With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers prove that Wingstop (WING) is a genuine EVA Monster and is uniquely positioned in the fast-casual food service industry, so it is worthy of your close attention. While the company may not yet have an indestructible competitive advantage, the trend of its moat looks very encouraging.

Wingstop is a franchisor and operator of fast-casual restaurants specializing in hand-sauced-and-tossed chicken wing offerings with various distinctive flavors, always cooked to order. Aside from a few company-owned restaurants, 98% of Wingstop’s units operate in a franchise model, either through individual franchisees or via a master franchise agreement. As of February 2024, the company has nearly 1800 restaurants in the U.S. and more than 250 locations in other countries worldwide.

Wingstop has three primary revenue streams. Firstly, the company generates around half of its sales from franchise fees, as each franchisee is required to pay a royalty amounting to 6% of their gross sales to the parent company, besides a one-time opening fee of $30,000.

Secondly, each restaurant also contributes 5% of its retail sales to fund national marketing and advertising campaigns, making up around 25% of the company’s top line. With that said, this is essentially a flow-through item since Wingstop is spending the entire amount on enhancing brand awareness. Lastly, the company generates the remaining ~25% of its revenues via retail sales of food in its U.S. company-owned stores.

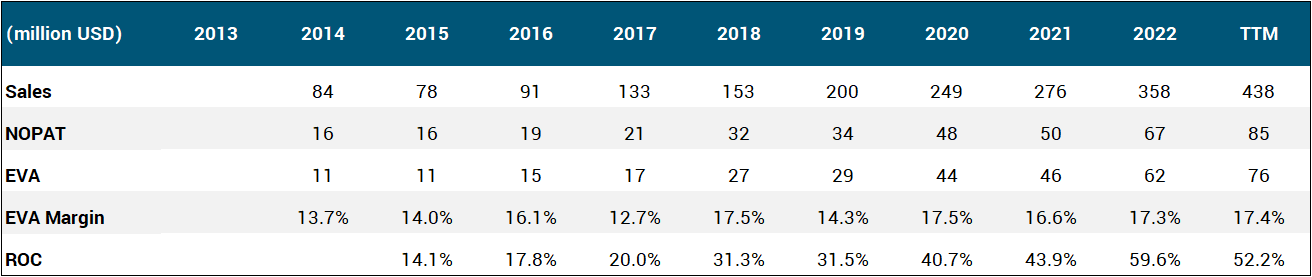

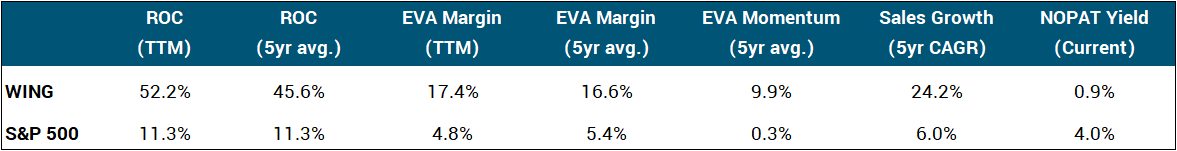

Examining the quality dimension from a quantitative angle, Wingstop’s double-digit EVA margin and impressive return on invested capital indicate the ‘moaty’ nature of the business. However, the qualitative side of the story requires further elaboration since it is immensely hard to carve out a durable moat in the highly competitive and fragmented restaurant space.

The handful of companies that eventually succeed in doing so have a few traits in common: a strong global brand, consistent customer experience coupled with the perception of “value for money,” scale-driven cost advantages in procurement and technology, and most importantly, excellent store-level profitability that makes the opening of new restaurants an attractive business opportunity for franchisees. It is apparent to us that Wingstop is on the right path to check all the boxes.

This company has established an immensely strong digital foothold in the restaurant business, possessing behavioral and consumption-related data of more than 30 million of its customers.

