With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much difference than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers prove that Costco (COST) is a genuine EVA Monster and the king of physical retail, so it is worthy of your close attention. It is truly remarkable how this company has managed to carve out an undisputed wide moat in an extremely competitive landscape.

Costco operates an international chain of over 800 membership-only warehouses that carry quality, brand-name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources. Members can also shop for private label Kirkland Signature products, designed to be of equal or better quality than national brands, including juice, cookies, coffee, housewares, luggage, clothing, and detergent. The company also operates self-service gasoline stations and an e-commerce business unit. Costco was founded in 1983 and is based in Issaquah, Washington.

Costco’s culture of customer obsessiveness has deep roots that trace back to how the company’s legendary founder, Jim Sinegal, thought about building a business that would outlast all of us. He served as CEO from 1983 until his retirement in 2011, and he was well-known among workers for traveling to each location every year to inspect them personally. He also stated numerous times that the well-being of his employees was far more important to him than pleasing the insatiable need of Wall Street analysts for short-term profit maximization.

The firm derives the vast majority of its top line (98% as of fiscal 2022) from merchandise sales. Importantly, Costco’s products can only be purchased by members. Even though membership fees represent only a small fraction of the top line (2%), substantially all these revenues flow through to the bottom line, accounting for the lion’s share of Costco’s profits.

There are over 65 million paid members worldwide, with the annual fee for the Gold Star Membership currently at $60 in the U.S. Paid cardholders are eligible to upgrade to an Executive Membership (for an additional annual fee of $60) for Rewards and benefits. Notably, Executive members generated 71% of worldwide net sales in 2022. The company mainly caters to individual shoppers, but nearly 20% of paid members are businesses.

Costco is widely regarded as the originator of the “scale economies shared” business model, utilizing its operating leverage to pass on the resulting savings to customers. In turn, this results in an extremely loyal customer base, with retention rates consistently above 90% in its membership programs. Costco’s secret sauce lies in its obsessive focus on efficiency, which enables it to charge low-teens markups compared to 25-35% for a typical retailer.

Costco’s stores are large warehouses located in low-cost industrial areas. The company sells goods in bulk packaging, which eliminates the need for extra handling and shelf stocking, and substantially reduces theft occurrences. Crucially, Costco holds a limited number of stock-keeping units (SKUs), averaging 4,000 vs. up to 40,000 for a traditional supermarket. As a result, the firm’s U.S. sales per SKU were over $40 million, 10+ times higher than Walmart’s and Target’s metrics, contributing to its negotiation leverage in procurement.

Notably, we view Costco’s private label brand as a significant moat contributor. The major aim of Kirkland is to manufacture equal or better quality products than national brands at meaningfully lower prices, thereby fostering customer loyalty. Based on various industry reports, Kirkland contributes 25-30% to companywide sales at higher margins than branded SKUs. Standalone, Kirkland would be the largest consumer packaged goods brand in the U.S.

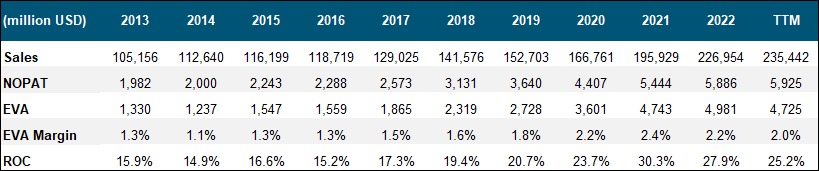

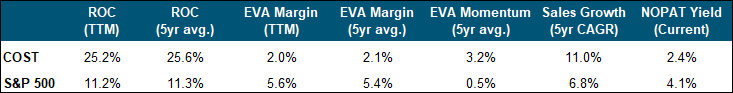

All things considered, we believe that thanks to its unique business model and relentless culture of efficiency, Costco has carved out a wide and enduring moat in the cutthroat retail space. This results in thin, albeit consistently positive and durable EVA Margins, and importantly, ROC levels that are completely unheard of in the physical retail industry.

As for the future, Costco typically opens 20-30 new warehouses each year, and it has historically grown its same-store sales at a mid-single-digit rate annually. These equate to a continued high-single-digit growth potential in product sales. The growth characteristics are largely similar in the membership aspect of the business as well, so Costco should be able to grow its top line by 6-8% annually over the long run. Our models also show that Costco’s EVA growth potential could outpace its sales trajectory and reach double-digit territory for years to come.

