I usually read 4–5 books per month, and although not all of them are investment-related, I often find striking parallels between the actual topic and the way I invest. The title “Scorecasting: The Hidden Influences Behind How Sports Are Played and Games Are Won” serves as an excellent example.

Following conventional wisdom leads to suboptimal choices most of the time, both in the field of sports and investing. David Romer, a prominent Berkeley economist, says that the play-calling of NFL teams shows “systematic and clear-cut” departures from the decisions that would maximize their chances of winning.

Based on data from more than 700 NFL games, Romer identified 1,068 fourth-down situations in which, statistically speaking, the right call would have been to go for it. The NFL teams punted 959 times. In other words, nearly 90 percent of the time, NFL coaches made the suboptimal choice. Of course, that suboptimal choice was the conventional one. After all, as a manager, it is harder to lose your job by making a typical decision than by doing something unusual, even if the latter had a higher expected value.

Scorecasting highlights several examples like the above. “We found that NHL teams pull their goalies too late (on average, with only 1:08 left in the game when down by one goal and with 1:30 left when down by two goals). By our calculations, pulling the goalie one minute or even two minutes earlier would increase the chances of tying the game from 11.6 percent to 17.6 percent. Over the course of a season, that would mean almost an extra win per year. Why do teams wait so long to pull the goalie? Coaches are so averse to the potential loss of an empty-net goal—and the ridicule and potential job loss that accompany it—that they wait until the last possible moment, which actually reduces their chances of winning.”

What does this have to do with investing? Well, the evidence cited above has just killed the notion of full rationality (had you ever signed up for the rational person hypothesis in the first place). If you lose the ordinary way—by doing what you are expected to do—everyone will gladly commiserate with you, and you can simply blame that loss on bad luck. Imagine, in contrast, what would happen if you dared to do something extraordinary that didn’t turn out so well. Lose in a “stupid way,” and you are left alone to draw conclusions and get back to the herd as soon as you are ready to follow the conventional wisdom again.

