With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

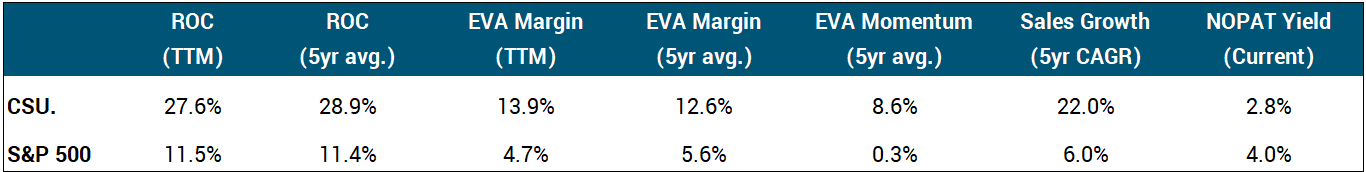

Without further ado, numbers clearly prove that Constellation Software (CNSWF) is a genuine EVA Monster and a truly unique vehicle, so it is worthy of your close attention. It is remarkable how this serial acquirer built an immensely durable (shall we say perpetual) growth engine.

Constellation Software Inc. acquires, manages, and builds vertical market software (“VMS”) businesses. These entities are dedicated to delivering mission-critical software solutions tailored to the requirements of their clientele within specific industries, catering to both the public and private sectors. Constellation’s extensive portfolio comprises hundreds of companies, spanning diverse sectors such as communications, agriculture, marine applications, utilities, credit unions, beverage distribution, and hospitality. Constellation Software Inc. was incorporated in 1995 and is headquartered in Toronto, Canada.

Mark Leonard, the founder and visionary behind Constellation Software, has been serving as CEO since the company’s inception in 1995, quietly shaping a unique success story. Despite his status as one of the lowest-profile billionaires in the business world, Leonard’s impact and capital allocation skills cannot be emphasized enough. His journey began with a decade-long stint in venture capital, during which he recognized the untapped potential of small VMS firms. This realization laid the foundation for his distinctive approach of building a growth engine around these underappreciated companies.

Constellation operates across a diverse spectrum of over a hundred distinct verticals, encompassing a portfolio that spans several hundred companies. Owing to this diversified corporate framework, no individual business unit or segment holds material significance for the organization.

Maintenance and other recurring revenue (71% of fiscal 2022 sales) primarily consist of fees from customer support on software products post-delivery and include recurring fees earned through Software-as-a-Service products. Professional service revenue (21%) comes from fees charged for implementation services, custom programming, product training, and consulting.

We believe the secret sauce in Constellation’s competitive edge lies in the culture that characterizes its acquisition approach. It aims to be a perpetual owner of the acquired companies, thereby distinguishing the business from conventional private equity firms whose primary focus is the subsequent resale of their acquired assets at a premium in the future.

Notably, the firm acquires over 100 companies each year (averaging one every other business day). This pace is only possible in a decentralized decision-making framework, which also includes the critical function of capital allocation. Constellation’s corporate headquarters grants significant autonomy to subsidiary management levels, empowering them with the authority to evaluate potential acquisition targets and make informed decisions based on their assessments.

We believe another pillar of Constellation’s moat lies in the characteristics of its portfolio members. Essentially, it’s a conglomerate composed of an army of small but moaty businesses, each characterized by high switching costs. In essence, VMS companies provide highly customized solutions to meet the needs of a specific segment.

Although we do not favor serial acquirers in general (as this feature seldom aligns with consistent shareholder value creation), we hold the conviction that Constellation’s attributes justify the designation of a wide-moat enterprise.

