With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers show that Ferrari N.V. (RACE), the king of supercar manufacturers, exhibits EVA Monster characteristics and is thus worthy of your attention. Make no mistake; this is not a lousy car maker but a true luxury company! The prancing horse stands for much more than just a vehicle: it’s a symbol of prestige and elite craftsmanship.

Ferrari engages in the design, engineering, and production of luxury performance sports cars. Its iconic vehicles range from standard models (such as the Ferrari Roma) to racetrack-suitable cars (like the Daytona), adhering to the motto “different Ferraris for different Ferraristi.” The firm also has a long tradition of participating in the Formula 1 series, with the prancing horse logo and the signature “Rosso Corsa” red color becoming synonymous with the Scuderia Ferrari racing team. The company was founded in 1947 and is headquartered in Maranello, Italy. Fiat Chrysler Automobiles spun off Ferrari in an initial public offering in 2015, listing its shares on both the NYSE and Euronext Milan.

The overwhelming majority of Ferrari’s top line (85% in fiscal 2022) comes from the sale of cars and spare parts. The firm markets its models through an exclusive dealer network, with the average realized sales price per vehicle consistently exceeding $300,000. Furthermore, personalization can significantly increase the final price, and certain limited production and one-off models (such as the iconic LaFerrari series) can easily sell for over $1 million.

As noted above, Ferrari stands apart from conventional automakers, aligning more closely with luxury fashion houses such as Hermès or Chanel. Accordingly, the company also prides itself in its rich heritage, dating back almost a century when its founder, Enzo Ferrari, formed the Scuderia Ferrari racing team in 1929. Since then, Ferraris have been known for their superior driving experience, drawing on cutting-edge technology from the firm’s Formula 1 racing arm, which also spurs demand for their road cars.

True to its founder’s belief that “the engine is the soul of the car,” Ferrari continues to design, develop and handcraft its powertrains in Maranello, along with other core components critical in differentiating the technology and performance of its cars. The “Made in Italy” badge resonates similarly to that of prestigious luxury fashion houses, where the outsourcing of production would be unimaginable.

Interestingly, Ferraris retain their value significantly better than any other brand in the luxury car market, reducing the total cost of ownership and providing a form of investment for the most affluent customers. Ferraris make up 10 of the top 20 most expensive cars ever sold at auctions. Client loyalty is also remarkable, with two-thirds of new cars sold to existing owners, of which every second customer already has more than one Ferrari.

A central aspect of Ferrari’s exclusivity is the limited number of models and cars they produce, often leading to wait times of up to two years and no discounts, despite the lofty price tags. The brand produces just over 13,000 vehicles per annum, significantly lower than, for example, Porsche’s 300,000+ figure. As Enzo Ferrari famously noted, “Ferrari will always deliver one car less than the market demand.” A beneficial outcome is that with an order book full for up to two years in advance, unit volatility and hence revenue cyclicality is lower compared to peers (let alone high-volume automakers).

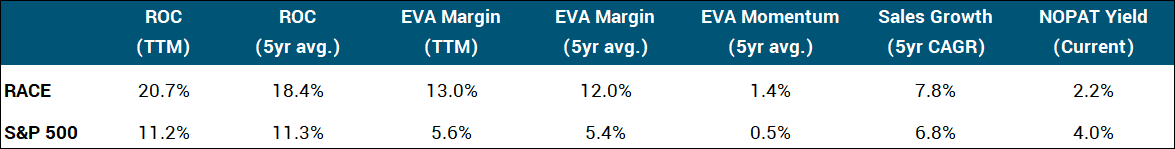

In our view, Ferrari deserves the wide-moat badge from a qualitative standpoint, with a competitive advantage period likely to last for many decades to come. Judging from the quantitative angle, Ferrari consistently delivers double-digit EVA margins. The firm significantly exceeds typical car manufacturers with these figures, which can barely generate positive economic earnings over full cycles.

As for the future, the firm’s total addressable market keeps expanding at a healthy pace, and repeat customers are also showing incredible loyalty, so healthy sales growth is almost guaranteed.

On the one hand, since the majority of production vehicles land at existing owners, it’s quite clear that volume growth could continue to rise at least in line with the expansion of the HNWI customer group, all while maintaining the brand’s aura of exclusivity. On the other hand, the company’s sales growth has consistently and significantly outpaced its volume trajectory, demonstrating strong pricing power. Overall, we estimate Ferrari’s long-term sustainable sales growth rate to be in the high-single-digit territory.

Switching gears to capital allocation, Ferrari’s reinvestment rate sits between 40-50%, paired with ROC levels nearing 20%: metrics completely unheard of in the auto industry. The main areas of capital expenditures are R&D investments and production capacity expansions. Concerning capital distributions, Ferrari has paid a dividend since its IPO, although the payout fluctuated with the company’s annual earnings.

