With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers show that Intuit (INTU) exhibits EVA Monster characteristics and is thus worthy of your attention.

Intuit is a diversified software company providing various services to small and medium-sized enterprises and individual customers. Its core offerings include the QuickBooks accounting suite and the TurboTax tax filing toolset. In addition to migrating its legacy desktop solutions to a cloud-based software-as-a-service (SaaS) model, the company has recently broadened its portfolio through major acquisitions. The Credit Karma personal finance platform and the Mailchimp email marketing solution are its most significant additions. The company was founded in 1983 and is headquartered in Mountain View, California.

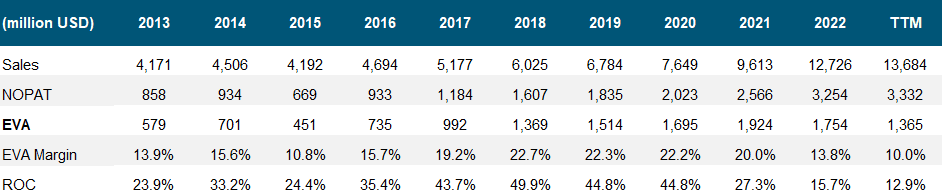

A quick glance at the EVA metrics reveals that Intuit boasts strong double-digit EVA Margin and ROC figures, which are telltale signs of a high-quality business.

We believe the firm’s flagship specialized software solutions, QuickBooks and TurboTax warrant a wide-moat rating. These make up over 70% of its top line and the overwhelming majority of the EVA generation.

QuickBooks, the bookkeeping tool, is the undisputed leader in the U.S., ruling with an 80% share of the small business accounting software market and a total subscriber base of almost 6 million accounts. Intuit is also the undisputed leader of the online DIY tax preparation market, commanding a 60%+ share. On top of that, the firm’s TurboTax Live, an assisted solution, serves as a further differentiator compared to its peers, where customers can access a tax professional to guide them through the filing process. Growing rapidly, this has become a billion-dollar business within Intuit in just a few years.

As for growth prospects, TurboTax operates in a mature market (with the number of U.S. tax filings staying roughly flat over the past decade), while QuickBooks is still in the early innings of growth (serving a little shy of 6M accounts with a total addressable market of 75M small business customers).

There’s nothing wrong with Intuit’s core business, as the capital-light operations gush out lots of cash at great ROC levels. Between 2006 and 2020, the reinvestment rate stood at 15%. However, the new CEO’s tenure brought a swift change in capital allocation policy, and this is where the picture becomes murky. Before that, Intuit had completed only a single billion-dollar deal since its founding nearly 40 years ago. Then, Goodarzi went on an all-out acquisition bonanza in the last few years, scooping up Mailchimp for a hefty ~$12 billion, only nine months after the firm closed the ~$8 billion deal to acquire Credit Karma.

Our judgment regarding these purchases is mixed. Although we understand that there might be some cross-selling opportunities and strategic advantages by combining these businesses, like providing a one-stop-shop solution for SMBs, we don’t think Intuit needed these deals to prosper. Furthermore, the price tags are tough to justify (for instance, Mailchimp was bought at 15 times revenues), and the related share issuances to fund these deals resulted in meaningful dilution to shareholders. Within the EVA framework, the huge added capital charge associated with these transactions causes the EVA Margin outlook to be very blurry going forward.

Regarding repurchases, the firm spent more than $12 billion on buybacks over the past decade, yet the share count has basically stayed the same. We cannot come to grips with Intuit’s share-based compensation expense, as it seems way out of touch. (Buybacks are also far from opportunistic, with management repurchasing $2.5 billion worth of stock in fiscal 2022 at nosebleed valuation levels.)

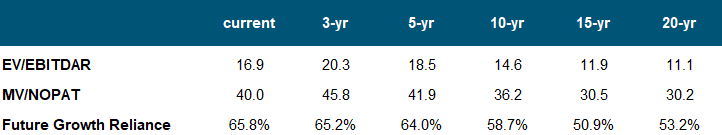

As for the stock’s valuation, although Intuit loves to tout non-GAAP financial measures, those might be hugely misleading because of excluding the expense of the egregious share-based compensation. The EVA framework remedies this distortion, along with many others.

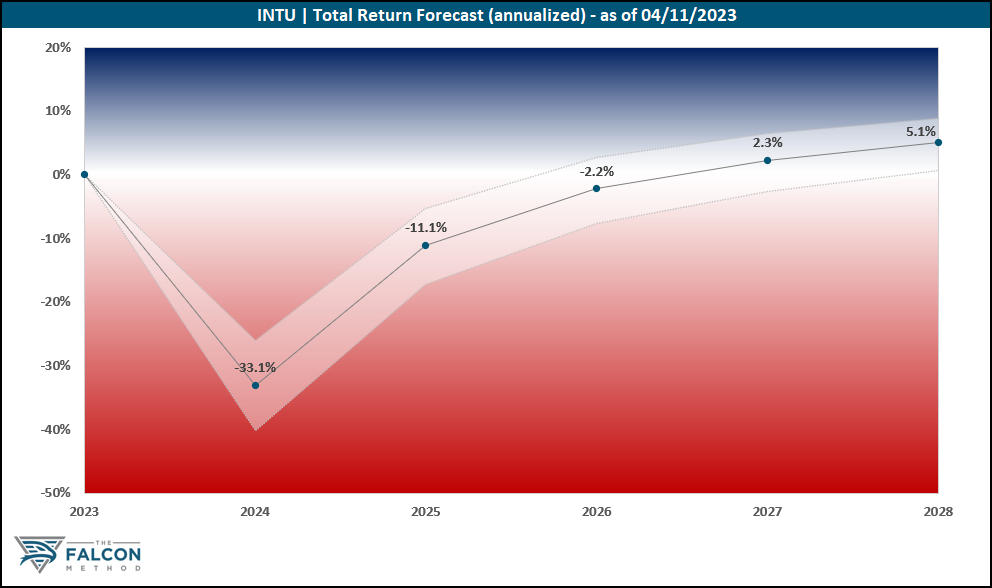

Despite the core business appearing to be superior to the market from both a quality and growth angle, even after assuming an EVA Margin rebound over the next five years, the valuation component acts as a meaningful headwind from today’s price level. The chart of 5-year total return potential speaks for itself.

All in all, the stock is too expensive for our taste at the moment.

The verdict

TurboTax and QuickBooks appear to be resilient, wide-moat businesses, with the latter enjoying healthy long-term growth opportunities thanks to a large total addressable market. If only these two units made up Intuit, with a laser-focused management team and meaningful capital distributions thanks to the capital-light model, we would surely be up for the ride at the right price. However, the current management team must prove first that the two “mega” deals were not a mistake at those price tags.

To be clear: there is a sizeable capital allocation risk associated with the current leadership team. Integrating the Credit Karma and Mailchimp deals will require significant time, energy, and resources. Ultimately, the expected synergies and cross-selling opportunities might never materialize or not to the extent that would justify the lofty price tags. If value-destroying acquisitions were to continue, that could put further pressure on Intuit’s EVA Margin (although fancy presentations about deals being “accretive to non-GAAP EPS” may be enough to sell any story on Wall Street).

Intuit’s stock is a comfortable pass for us at the current valuation.

The company ranked 33rd of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking five boasting total return potentials above 16% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!