Let me share one of my favorite stock market-related analogies. A middle-aged woman is walking through Central Park, and she has a very active dog with her.

My Hungarian vizsla (Lara) would fit well in this story. Here she is to help you imagine the story.

If you just looked at the lady, you would notice that she is taking normal steps, going in a straight line, walking upright at a moderate pace. Nothing exciting, indeed.

Now let your eyes pan down a little bit, and look at the dog. The vizsla is going crazy. It is chasing birds, digging up clumps of mud, running at trees, and peeing all over the place.

As you may have guessed, the dog is the stock market, and the woman is the economy.

So if you’re watching the dog (the more entertaining stuff), you’re losing sight of the economy (the underlying business performance that determines values in the long run). As long as you can’t get your eyes off the dog, you’re observing the manifestation of hundreds of millions of people’s greed and fear, their buying and selling. But you’re not watching an actual representation of how the economy is doing, and this is a crucial point to keep in mind.

That said, under normal circumstances, the dog periodically checks where the woman is and what direction she is taking. So the dog and the lady, or the stock market and the economy, are somewhat connected, but they most certainly do not look the same or act the same, even if they are walking in the same direction.

Looking at this relationship, sometimes it seems as though the dog has completely lost interest in the woman; it runs far ahead and doesn’t even seem to care that the woman may need to take a break to catch her breath. Make no mistake; the dog still needs the lady; their connection may only loosen temporarily, so the question is where the two will meet again. The dog may choose to sit down or sniff around while staying in the same place (stagnating stock prices) until the woman catches up, or it can run straight back to her (falling stock prices).

Nobody knows how the next chapter of the story will unfold, but pundits would certainly not bet on an outcome where the middle-aged woman could sprint to catch up with her agile dog. That would be impossible with a vizsla, believe me. (Lara was clocked running at ~40mph, which is 60+ km/h.)

The economy, the underlying business performance, tends to move slower than the stock prices. As Joel Greenblatt says:

“Prices fluctuate more than values—so therein lies opportunity.”

When the dog is far ahead of the woman (prices are way higher than intrinsic values), value-conscious investors find hardly any opportunities and tend to underperform until the pair are reunited.

In fact, a value investor’s market would be where the dog is left behind sniffing while its owner is marching ahead at a steady pace.

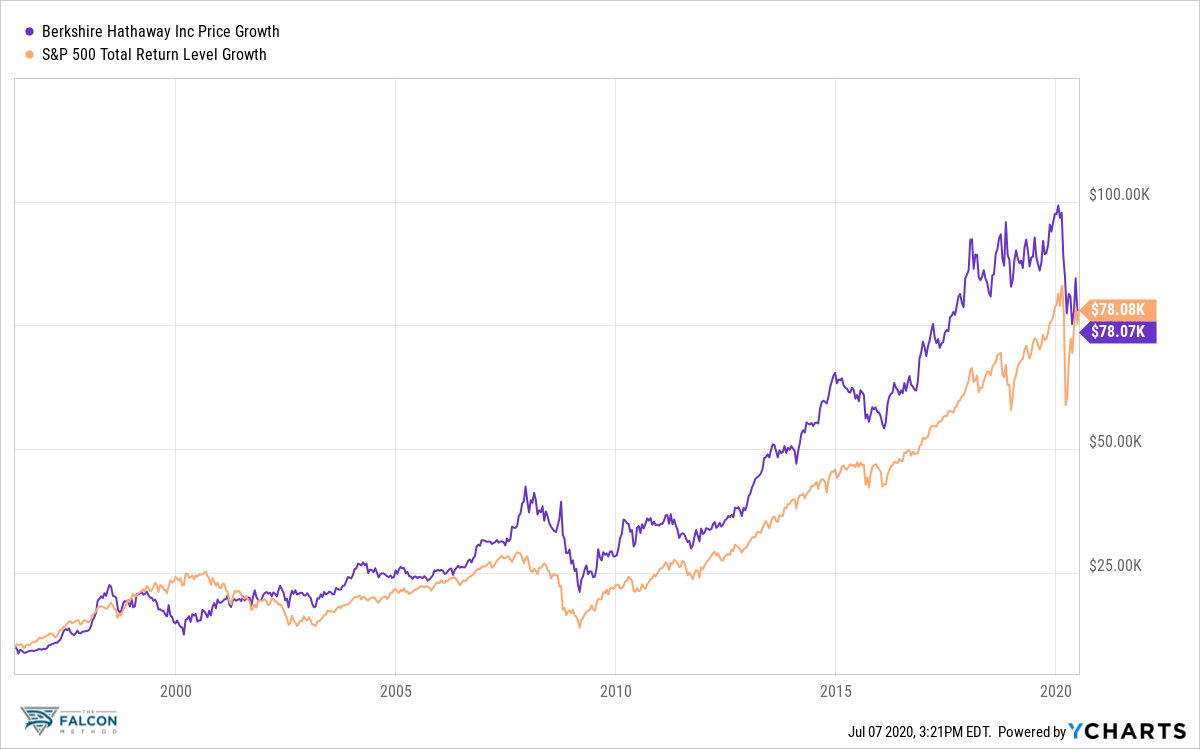

If you think this has nothing to do with investing, you can check out how even the world’s most reputable value investor, Warren Buffett, couldn’t outperform the stock market over a 25-year timeframe.

Yes, that’s a quarter of a century, and the period is picked somewhat arbitrarily to illustrate the point that prices and fundamentals can decouple for longer than you’d think. (Note that Berkshire’s performance is measured against the S&P 500 total return index, which assumes that all dividends are reinvested into the index. As Berkshire pays no dividend, this total return index helps us make an apples-to-apples comparison.)

Taking our analogy one step further, if you are the contemplative type like me, you can imagine that thousands of pairs of dogs and owners are walking through Central Park, together making up the whole stock market. A sensible investor’s task is to spot a pair where the dog lags behind, and the owner looks healthy enough to keep walking along.

It’s not an easy job, but that’s what we are helping you with at the FALCON Method using institutional-level data inaccessible to retail investors.

Hand on your heart, are you guilty of just watching the dog?

Take the first step to getting over this costly mistake by learning more about our evidence-based stock selection process with this free report.