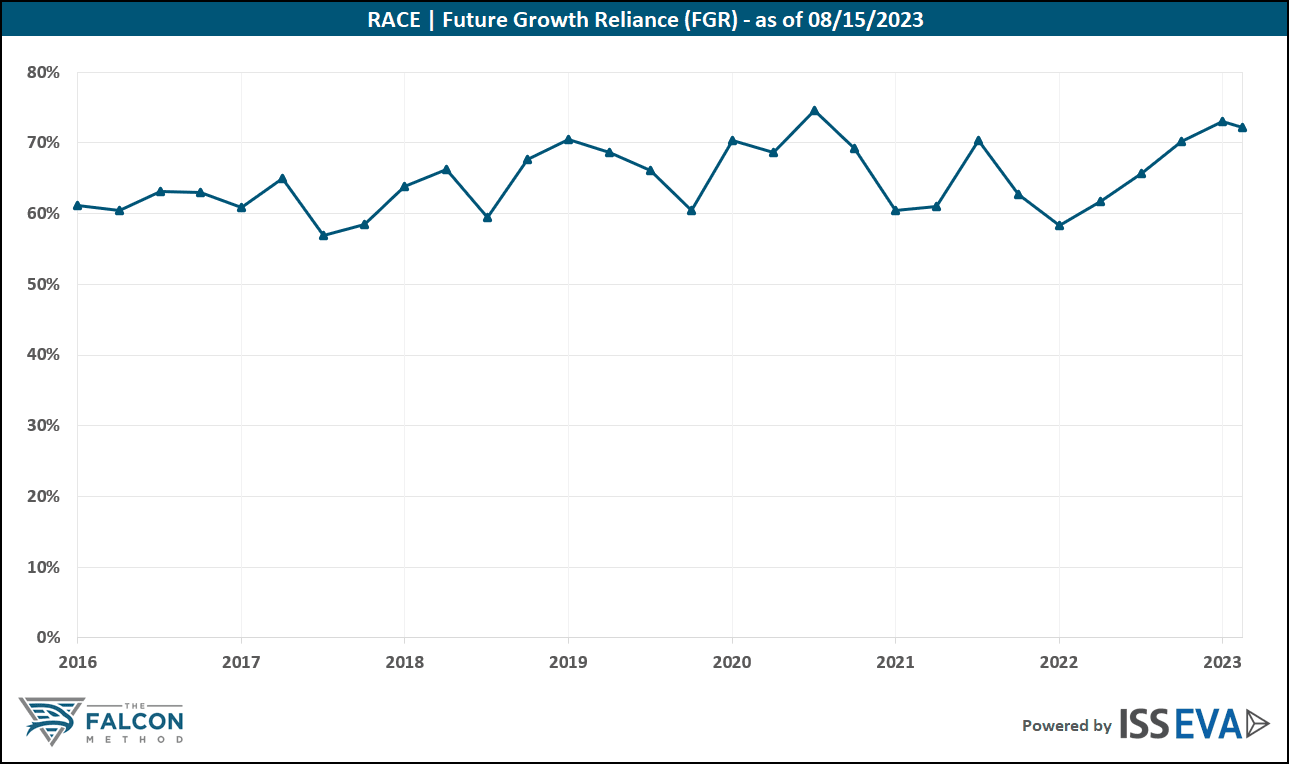

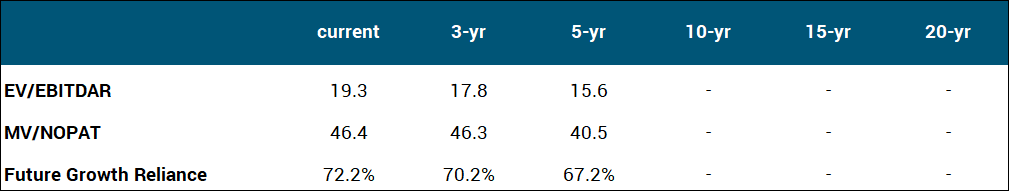

While it would be misguided to value this company like an average automaker, even the most pessimistic historical snapshots imply a more than 15-year explicit EVA growth period at a healthy CAGR, which feels very optimistic to our taste. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