As for capital allocation, Costco operates with a relatively low reinvestment rate, primarily aimed at new store development and enhancing its Kirkland brand. Meanwhile, ROC levels are on an upward trend as rising same-store sales are driving improved capital efficiency.

Turning to capital distributions, the company first initiated a dividend in 2004 and has been increasing it ever since at a healthy double-digit rate. The ordinary dividend uses only about 25% of internally generated cash, translating to unquestionable safety. The firm also has a history of paying special dividends to its owners. Costco also carries out share repurchases; however, restricted stock units provided to employees (generous enough to make it one of the best retailers to work for) largely negate the effect, leading to a historically stagnant share count.

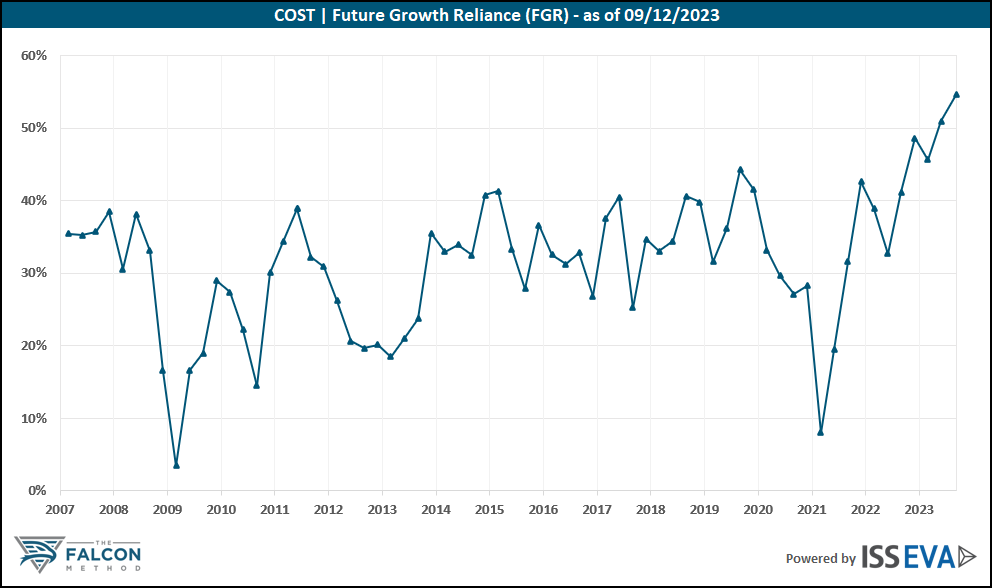

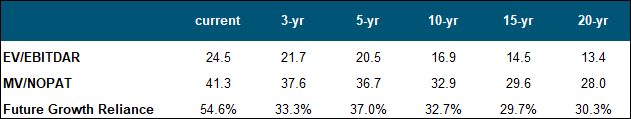

Looking at the stock’s valuation, we would have eagerly acquired shares during the financial crisis when the FGR metric fell close to 0%. However, aside from a surge in EVA thanks to COVID-induced stockpiling in 2020-2021, the company’s multiples have generally remained stretched. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

Regardless of how we look at it, the current valuation sits at the very high end of Costco’s historical range. Waiting for the valuation component to become at least neutral to the total return formula seems a reasonable approach at this point.

Overall, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Costco for now.

The verdict

What first comes to mind when assessing risks surrounding this business model is that, over time, consumers might increasingly turn to digital channels to fulfill their shopping needs. If Costco were unable to successfully develop a relevant omnichannel experience (which may also come with elevated investments, hurting profitability), its operations could be adversely affected.

It’s a tough call at this point, but Amazon’s extensive network of warehouses and fulfillment centers could serve as a foundation upon which it might try to replicate Costco’s business model, leveraging its preexisting Prime membership base.

While challenges like the rise of e-commerce or Amazon’s push into grocery do pose threats, we would be more than happy to own this business at the right price. With an operating model that has thrived for over 50 years, an exceptional leadership team focused on long-term value creation, and significant opportunities for overseas expansion, we think the company has a bright future. As for position sizing, we would be comfortable with a 3-5% exposure.

The company ranked 40th of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!