Throughout the years, I kept emphasizing in the FALCON Method Newsletter that the current market price of a stock might have nothing to do with the value of the underlying business. While this statement is the cornerstone of value investing, it may sound disturbing for those familiar with the names and theories of reputable economists contradicting me. (Burton Malkiel, Eugene Fama, and Paul Samuelson come to mind, the latter two of them being Nobel Laureates.) There’s no way to invest successfully without seeing clearly who is right—the academics or the real investors—so it is vitally important that you understand the points I outline below.

To lay the groundwork, let me quote Warren Buffett’s letter from 1988 first. “[The efficient market theory] doctrine became highly fashionable – indeed, almost holy scripture in academic circles during the 1970s. Essentially, it said that analyzing stocks was useless because all public information about them was appropriately reflected in their prices. In other words, the market always knew everything.” According to the EMT, price equals value, and that’s it.

Now let me show you two real-life examples that may make you think twice about what this theory says. On January 4, 2000, Yahoo! stock was selling for $500 per share. The business had a market cap of $505 billion at the time. The earnings were $47 million, and the PE ratio was 11,478! As value investor Phil Town writes, “Assuming the earnings were growing at some astronomical rate, say 36 percent a year, how long before we’d get our money back? Sixteen years. Never mind that no company ever grew that fast for that long starting that big. […] Oh, and if it did somehow grow that fast, the earnings would be over $300 billion. Exxon just had record earnings in 2008 of $45 billion. Earnings of all of the U.S. stocks traded regularly that year added up to about $300 billion, so Yahoo! all by itself would have to become pretty much the whole stock market to make sense out of that price. Yes, Professor, stocks do get mispriced from time to time. Just a bit.”

Scott McNeely was the CEO of Sun Microsystems, one of the darlings of the tech bubble. At its peak, his stock hit a valuation of ten times revenues. A couple of years afterward, he had this to say about that time: “At ten times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for ten straight years in dividends. […] That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next ten years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

