One of the companies in our FALCON Portfolio announced in 2019 that it would discontinue the practice of giving quarterly guidance. That was Illinois Tool Works, and here’s the brief comment that I added to the news:

“I welcome this decision as quarterly guidance breeds short-termism that is the enemy of long-term shareholder value creation.”

In fact, you could read headlines in 2018 that Warren Buffett and Jamie Dimon (the chairman of the Business Roundtable and the chairman and CEO of JPMorgan Chase) joined forces to convince CEOs to end quarterly profit forecasts. They even wrote about the issue in an opinion column in The Wall Street Journal.

What do you think is wrong with the practice of quarterly guidance? Put simply, it shifts management’s focus from thinking about the long term to thinking about the next quarter. Companies forecast sales and profit numbers to Wall Street analysts, who use the data to produce research and stock recommendations for investors.

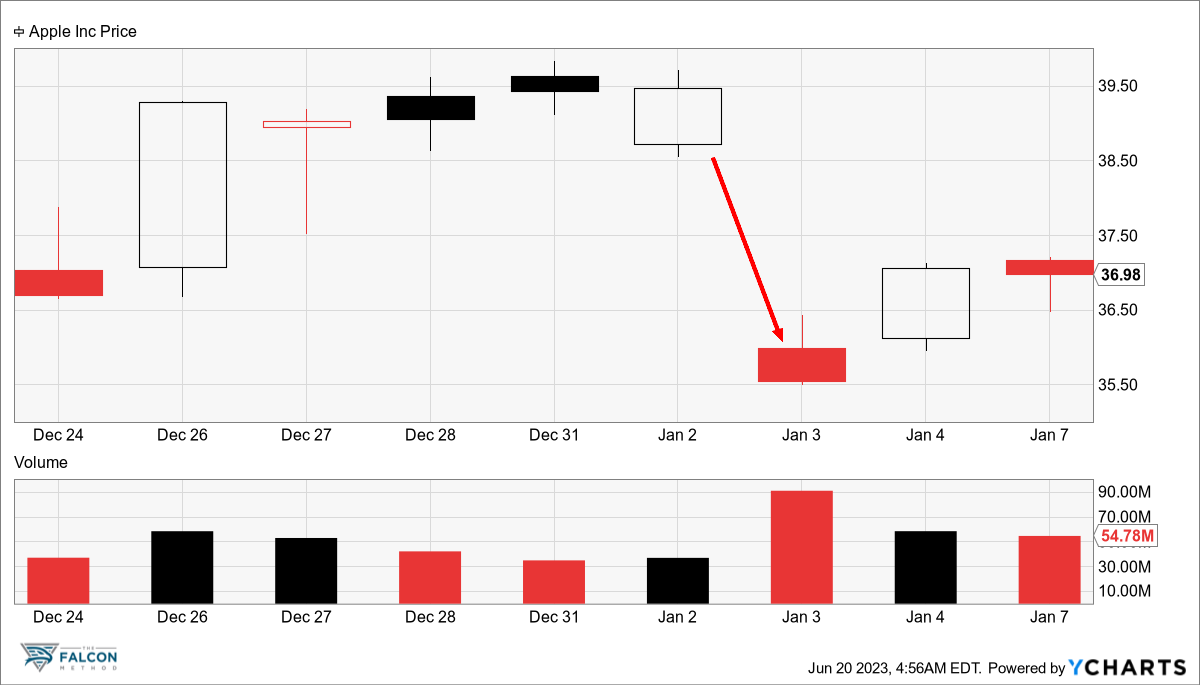

Missing “the number” can often result in huge and sudden stock moves. Think about Apple’s missed revenue forecast for its fiscal first quarter period that ended on December 29, 2018. CEO Tim Cook kicked off 2019 with a letter to investors describing various difficulties the company experienced during the holiday quarter. The number that analysts immediately focused on was the revised revenue guidance, which was lowered to $84 billion from a range of $89 to $93 billion given during the last earnings call on November 1. The market’s reaction was swift and severe, with the stock price falling nearly 10 percent on January 3.

On the other hand, making a forecast and then hitting the target are seen as a way to manage expectations and eliminate volatility.

While those in favor of guidance say that it improves communications with Wall Street, reduces share price volatility, and boosts a stock’s value, McKinsey & Co. found in a 2006 study that quarterly guidance had no effect on valuation multiples and didn’t reduce share price volatility. Instead, McKinsey found that the practice of giving quarterly guidance took up valuable time from management and made them focus too much on the short term.

Think about this last point! Earnings calls typically take place a month into the subsequent quarter, so analysts expect the management to not only talk about the prior period but to give a sense of how things are going during the current quarter. This essentially means that a month into a quarter, analysts ask executives to look at the first third of the quarter and make projections for the next ~60 days. Because investors pay so much attention to guidance, managers spend significant time thinking about these estimates, and this is time that they are not using to run the actual business!