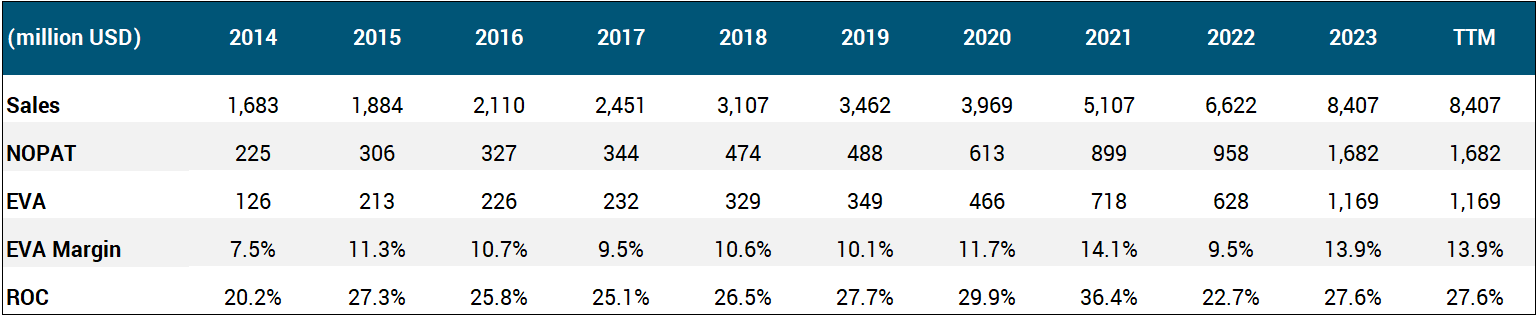

As for the future, it is worth noting that the collective organic growth rates exhibited within Constellation’s portfolio of companies have been rather modest, yielding a low-to-mid-single-digit annualized CAGR over recent years. Consequently, Constellation’s growth engine can be best understood by the principle that a firm’s long-term annualized earnings growth rate converges to its reinvestment rate times the return on its incremental invested capital. Assuming that Constellation can continue allocating 80% of its internally generated cash (NOPAT) each year at 20%+ ROC levels, we arrive at a strong double-digit inorganic revenue and earnings growth potential.

At its core, this firm can be characterized as a capital-light compounder because the VMS businesses under its umbrella require very little reinvestment. Then, recurring cash flows generated by the VMS firms are harnessed to fuel a relentless acquisition engine, resulting in consistently stellar ROC levels in the 25-30% range.

Turning to shareholder distributions, Constellation pays a tiny, negligible regular dividend. In 2019, shareholders received a sizable, ~$18 per share special dividend due to the lack of attractive redeployment opportunities. Constellation has garnered a unique shareholder base that would prefer Leonard to reinvest this money instead of distributing it. Therefore, we find it unlikely that another special payout will take place in the foreseeable future, and even the ordinary dividend could be sacrificed if a better use of cash presents itself.

