I’m a practical guy, so let’s start with two case studies:

These will make it easier to understand the logic behind the two different kinds of stocks: Fallen Angels and EVA Monsters.

(If you haven’t already, please read my articles about commonly used multiples and EVA, the most demanding profit score.)

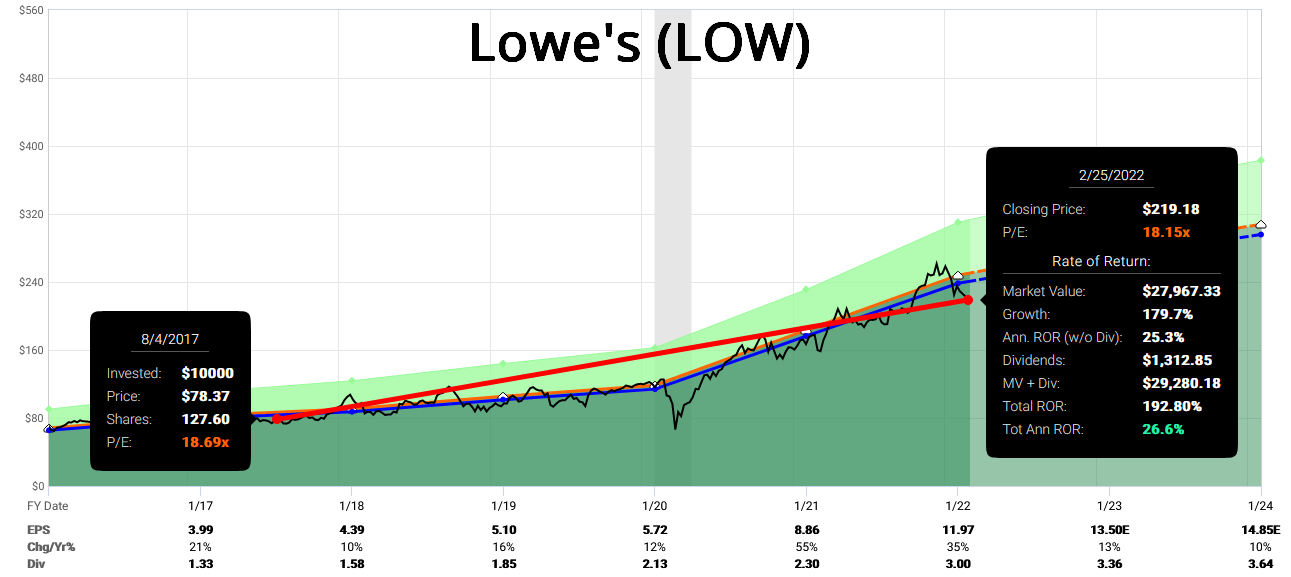

I bought Lowe’s (LOW) stock on August 4, 2017, at $78.37. As things stand, this investment has produced a ~27% annualized return in 4.5 years, and I’m still holding the shares.