Executives often feel pressure to make quarterly forecasts because the market appears to demand this, but “it can often put a company in a position where management from the CEO down feels obligated to deliver earnings and therefore may do things that they wouldn’t otherwise have done,” Dimon said in an interview on CNBC. “Quarterly earnings: they’re a function of the weather, commodity prices, volumes, competitor pricing. And you don’t really control that as CEO,” he added. “Sometimes you’re just like the cork in the ocean, but do the right thing anyway, and you’re going to be fine in the long run.” (Here is where the primary mission of long-term shareholder value creation comes into direct conflict with meeting and beating the short-term guidance.)

“When companies get where they’re sort of living by ‘making the numbers,’ they do a lot of things that really are counter to the long-term interests of the business.” (Warren Buffett)

Besides diverting management’s focus from long-term shareholder value creation, the widespread practice of quarterly guidance has another negative effect. When managers provide guidance, this effectively causes Wall Street analysts to crowd around the mid-point of the guided range in their own models. As a result, the variation of estimates is narrower than would be the case if analysts had to do their work. This kind of spoon-feeding does have serious consequences. I came across a well-written piece of opinion on Marketwatch that was titled “Why you can’t trust Wall Street analysts.” Here’s the essence of that writing:

“Many companies provide earnings guidance, which analysts incorporate in their estimates. For companies, guidance is designed to ‘under-promise and over-deliver’ in order to set up earnings beats, which propel the stock higher. Analysts are much more likely to rate stocks buy than sell, and if the beats help push stock prices higher, their track records as stock pickers look better. The conclusion: If you invest in stocks, you had better take analysts’ ratings and earnings estimates with a grain of salt.”

As to the uselessness of analysts’ recommendations, in 2000, Merrill Lynch analysts said there were 940 stocks to buy and only 7 to sell. Salomon said you should buy 856 and only sell 4. First Boston analysts were more negative; they only found 791 stocks to buy and 9 to sell. And Morgan Stanley said there were 780 wonderful businesses to buy and none to sell. This, right before the market plunged as much as 90 percent in some of these recommended stocks. The week that Enron went bankrupt, nine of the fourteen investment banking companies covering the stock had a “buy” rating on it. None said to sell it.

Here’s another eye-opening statistic from S&P Global Market Intelligence: in a typical quarterly earnings season in the U.S., two-thirds of S&P 500 member companies tend to publish earnings per share that are higher than the consensus estimate among analysts. This is hard evidence of the “under-promise and over-deliver” practice in action as well as the spoon-fed nature of the analyst community who fail to come up with their own forecasts but use the company’s guidance instead. After all, if each analyst had good information to formulate reasonable estimates, the average beat rate would be expected to be somewhere around 50%.

Let me summarize your takeaway. Most managers feel pressure to provide quarterly guidance. Once analysts get these numbers, they are quick to incorporate them into their models, and they most certainly do not want to look stupid by publishing estimates that are meaningfully different from the corporate guidance. Now that the spoon-feeding is done, both the executives and analysts know that it makes tremendous sense to under-promise and beat the heavily influenced Wall Street consensus quarter after quarter since this seems to drive stock prices higher (in the short run).

If you were an analyst familiar with the rules of this game, you would be biased toward issuing buy recommendations since (the highly probable) quarterly earnings beats can propel stock prices higher, thus proving your stock-picking ability and your worth to your employer. As a long-term investor, however, you should realize that short-termism is written all over Wall Street and is part and parcel of the above-detailed quarterly earnings game. Knowing this, you may still read the analysts’ research reports on companies, entire market sectors, or industries to obtain valuable information, but you should never let their recommendations influence your independent decision-making. You either have your own process for stock selection (like that of the FALCON Method), or you can easily fall prey to the predators of Wall Street who are much more eager to push up trading volumes than to boost your investment returns. (In fact, the McKinsey study of 2006 found that the only significant effect of quarterly guidance was increased trading volumes.)

Don’t get me wrong, guidance and disclosure are two different things! While making quarterly forecasts makes no sense, publishing quarterly reports is useful. Truth be told, there is not much that could happen in any single three-month period that could alter the long-term investment thesis of a sensible investor, but it is still good to get some update on how the execution of the announced strategy is progressing. By the way, even a whole year is meaningless for us both in terms of our investment performance and the operating performance of the companies in our portfolio. As Buffett put it in 1966:

“Our investments are simply not aware that it takes 365-1/4 days for the earth to make it around the sun. Even worse, they are not aware that your celestial orientation (and that of the IRS) requires that I report to you upon the conclusion of each orbit (the Earth’s – not ours).”

Now you understand the rules of the game and hopefully accept that by playing the long-term game, we are rather the exception than the rule.

Want to learn more about our stock ranking methodology and evidence-based investment approach? Start with this blog post!