With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers prove that IDEXX (IDXX), being at the forefront of the animal health industry is a genuine EVA Monster, so it is worthy of your close attention. The pool of public companies that directly benefit from the humanization of pets’ megatrend is very shallow, and this firm stands out as one of the best opportunities to ride this multi-decade secular tailwind.

IDEXX is the leading provider of point-of-care veterinary diagnostic products, including instruments, consumables, and rapid assay test kits. It also offers animal health reference laboratory diagnostic and consulting services, alongside practice management and diagnostic imaging systems and services for veterinarians.

The overwhelming majority of IDEXX’s top line (91% as of fiscal 2022) stems from its Companion Animal Group (CAG) segment, making the company primarily a pet health diagnostic enterprise. Notably, within this division, instrument sales only contribute 4% to overall revenues.

The company generates substantial revenues from the sale of consumables used in its instruments, with the multi-year consumable revenue stream being significantly more valuable than the placement of the instruments. Besides its point-of-care solutions, IDEXX also operates a broad array of reference laboratories, used by veterinarian practices to address more complex testing needs.

IDEXX is the undisputed leader in point-of-care diagnostic tests and in-house analyzer equipment, generating revenues that are 10 times higher than its two closest competitors: Antech Diagnostics, a brand under the privately held Mars Petcare umbrella, and Abaxis, a fully-owned subsidiary of Zoetis.

We think the essence of IDEXX’s competitive advantage lies in its all-in-one diagnostic suite for veterinary practices. It begins by offering diagnostic instruments, often at a discount or even without upfront costs, on the condition that the practice orders its consumables from IDEXX and utilizes its pool of reference lab services.

The company’s practice management systems create embedded integration with IDEXX’s in-clinic instruments and outside reference laboratory test results, while also offering an invaluable customer management database. In aggregate, IDEXX’s ecosystem benefits from considerable switching costs, resulting in dependable and highly lucrative recurring revenues. Notably, customer retention rates consistently exceed 95% for consumables and reference lab solutions.

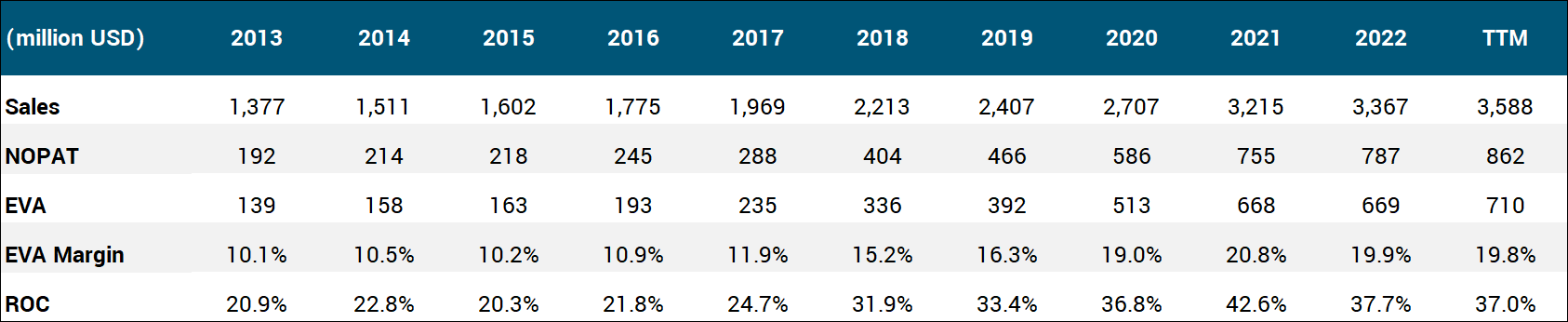

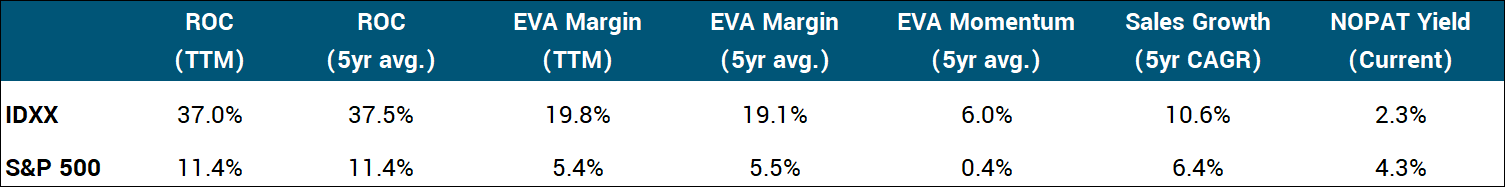

Its pricing power is evident in the exceptional quantitative results, delivering strong double-digit ROC and EVA Margin figures.

