With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers show that ASML Holding N.V., an essential monopoly in extreme ultraviolet (EUV) technology (used for producing advanced chips for applications such as fighter jets, AI supercomputers, and smartphones), exhibits EVA Monster characteristics and is thus worthy of your attention. The company’s shares trade under the ticker symbol ASML on both the Euronext and NASDAQ.

ASML is the leading supplier of photolithography systems used in the manufacturing of semiconductors. The process utilizes light to form the paths and electronic components in the silicon wafer of microchips. ASML pioneered cutting-edge extreme ultraviolet lithography (also known as EUV) and is currently the sole supplier of the technology in the world. The company’s systems are used by every major high-end semiconductor manufacturer, including TSMC, Samsung, and Intel, with the growing installed base serving as a dependable source of recurring service revenues. ASML Holding N.V. was founded in 1984 and is headquartered in the Netherlands.

ASML’s bread and butter is the design, manufacturing, and sales of photolithography systems. The process involves light exposure through a mask to project the image of a circuit, similar to a negative in traditional photography, hardening certain parts of a photo-resistive layer on the silicon wafer. During the subsequent etching process, the hardened areas stay behind as circuit paths, and the emerging structure looks much like a labyrinth viewed from above.

The vast majority of the firm’s top line stems from systems sales (essentially lithography machines), with the rest coming from installed base management. Just to give you a feel of the business, an EUV machine costs a whopping $150-200 million, and ASML’s personnel are required onsite at semiconductor fabs to support ongoing operations.

As of today, ASML is the only company in the world able to produce EUV machines, rendering it an essential monopoly in the space. Besides its proprietary know-how, ASML’s supply chain management strategy has also been crucial in the process, with the firm reaching exclusive agreements with sub-suppliers of key technologies or buying them outright. For instance, ASML acquired Cymer, the developer of light sources for EUV machines, and made a strategic investment in a Carl Zeiss subsidiary developing advanced optics. We like that the company’s M&A activity has always been highly strategic and bolt-on in nature, mostly scooping up or building a stake in key suppliers.

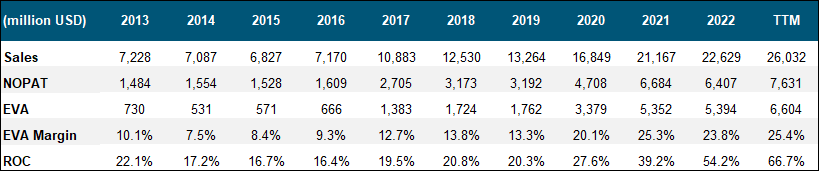

Overall, the firm’s competitive position is as strong as it gets. It’s no wonder the company possesses immense pricing power, which manifested in market-beating EVA Margin and ROC figures over the past decade. The table below showcases the telltale signs of a moaty business.

As for the future, semiconductors form the backbone of the new digital economy, and we see humanity’s insatiable need for rising computation capacity as one of the most powerful forces of the century. The number of chips produced is expected to increase at a high-single-digit clip annually over this decade, with advanced logic applications significantly outpacing the overall market. (A strong tailwind for the EUV business.)

On the capital allocation side, ASML has been paying dividends since 2008 and has increased its payout at a very dynamic pace, while management also utilizes buybacks to return cash to shareholders.

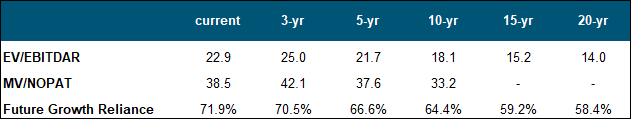

When it comes to the stock’s valuation, ever since ASML began the shipment of its second-generation EUV machines (after several prototypes), the company has been so highly rated that it is hard to draw any rational conclusions based on average historical multiples. As growth is expected to be extremely dynamic, coming up with a fair value estimate is no easy task either.

Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

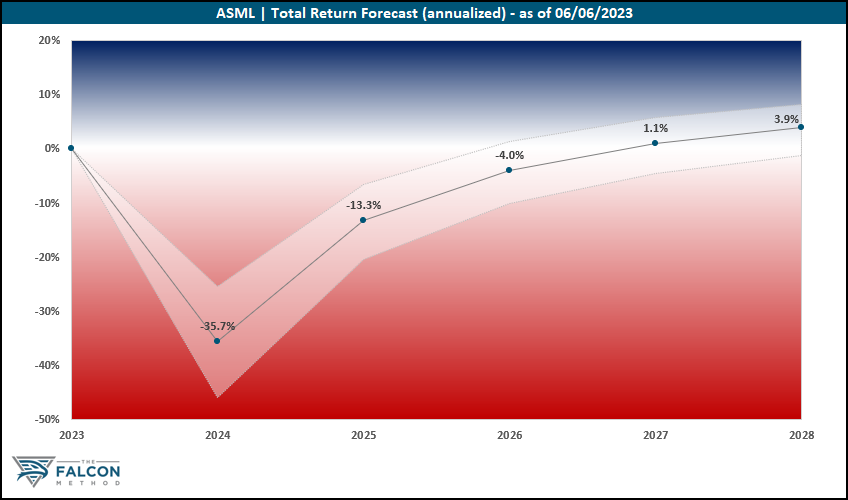

While ASML’s business appears far superior to the market from both a quality and growth angle, even after assuming a somewhat optimistic FGR range (but still one that the company could easily live up to), the valuation component remains a significant detractor to the otherwise stellar fundamental return potential. The “Key Data” table and the 5-year total return potential chart speak for themselves.

Overall, the FALCON Method can identify much better opportunities in the current market, so we are passing up on ASML for now.

The verdict

No business is without risk, and ASML is no exception. Regarding the client base, TSMC, Samsung, and Intel make up more than 80% of ASML’s sales. The company also relies heavily on some of its key suppliers. For instance, if there were any hiccups in Carl Zeiss’s production or delivery of optics over a prolonged period, ASML would effectively cease to be able to conduct its business.

It is also noteworthy that Peter Wennink (CEO) and Martin van den Brink (CTO) are in their mid-sixties, meaning that the retirement of both important leaders is not off the table over the upcoming few years. While these risks are worth monitoring, the elephant in the room is a viable competitor entering the EUV lithography space. Although seemingly impossible, it could significantly impair ASML’s monopoly. Unless that happens, it is hard to sink this investment thesis.

Considering all factors, ASML seems best positioned among semiconductor companies in our EVA Monster Universe to benefit from the overarching secular megatrend of rising chip demand and complexity. At the same time, this firm also carries the least significant risks. Without viable competitors, its monopoly status and wide moat seem nearly unassailable, coupled with a highly skilled management team and shareholder-friendly capital allocation policy. While the stock is on our must-have wishlist, the time to buy is not now.

The company ranked 34th of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!