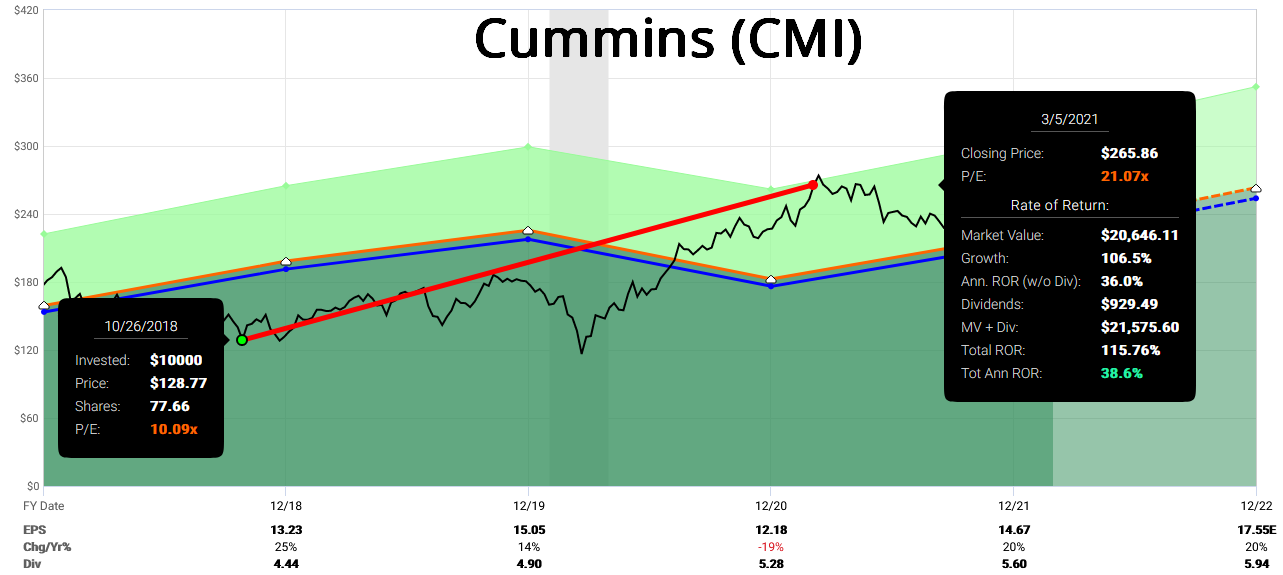

The second example is Cummins (CMI), which I bought on October 26, 2018, at $128.77 and sold at $265 on March 5, 2021, pocketing an annualized return of ~39%.

Source: FAST Graphs

There was a reason for selling the latter stock while holding on to my Lowe’s position. You’ll get it very soon.

Although the returns look great in both cases, Lowe’s and Cummins are two very different types of investment, and this is exactly what I’d like you to understand.

Why were these returns so high?

When you hold a stock, you can make money from two sources: the price can go up, and you can collect dividends. There is no other way!

To take it a step further, we can break up the stock appreciation part into two components: earnings growth and price-to-earnings (valuation) expansion/contraction.

So the comprehensive total-return formula looks like this:

Total return = Earnings growth + price to earnings expansion + dividends

Now back to the question: what drove those eye-catching returns in the two examples?

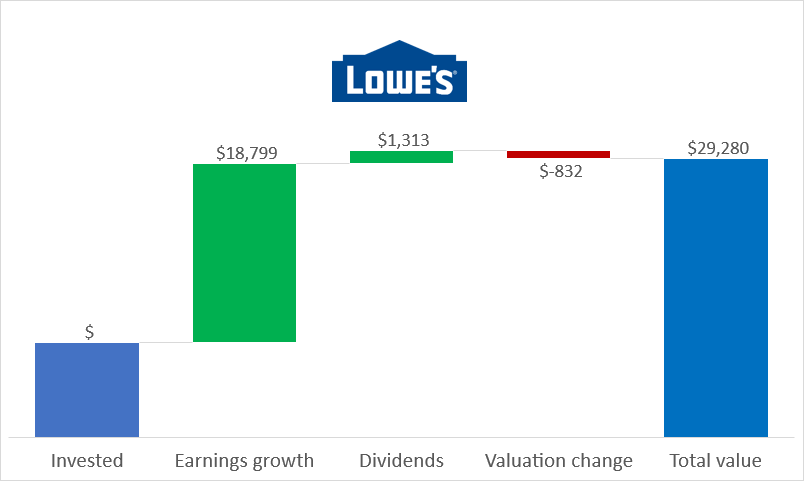

In Lowe’s case (the stock I held onto), the earnings per share almost tripled, while the PE multiple actually contracted somewhat (acting as a headwind), and we harvested growing dividends along the way.

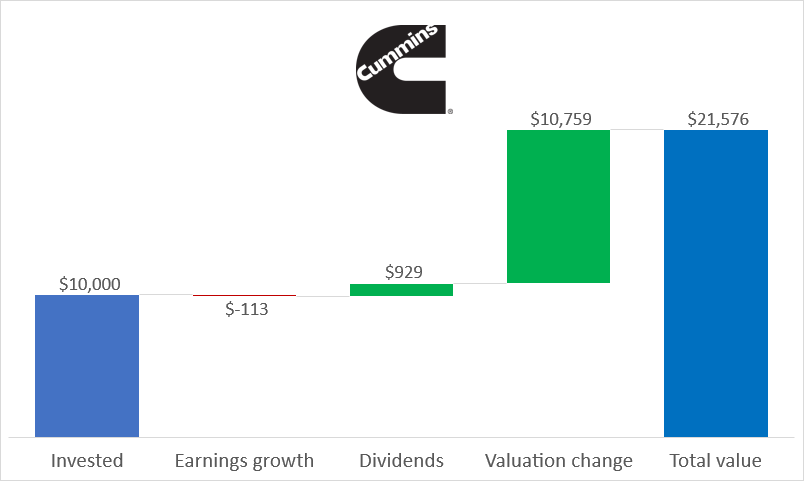

Here is how the combination of these factors worked: (Adding up the first 4 columns equals the total value)

It is obvious that the company’s earnings growth drove my investment return with Lowe’s. Now let’s see how the Cummins position worked. (The stock I sold.)