One of the most enduring megatrends of our times is the humanization of pets. Dogs and cats are increasingly treated as family members, especially among millennials and younger generations who are less enthusiastic about having children than their parents. Multiple studies have revealed that people are willing to sacrifice other discretionary items to maintain or increase spending on their beloved pets, even in tough economic situations. Pets are living longer because of their owners’ commitment to their health and well-being, increasing the number of elderly companion animals (much like in the case of humans). This translates to a tailwind for veterinary care expenses. All things considered, IDEXX’s annualized top-line growth rate could approach 10% for years to come.

The firm maintains a prudent approach to capital allocation, traditionally reinvesting approximately one-third of its internally generated cash. These reinvestments have resulted in exceptional 30-40% ROC levels, which is truly commendable.

Regarding capital distributions, the firm has never paid a dividend, nor does it expect to do so in the foreseeable future. Nevertheless, share repurchases have been a standard practice for quite some time now, even as the focus on reducing debt levels has put pressure on buybacks. (Frankly, we don’t fully understand the strategy behind IDEXX operating with almost no debt when the nature of the business could easily support modest leverage.) Unfortunately, these automatic repurchases have often occurred at astronomical valuation levels in our view, revealing a poor use of shareholder capital.

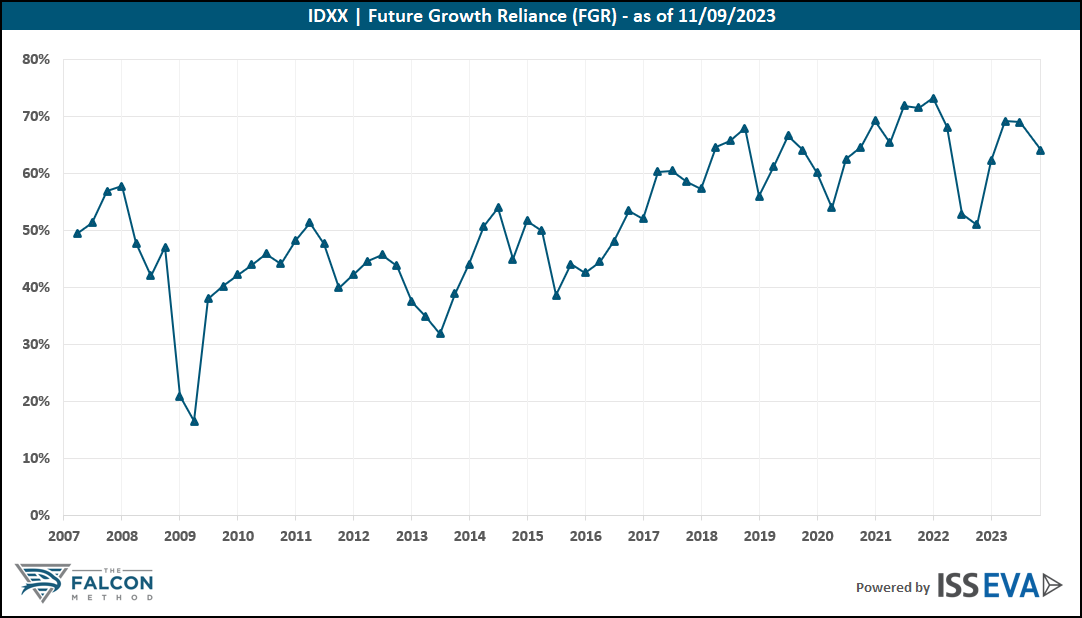

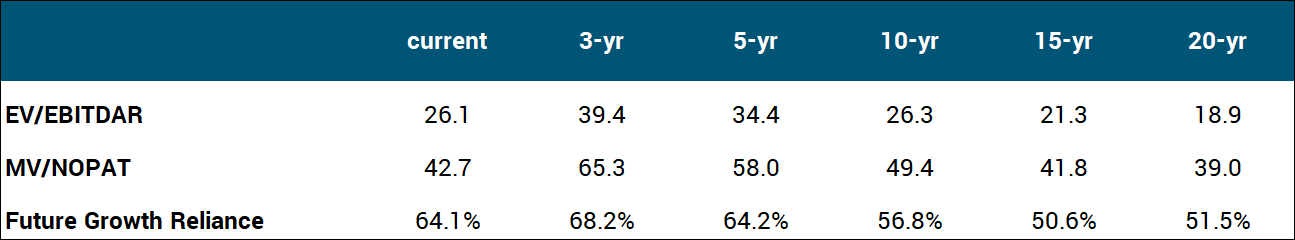

