total return potential chart speak for themselves.

Overall, the FALCON Method can identify much better opportunities in the current market, so we are passing up on Novo for now.

The verdict

We typically avoid investing in pharmaceutical companies due to the need for medical knowledge to understand (let alone forecast) their drug development pipeline and the efficacy and safety of their current portfolio. Novo Nordisk is the only exception that has been included in our EVA Monster universe. Our confidence lies in the continuing dominance of a market leader in a lucrative and relatively stable sub-segment of therapeutics rather than betting the farm on the questionable success of an early-stage pipeline.

As for the risks, both Novo’s insulin and GLP-1 products are considered biological medications, characterized by their large and complex molecules derived from biological sources through manufacturing, extraction, or semi-synthesis. Since biosimilars for these formulations are difficult to produce and even harder to get approved by entities like the FDA, this has historically meant very little generic competition.

While Novo’s insulin portfolio held up well, it remains uncertain whether GLP-1 formulas will be similarly resilient to biosimilar competition. The company’s flagship GLP-1 drugs enjoy patent protection until the early 2030s. With an R&D budget well over 10% of annual sales, we have all the reason to believe that Novo will keep its innovation flywheel spinning and lay the groundwork for the eventual “post-semaglutide” era.

Another noteworthy aspect is that around half of the company’s sales come from the U.S., where pricing mechanisms in the healthcare system are rather intricate. Also, with pharma companies, legal risks are unpredictable.

All in all, we would buy Novo Nordisk at the right price, but would avoid overexposure, shooting for the lower end of a 3-5% portfolio weight.

The company ranked 40th of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 11% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!