With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers show that Veeva Systems (VEEV) is a genuine EVA Monster, so it is worthy of your close attention. We consider the firm to be a perfect long-term play on the growing importance of the life sciences industry without being exposed to any degree of pipeline risk inherent in every pharma company.

Veeva is a leading global provider of industry-specific, cloud-based software solutions for the life sciences industry. Its offerings include cloud software, data, and business consulting, all designed to meet customers’ unique needs and address their most strategic business functions, from research and development (R&D) to commercialization. Veeva’s solutions help life science companies develop and bring products to market more quickly and efficiently, enabling effective marketing and sales while maintaining compliance with government regulations.

In 2007, Peter Gassner founded Veeva as a verticalized Customer Relationship Management business built on top of Salesforce and custom-made for the life sciences industry. Gassner had the original insight while working at Salesforce as VP of Technology and saw their limitations as a horizontal platform. He profoundly impacted the pharma industry by introducing a brand-new SaaS solution to the market, and he has been serving as CEO ever since Veeva’s founding.

Subscription fees are Veeva’s primary revenue source, contributing 80% to the top line as of fiscal 2023. These fees encompass Software as a Service (SaaS) revenues, roughly evenly distributed between commercial and R&D offerings.

Veeva Commercial Cloud represents a product family comprising software and data services tailored specifically for life sciences companies aiming to enhance the efficiency and effectiveness of their product commercialization processes by offering solutions for sales, medical affairs, and marketing functions. Conversely, the firm’s R&D solutions target the clinical, regulatory, quality, and safety functions, assisting life sciences companies in streamlining their end-to-end product development processes. This, in turn, promotes increased operational efficiency and ensures regulatory compliance throughout the product life cycle.

While its customer base is concentrated in the biopharma industry, Veeva serves a diverse array of over 1,000 enterprise clients. These range from the largest global pharmaceutical and biotechnology firms, such as Eli Lilly, Gilead Sciences, and Merck, to emerging startups in the field.

Veeva has established a moat around its business by differentiating itself from generic Customer Relationship Management (CRM) providers. Specializing in the life sciences industry, the firm embodies all the characteristics of a typical Vertical Market Software (VMS) provider. Generally, such solutions handle mission-critical applications in their clients’ businesses, thereby incurring substantial switching costs.

What distinguishes Veeva is its highly cohesive product ecosystem, spanning from commercial (cloud, data, analytics) to R&D solutions (clinical, quality, regulatory, safety). In essence, Veeva’s platform consolidates traditionally siloed and disconnected workflows, enabling its customers to manage the entire lifecycle of a clinical trial, from molecule discovery to commercialization. While competitors do offer some similar solutions, no product on the market can match the firm’s comprehensive platform, which is its primary advantage.

Because the total cost of Veeva’s software suite amounts to approximately 1% of its customers’ annual revenue, there is little incentive to switch to a competing solution and potentially risk business disruption. The company’s retention rate has exceeded 100% over the past few years, indicating that its customers not only renew but also increase their purchases each year, with few subscription cancellations.