Looking at the stock’s valuation, IDEXX hardly ever traded cheaper than the market. That being said, we believe that today’s valuation is above any reasonable fundamental estimate, with more than 17% 10-year EVA growth baked in at the current price. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture of where the stock stands in a historical context.

We would get interested when the valuation component becomes a mild tailwind to the ~12% fundamental return potential, marked by an FGR of 40% or lower.

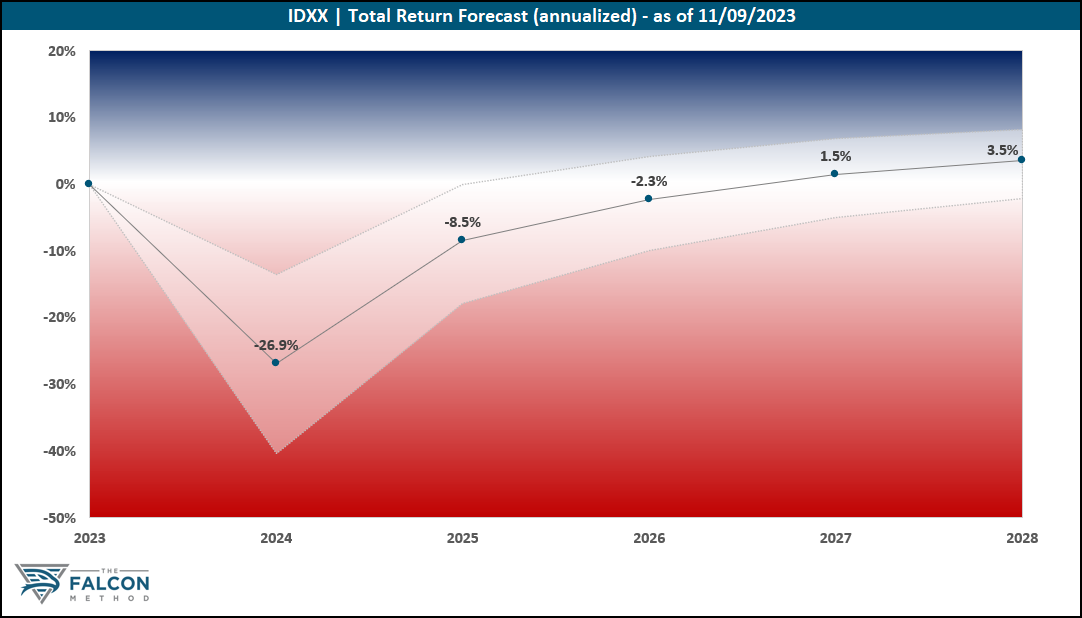

The stock is an easy pass today. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on IDEXX for now.

The verdict

What first comes to mind when assessing risks surrounding this business model is that IDEXX must continue innovating to improve the ease of use and accuracy of its diagnostics tools and enhance its full suite of integrated offerings. Although most of its competitors are either smaller in scale or lack a singular focus on animal diagnostics, the firm needs to continuously develop and market the best products to protect its competitive position.

The consolidation of IDEXX’s customer base could be problematic. An increasing number of veterinary clinics are now owned by corporations (like Mars), and these consolidators may wield significantly higher bargaining power than standalone vet clinics.

While challenges like the shortage of veterinary professionals do pose threats, we would be more than happy to be owners of this business at the right price. The width of the firm’s moat in its niche market is more than sufficient, while the recurring nature of its revenues is a major plus. The fundamental return potential is also firmly in the double digits, so we get everything we want from an EVA Monster. As for position sizing, we would be comfortable with a 3-5% exposure, skewed to the lower end of this range.

The company ranked 43rd of our 59 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!