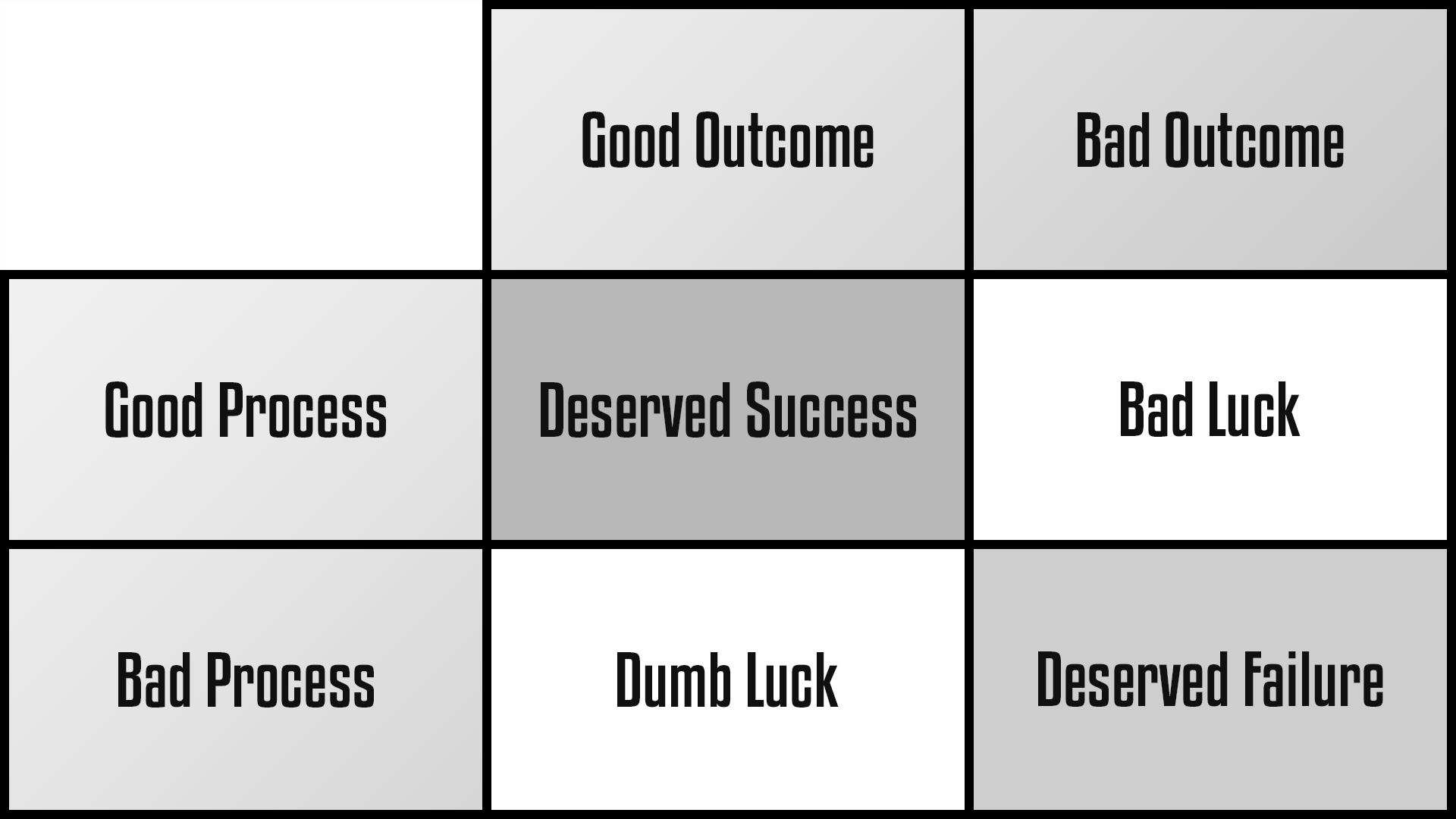

Of course, this is just hindsight bias. If you did the right thing but failed because of bad luck, you’re labeled stupid. If you did the wrong thing but succeeded because of good fortune, you’re hailed as a genius. In reality, it’s often the opposite, but the psychological burden of going against the crowd is enormous.

Are you familiar with the process-outcome matrix? Focus on the process you can control, and don’t let the short-term outcome divert you from the winning strategy! This message is so important to keep in mind that I have the matrix on my fridge door.

As long as you are buying the overhyped and overvalued darlings of the market, you are doing everything right from the herd’s point of view. Underlying probabilities say that your performance will not be that great, but hey, you’ll have a lot of people to commiserate with! What if you bought an out-of-favor stock instead? As investing is probabilistic and never deterministic—although the base rate may support you—there is absolutely no guarantee that your particular pick would perform well. If, for some reason, it turns out to be a subpar investment, you will get the rotten tomatoes for purchasing the stock of a company that was “so apparently a dud.”

Can you handle the pressure of going against the crowd and being wrong sometimes? This brings us to the next psychological issue of the not-so-rational person, the question of broad vs. narrow framing. Narrow framing means that every stock matters to you individually, and you want to win with all of them. Coupled with the standard loss aversion, this narrow framing leads to disastrous performance and a lot of misery. Closely following daily fluctuations is a losing proposition because the pain of frequent small losses exceeds the pleasure of equally frequent small gains.

In contrast, broad framing means that you want your stock portfolio as a whole to perform well, and you are not that focused on individual stock positions within that portfolio. This latter frame of mind can hugely increase the willingness to invest in stocks (the proven best asset class for wealth building). For my part, I would never take one single bet even with the odds in my favor, but I gladly take that same bet if I am allowed to do it many times so that probabilities can play out and my advantage can materialize. Call me risk-averse, but this is exactly what broad framing is about!

It is easier said than done, I know. Scorecasting highlights that professional golfers are also risk-averse and plagued by narrow framing. In golf, the idea is to maneuver the ball into the hole in as few strokes as possible on every hole, no matter what. Even Tiger Woods—so unflappable, so mentally impregnable—changes his behavior based on the situation and putts appreciably better for par than he does for a birdie, evaluating decisions in the short term rather than in the aggregate. He should optimize for the total number of strokes, yet he is deviating from that strategy. Analogize this to your retirement portfolio. You simply want the most favorable total at the end. It shouldn’t matter how you got there. The soundness of the underlying process is decisive. However, a single year’s or position’s performance is of minor importance in the grand scheme of things and should thus never be taken too seriously.

As we are aiming for above-average returns, the FALCON Method goes against the crowd most of the time. However, simply being contrarian—doing the opposite of what others are doing—would be just as foolish as following the herd; this is why we pick our spots carefully and employ an evidence-based investment method that is “selective contrarian” in style. Some subscribers emailed me their concerns that they had read negative articles and analyses about the companies in our FALCON Portfolio. As long as the factually proven underlying factors of our stock selection process are pointing toward a buy decision, you should be happy to bump into all those negative articles since they create and keep up the sentiment that diverts the stock’s price from its intrinsic value. By the time positive articles start to surface, your portfolio will be loaded with quality stuff purchased at bargain basement prices. E.g., I bought McDonald’s at $92.59 when positive opinions and analyst recommendations were nearly impossible to come by. The same with Microsoft at $41.05. I encourage you to take a look at the current prices of these two stocks and the positivity of the most recent articles and analyses on them. By the time the cheerleaders appear on stage, you should be done with your buying.

As an individual investor, you can have the enormous advantage of long-term focus. Unlike the NFL manager (not daring to go for it on fourth-down) or the wealth manager on Wall Street (sticking to the current darlings of the market), you will not be fired if you make unconventional evidence-based choices instead of the typical, often suboptimal ones.

Want to learn more about our stock ranking methodology and evidence-based investment approach? Start with this blog post!