The company’s marketing strategy is centered around building a ‘platform brand,’ utilizing this rich dataset, and employing targeted advertising campaigns, personalized for each user cohort. As a result of this initiative, over 65% of sales are generated via digital channels (up from a mere 6% in 2014, signaling the immense progress), and thanks to the effective personalization of additional menu items, digital orders carry a $5 higher value on average.

We believe a further moat source is the attractiveness and quality of the firm’s offerings. Based on our research of online reviews, customers seem to love Wingstop for the consistent taste and high-quality flavor of their chicken wings.

All in all, we believe if we want to assess whether a restaurant chain has carved out a moat around its business, the telltale metric to look at is store-level profitability. Wingstop absolutely trumps the competition on this front, with stores providing a ~70% return on investment (rivaling or even surpassing Starbucks, one of the strongest global brands), translating to a less than 2-year payback period for franchisees.

As for the future, poultry consumption is on the rise, and more importantly, the share of poultry in total global meat consumption has steadily increased over the last 20 years, and we expect this trend to continue. This phenomenon could partly be explained by the rise of eco-consciousness since raising cattle takes a much heavier toll on the environment than chicken farming.

Besides that, the underlying fast-casual restaurant market where Wingstop operates is expected to grow ~10% annually through 2031, significantly outpacing the ~5% annual expansion of the global fast food and quick-service restaurant industry.

The business requires literally zero capital to grow, making Wingstop the epitome of a capital-light compounder with already impressive and expanding 50%+ ROC numbers. Thanks to the firm’s asset-light business model, there is ample cash available for shareholder distributions.

The company does not engage in share repurchases; instead, it initiated a dividend in 2017. Besides the regular quarterly payouts, special dividends have also been declared five times since 2016, at a pretty significant scale. Management’s policy regarding these special distributions is quite interesting since the company has paid more than 2x the money it has internally generated since its IPO.

The deficit has been financed by taking on debt at really low rates (which the business itself did not need, so there was ample room from a leverage standpoint). That said, the interest rate landscape has changed pretty dramatically, while leverage ratios are now at a level where the capacity to take on more debt will mostly depend on the growth rate of Wingstop.