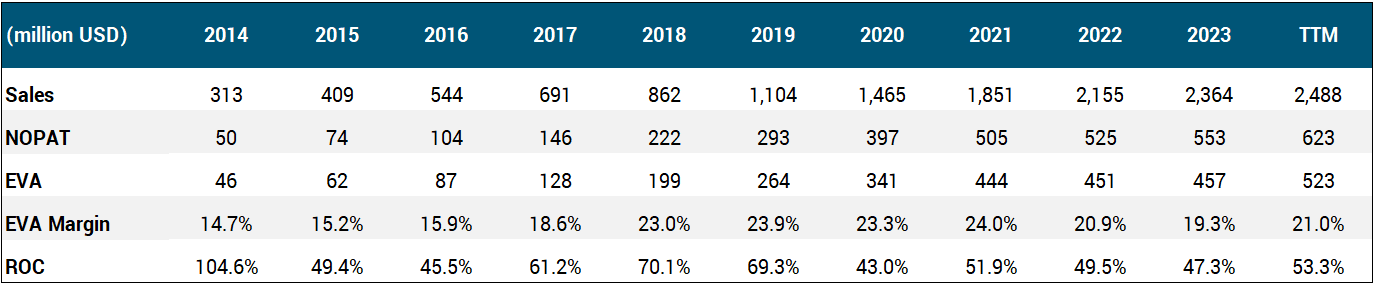

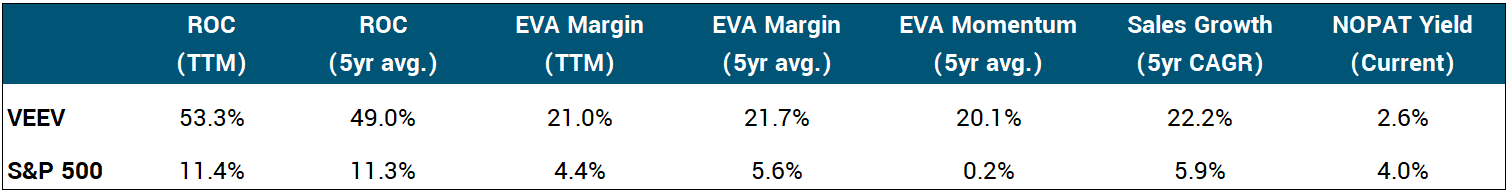

Overall, the company undeniably deserves a wide-moat classification from a qualitative standpoint. It also excels in meeting our quantitative criteria, displaying robust double-digit ROC and EVA Margin figures. Alongside evident pricing power and a lucrative clientele, the underlying dynamics in life sciences contribute to these outstanding profitability metrics.

As for the future, Veeva’s life sciences end markets represent a large and growing pie, with the biopharma and medical technology sectors estimated to expand at a mid-single-digit annualized rate over the long run. Industry-specific software and data solutions will likely exhibit higher growth rates as the segment becomes more technologically enabled. The firm’s prospective customers are eager to replace their in-house legacy software or general-purpose CRM tools with Veeva’s cloud-based solutions focused on life sciences. According to management, the firm has penetrated just over 10% of its addressable market, leaving ample room for future share gains.

Turning to capital allocation, Veeva typically reinvests about 40% of its internally generated cash and achieves magnificent ROC figures north of 50%. R&D is generally the most significant use of capital as the company continues to release new product categories (like Vault and QualityOne) and add-on modules, paired with smaller, tuck-in acquisitions that management considers complementary to the product portfolio.

The picture is pretty bleak on the shareholder distribution front. Veeva has never paid a dividend (which is unlikely to change anytime soon), and it has spent only a negligible amount on share buybacks since its IPO. This has two consequences. (1) As the reinvestment rate is below 100%, and virtually no money is returned to shareholders, the firm’s cash balance has grown from $300 million in 2014 to over $4 billion as of today. (2) The share count keeps rising due to the dilutive effect of employee equity grants, increasing by ~13% in aggregate since the IPO. Despite management’s indisputable “efficiency focus,” Veeva is granting enormous stock-based compensation packages, resulting in an average annual dilution of over 2% per annum (way above our not-so-strict threshold of 1%).

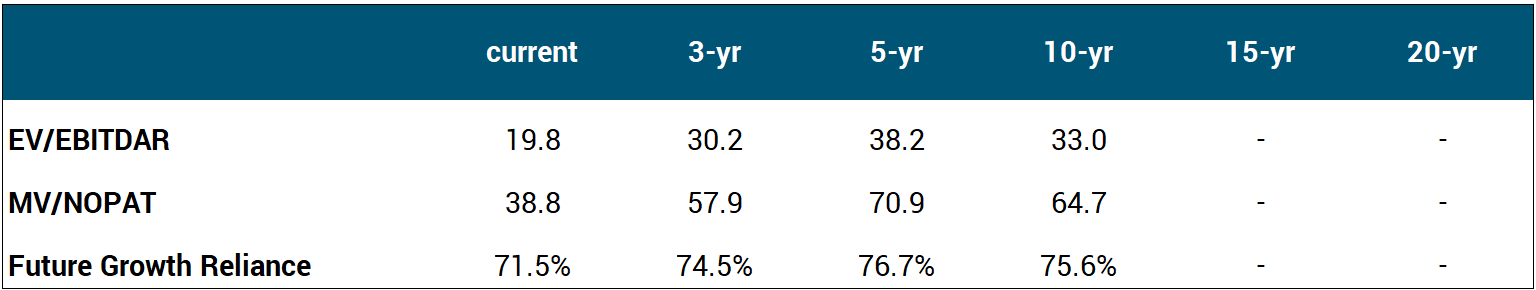

Looking at the stock’s valuation, in Veeva’s case, we don’t consider historical multiples to be a good forward-looking proxy, given the company’s material increase in size over the past 5-10 years, while its growth rate has (naturally) come down. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