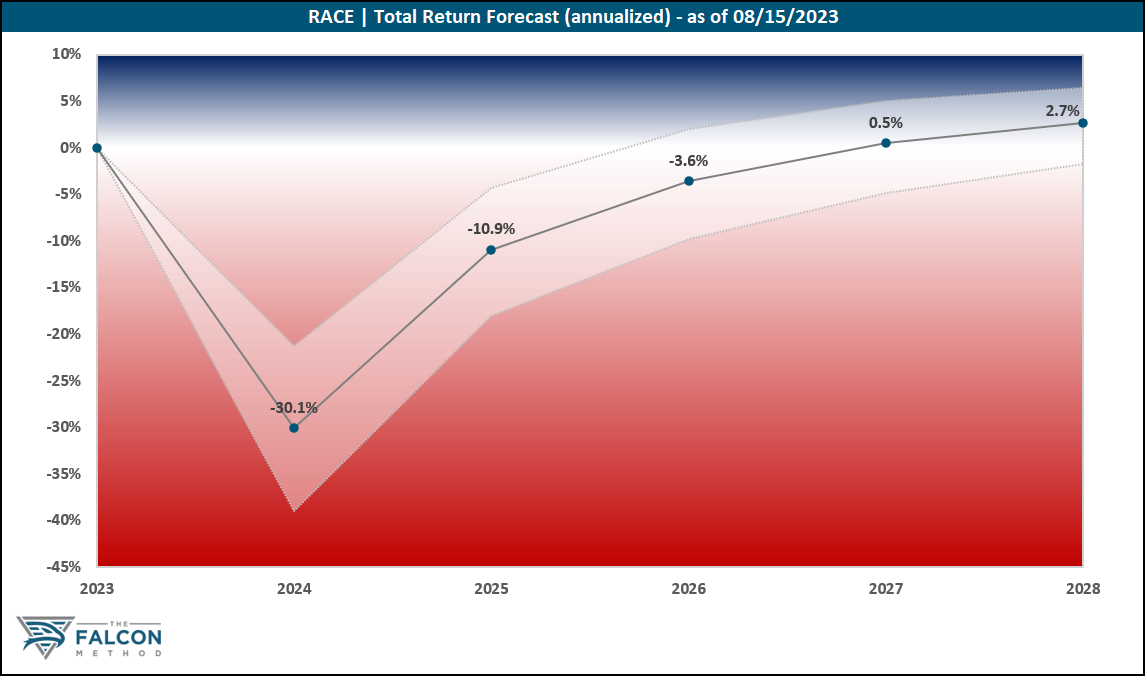

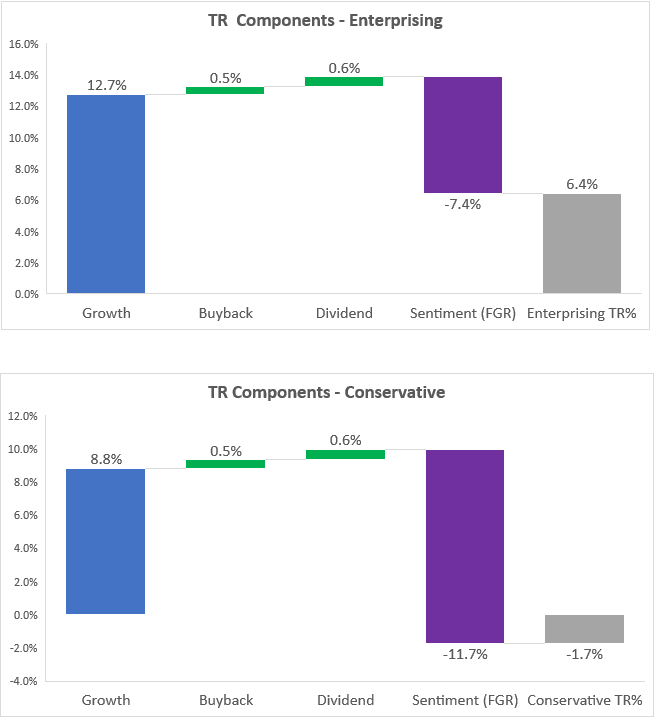

That being said, Ferrari’s unprecedented quality would pique our interest in this stock at the lower end of its historical valuation range. In our model, the valuation component acts as a meaningful headwind to the otherwise excellent fundamental return potential, as shown below.

Overall, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Ferrari for now.

The verdict

The most pronounced risk with any luxury company is that short-termism can kill long-standing intangible assets. In this specific case, management could let go of volume restriction to increase sales or cut R&D expenses to boost the bottom line. In essence, leadership could damage or outright destroy Ferrari’s crown jewel of assets, its brand value, by putting too many cars on the road.

Speaking of F1, Ferrari’s results in the past couple of years were most likely below the company’s expectations. Should the team fail to reclaim its historical position as the premier racing garage in the league, its brand image and hence sales of road-going Ferraris may also be affected.

The auto industry’s push toward fully electric vehicles could also pose a serious challenge, as do self-driving cars. (Just think about how the absence of charismatic, roaring V8 or V12 engines could hurt user experience and render the electric drivetrain more commodity-like.)

All in all, Ferrari’s unprecedented quality would pique our interest in this stock at the lower end of its historical valuation range. As for position sizing, we would be comfortable with a 3-5% exposure, geared toward the higher end at the proper price.

The company ranked 44th of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!