While Cummins’s earnings grew nothing during my holding period, I received ~9% of my invested capital in the form of dividends in those ~2.5 years, and the expansion of the valuation multiple did the heavy lifting to contribute the lion’s share of my returns.

Jumping ahead…

What on earth could have made me hold on to my Cummins stock after the valuation corrected upwards while the company didn’t show any sign of growth?

The best part has already happened!

The valuation became high, and without the business growing, I could not expect exceptional returns in the future.

On the other hand, selling Lowe’s would be a costly mistake even at a seemingly stretched valuation (high PE). And this gets us to the point that not all stocks are equal, and different types may need different treatment when it comes to analysis and decision-making.

Read on, and get the insight that took me 10+ years to grasp…

EVA Monsters and Fallen Angels

In pursuit of maximizing total returns, two segments of the stock universe are of exceptional importance, which we simply refer to as “EVA Monsters” and “Fallen Angels.”

The fundamental return of every stock (excluding the effect of valuation) is composed of:

Fundamental Return = Profit (EVA) CAGR + dividend yield + share count reduction

In the case of the aforementioned two categories, the composition of fundamental return is very different:

1. EVA Monsters:

These are high EVA-growth companies, where the majority of our fundamental return stems from future growth in EVA. Some of these companies are major repurchasers of their shares, and most pay no dividends since they have wonderful reinvestment opportunities.

2. Fallen Angels:

These are mature businesses that have stable EVA generation capability but lackluster growth. Most have a sizable dividend payout, potentially enhanced by share repurchases.

While both types of investments can yield handsome results, it is readily apparent that “EVA Monsters” have a higher fundamental return than “Fallen Angels” because they possess much better growth characteristics.

Why is fundamental return important? Because the longer you hold a stock, the closer your return will get to this fundamental return.

As Charlie Munger put it:

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns.“

In short: when our aim is to hold a stock for decades, we want “EVA Monsters” in our portfolio.

Once we have laid this foundation, we can introduce valuation as the last missing piece of the equation. Let’s see the full investment thesis behind both groups:

Total Return = Fundamental Return + Change in Valuation

In the case of “Fallen Angels,” sentiment change is the primary source of total return. Since reversion to the mean is a one-trick pony, the sooner it happens, the higher our annualized return.

The most dangerous pitfall is that this reversion takes too long to happen (if at all), dampening our total return since there is no growth to compensate for the time elapsed.

A company can offset some of the “waiting time” with a handsome dividend payout, assuming the dividend is sustainable and that the EVA generation is stable.

Simply put: when we buy “Fallen Angels,” we want a huge discount to fair value coupled with a short holding period, hoping for a quick rebound in valuation.

Until then, we collect the dividends, and when the reversion takes place, we sell at fair value (the sooner, the better).

In a nutshell, we don’t want to be stuck holding a “Fallen Angel” for too long unless it turns into an EVA Monster along the way (which is rather unlikely but cannot be ruled out).

Monitoring these positions closely is absolutely essential since some of them may turn out to be value traps while others may transform into EVA Monsters.

When it comes to “EVA Monsters,” we want to buy companies with lots of EVA growth left in the tank, at a reasonable entry price and hold them for the long run.

The primary pitfalls are that we either overpay for growth or the forecasted growth does not materialize to the extent we expected. Both scenarios would sink our total return potential.

Thus, we have to leave a buffer in our purchase price in case some of the EVA growth we had anticipated does not materialize, which is painful in not one but two ways:

- the significantly dampened fundamental return

- and the corresponding change in market sentiment (that affects the valuation component of the equation), to adjust for lower future growth.

Back to the case studies

While the quality and growth factors played the most important part with EVA Monsters, it is the valuation that drives returns with these once-beloved dividend darlings that landed in the bargain bin. This describes perfectly why we call this category Fallen Angels.

As a reminder of our case study, you can see how different components of the total return formula played the key role in Lowe’s and Cummins’ case, where the former classifies as an EVA Monster while the latter was a Fallen Angel investment.