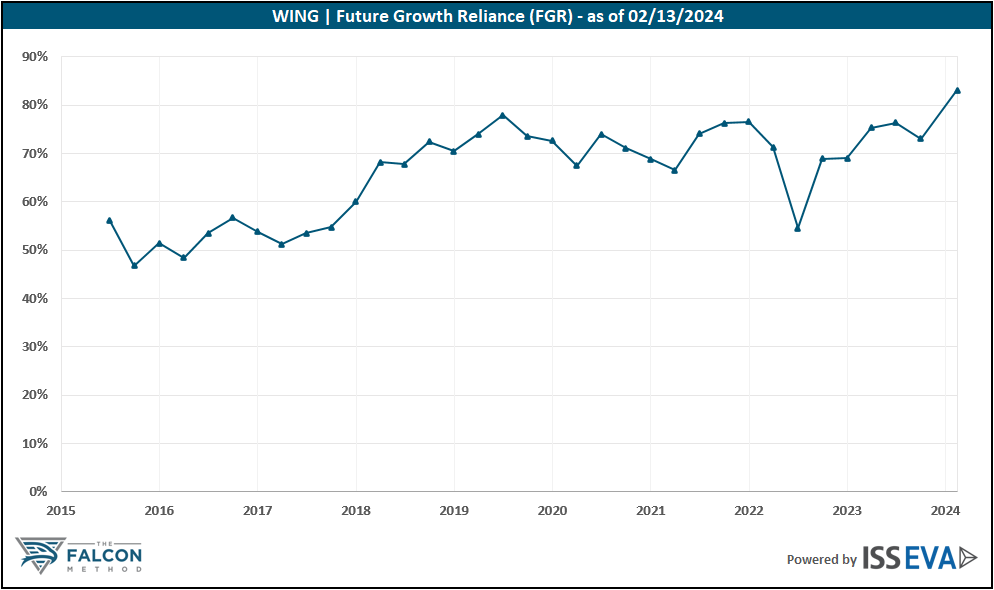

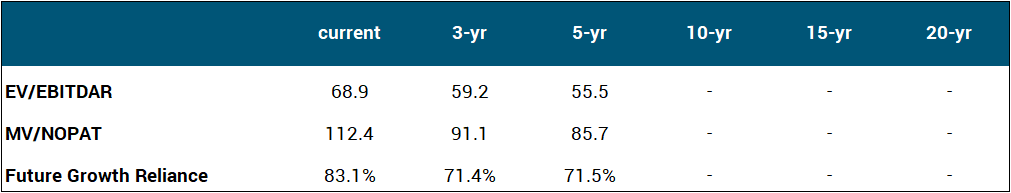

Looking at the stock’s valuation, the company’s current FGR of 83% seems absolutely exuberant, both from an absolute and historical perspective. The baked-in EVA growth expectations stand at ~25% annually for the next decade, which we deem very substantial, even if Wingstop is still in the early innings of what could be a decade-long profitable growth story. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture of where the stock stands in a historical context.

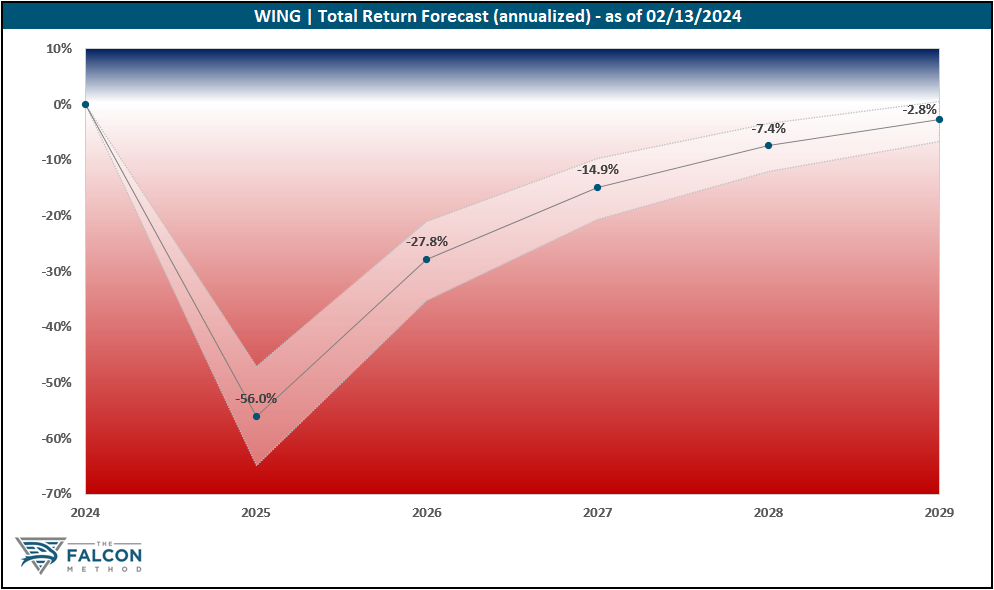

Regardless of how we look at it, Wingstop seems wildly overvalued at this point. The valuation component detracts so much from the otherwise stunning, 15-18% fundamental return potential that the total return potential falls into negative territory at the current price.

All in all, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Wingstop for now.

The verdict

With Wingstop, we get a simple, incredibly lucrative, asset-light business model with high returns, paired with several secular tailwinds that are expanding the company’s total addressable market. This makes us believe that this firm could turn out to become an EVA Monster success story that we managed to detect at a very early stage.

That being said, since this firm rather falls in the „developing moat” category, for now, we would feel comfortable with a maximum position size of 3-5%, geared to the lower end of this range.

The most prominent risk is that much of Wingstop’s valuation is tied to its compelling international development narrative. An inability to appropriately source strong franchise partners, and build a robust development pipeline outside the U.S. (with similarly strong store-level economics) could materially hinder the company’s growth prospects and put pressure on its high valuation.

The company ranked 58th of our 59 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!