Regardless of how we look at it, the stock appears very expensive on a market-relative basis with its 2.6% NOPAT Yield. The 10-year baked-in EVA growth is also near 20% at the current price, which we deem extreme.

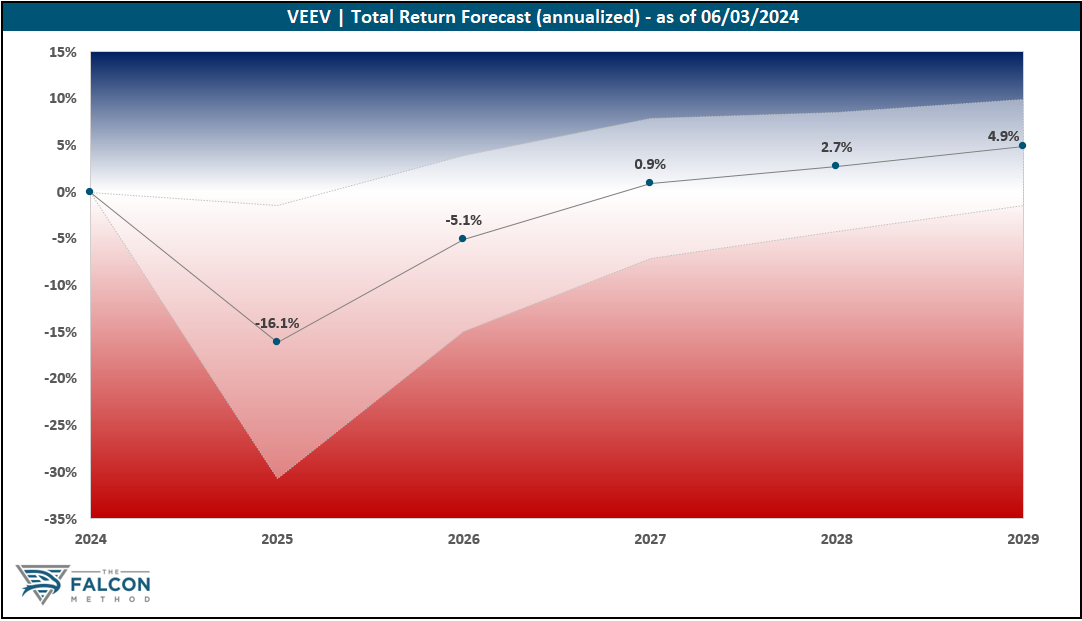

Overall, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Veeva for now.

The verdict

The most prominent short-term risk factor to consider is Veeva’s intent to migrate its CRM business from Salesforce’s platform to its own Vault system by 2025, which might raise customer concerns and lower retention rates. Mishandling this migration could lead to disruptions or loss of certain data, posing serious trouble for Veeva’s customer base. Currently, the firm generates ~30% of its revenues from products built on top of Salesforce’s platform, making it worth monitoring.

Since nearly all of Veeva’s revenues come from sales to customers in the life sciences industry, the business exhibits a heightened level of macroeconomic sensitivity. This is precisely the situation of late, as the bleaker macro picture has led to a challenging funding environment (or outright bankruptcies in some cases) for Veeva’s smaller biotech customers who use the company’s R&D solutions. Such difficulties have impacted, and may continue to impact, Veeva’s operating results.

While challenges like data breaches, mishandling of sensitive information, or regulatory interventions do pose threats, we would be happy to scoop up this EVA Monster at the appropriate price. Its SaaS model is extremely lucrative, the moat is unquestionably there, and the growth outlook remains bright. Although the excessive stock-based compensation and lack of shareholder returns are far from ideal, these alone do not warrant sidestepping the stock. As for position sizing, we see no reason to go below a 3-5% position size target.

The company ranked 35th of our 59 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!