I hope you see that this type of Fallen Angel stock that offers hardly any growth but pays reliable dividends must be analyzed differently from the EVA Monsters that you can hold for decades for their exceptional fundamental business performance.

Numbers clearly show that one shouldn’t use the same ranking and analysis framework for Fallen Angels and EVA Monsters since

- different components of the total return formula tend to play the most important part with these categories and

- these disparate types of investments work on very different timeframes.

That said, I’m yet to see another newsletter or info service that treats the EVA Monster and Fallen Angel categories separately.

Long story short: what we do is put together the EVA-based financial models for those Fallen Angels that rank highest based on our composite Angel Score. (Modeling and keeping all the data up-to-date wouldn’t make sense with all the ~300 companies that could qualify as Fallen Angel candidates based on their dividend history, so we only put in the work with the highest-ranking names.)

If the total return potential warrants, Fallen Angels can land on the FALCON Method newsletter’s Top 10 list (after careful qualitative assessment, of course).

That said, if a Fallen Angel and an EVA Monster provide identical total return potential, buying the EVA Monster is a no-brainer choice.

The problem with Fallen Angels is that the valuation usually reverts to the mean within 2-3 years (as Joel Greenblatt teaches at Columbia Business School), so you have to sell your positions and reinvest the capital.

Here is how Josh Tarasoff of Greenlea Lane Capital Management describes this problem: “I was noticing that investors are typically under intense time pressure to find new ideas. The math is simple: a portfolio with two dozen stocks and an average holding period of two years requires one new, market-beating idea each month, without end.

And this example involves a relatively concentrated and low-turnover portfolio by the standards of the industry: most investors need to keep up an even faster pace. The necessity to be continuously on the verge of some great new idea sows an endemic hurriedness that can be seen on people’s faces and heard in their voices. This struck me as unhealthy for decision making (and perhaps even unhealthy, period).”

I’ve been living financially free since I turned 33, and having experienced the continuous pressure of Fallen Angel investing that Tarasoff writes about, all I can say is “thanks, but no thanks.”

Investing in EVA Monsters is the way to go for the true buy-and-hold investor, and Fallen Angel situations are only interesting when they provide extraordinary opportunities.

We keep our eyes open and systematically comb through the list of dividend payers to identify such situations.

Selling rules are different

For those who understand the role and importance of the various total return components with EVA Monsters and Fallen Angels, the simple rules on when to sell will not come as a surprise.

The number one insight in a nutshell

You saw that the expansion of the valuation multiple drives returns with Fallen Angel stocks. This expansion is a one-time event: the multiple will revert to its mean once and will not keep climbing further for decades.

Once the mean reversion happens, only the remaining components of the total return formula work for you. Simply put, you will reap the returns produced by the underlying company’s fundamental business performance (the combination of EVA growth, dividends, and share repurchases), and this return tends to be mediocre with most Fallen Angels.

Conclusion: selling Fallen Angel stocks once the valuation expansion happens is the reasonable decision.

With EVA Monsters, on the other hand, the growth part of the total return formula plays the central role. The implications of this difference are crucial. EVA growth is not a one-time event but can continue for decades if the company’s competitive position and growth opportunities allow it to reinvest a big part of its cash flows at high rates of return.

Conclusion: As long as the “Monster characteristics” of the business are intact, you have every reason to hold on to the EVA Monster stocks, (almost) regardless of valuation.

As you saw, with Fallen Angels, once the valuation multiple reverted to its mean or even overshot to the upside, there is not much one should wait for with selling.

You can call on the dividend yield theory or use valuation metrics like the NOPAT yield or Future Growth Reliance to get a picture on when to sell.

As for EVA Monsters, a “longer leash approach” is warranted since the majority of our returns stem from the growth component (the combination of the reinvestment rate and the return on that newly invested capital), and the longer the holding period, the less important the role of the valuation multiple becomes.

In summary: we keep our Fallen Angel positions on a relatively short leash and sell when they approach fair value, while EVA Monsters need that kind of extendable, longer leash since the valuation multiple is not the major part of our total return as long as the “Monster characteristics” remain intact.

Makes sense? You can learn more about the FALCON Method here and see how you can make institutional-level decisions for a price that is affordable to individual investors.

Our subscribers get the best of both worlds within the same service, so they can buy the best Fallen Angel and EVA Monster stocks as well.

Ready to take the guesswork out of investing and get to the next level?

Join our free webinar and upgrade your stock selection process with cutting-edge cata!