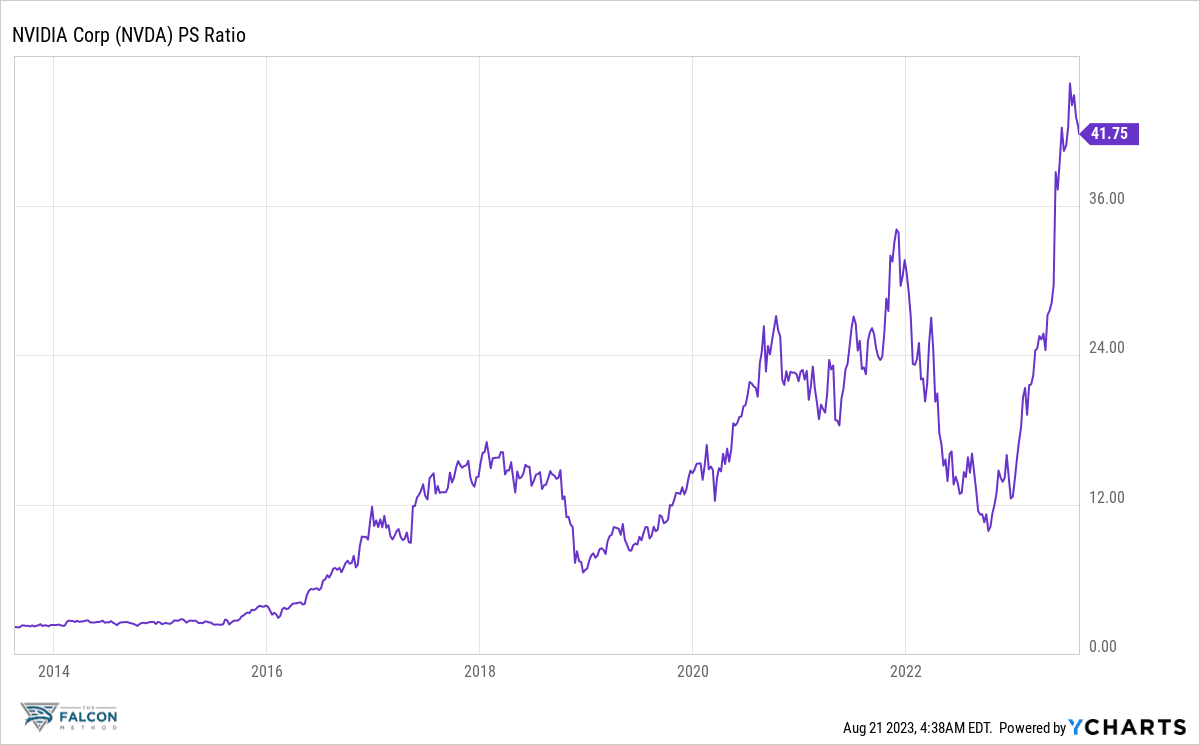

As a side note, you don’t have to look further than the tech sector to find companies trading at 10 to 15 times revenues today. I don’t know if they will follow the same path Sun did, but it certainly looks like there are tons of investors who will, at some point in the future, be asking themselves once again, “what were you thinking?”

I hope these two examples managed to highlight that the stock price and the value of the underlying business can diverge from time to time. The hypothesis of a totally efficient stock market simply doesn’t stand. After all, if you spot one single black swan, you have to abolish your hypothesis that all swans are white. And these examples show glaring market inefficiencies! On the other hand, the efficient market theory (EMT) is not 100% wrong either. The truth is somewhere in between, as Warren Buffett writes:

“Observing correctly that the market was frequently efficient, they went on to conclude incorrectly that it was always efficient. The difference between these propositions is night and day.”

In fact, Professor Malkiel, a pioneer of EMT, came to similar conclusions when he was asked after the 2000 to 2003 stock market debacle how some very good businesses could see their stock prices drop by 90 percent if the market was truly efficient. Very interestingly, he came as close to junking his theory as an academician ever could when saying, “In the long term, I think that [markets] are generally efficient. Though I’ll admit, they do go crazy from time to time.” So, Professor, the stock market is efficient, but sometimes it’s not. Sounds funny, but this is exactly what Buffett and other value investors have been saying for the past 50 years. And that “sometimes it’s not” part is what creates windows of opportunity for thoughtful investors. (By the way, did you know that Nobel-winning proponent of EMT, Paul Samuelson himself, invested in Berkshire Hathaway stock?)

Honestly, which camp looks stronger at this point: academics or real investors? For my part, I’d let economists keep their Nobel prizes while I’m becoming a rich statistical anomaly according to their models. That’s fun, believe me! After all, if you accept that the market price of stocks and the values of underlying businesses can diverge from time to time, all you need is the patience of a hunter to do nothing when companies are overpriced and to strike aggressively and buy when companies are priced far below their value. Did you know that a giant crocodile can go without eating for 12 months, waiting for the right opportunity to pounce on its prey? When learning this at Dubai Mall’s Aquarium, I already thought this was the exact kind of virtue true investors need to possess. We only strike when something appetizing comes along; in the meantime, we wait.

For value investors, cash size is usually a result of not being able to find anything to buy, and that’s the right approach. Rather than going to cash as a strategy and trying to time the market, it comes naturally for value investors as we do not like to overpay.

One thing to keep in mind, though, is that your standard reaction to a steep decline in the price of your stocks involves typical efficient market theory thinking. “Why is the price going down? There must be a serious problem that I don’t understand. Time to cut my losses and run away.” Whenever such garbage crosses your mind, please remind yourself that the market price of a stock can and does deviate from the underlying value time and again. The hypothesis of a totally efficient stock market has been proven dead wrong, and even one of its Noble winning proponents was investing with Warren Buffett.

In summary, value investors have every reason to be grateful for how Mr. Market operates. Most of the time, this bipolar fellow is taking his meds, so on most days, he’s pretty lucid and rational about the prices he buys and sells at. That means most of the time, the price of a business is pretty close to its value. On some days, however, he gets overwhelmed by his mood swings and gives us opportunities to pounce on. If you only remember one sentence from this writing, make it this one: If markets weren’t short-term inefficient, we would make no money, and if markets were not efficient in the longer term, we would make no money. The long-term efficiency part of the equation is needed so that valuation multiples can revert to their mean, giving us a nice capital appreciation in addition to the dividends collected along the way. Now you know why the market is perfect just the way it is.

Want to learn more about our stock ranking methodology and evidence-based investment approach? Start with this blog post!

Or read more like this in the Beyond Dividends book.