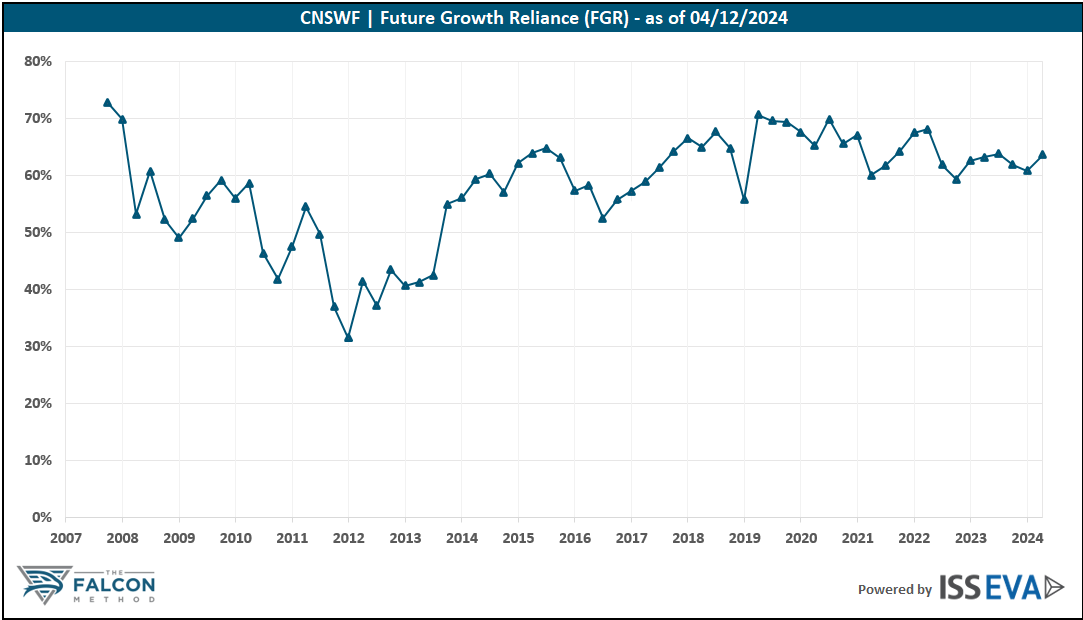

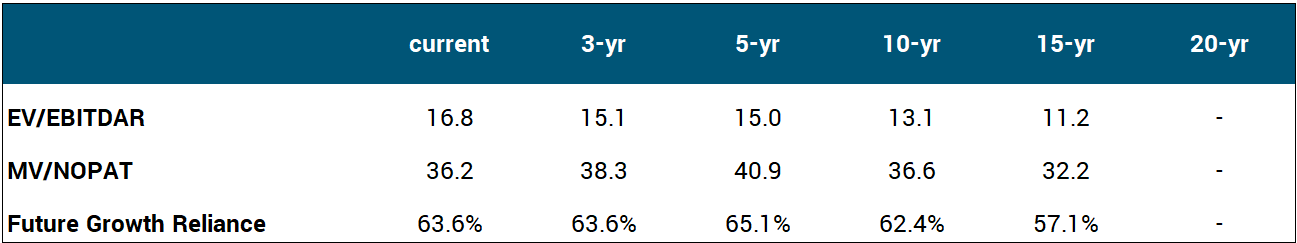

Looking at the stock’s valuation, Constellation’s shares have always appeared pricey on the surface. Regardless, its EVA growth over the past 5-10 years has managed to surpass even the market’s rosy expectations. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

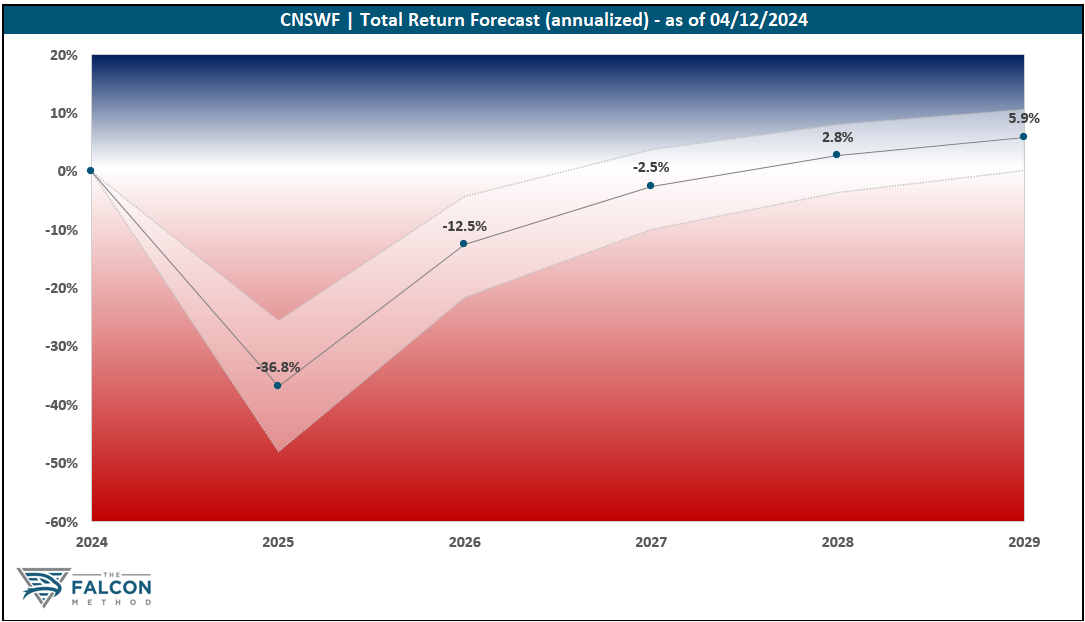

The “fair” valuation range in the future hinges on the firm’s reinvestment efficiency, and as we see potential downside risks on the growth front, we have employed more conservative assumptions in our model. Nevertheless, the market-relative valuation seems unattractive at the moment with a NOPAT yield of 2.8%. Waiting for the valuation component to become at least neutral to the total return formula seems a reasonable approach at this point.

Overall, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Constellation for now.

The verdict

The most obvious risk that comes to mind is that Constellation may have reached a point where it is too large to sustain its historical growth levels. The company will have to allocate as much cash in the upcoming five years as it had in the last two decades, and this raises several questions.

Furthermore, Mark Leonard’s willingness to go outside Constellation’s core circle of competence when seeking alternative options to deploy capital brings an elevated level of uncertainty. As a true value investor at heart, he warned investors that any non-VMS deal is likely to be a highly contrarian, “eyebrow-raising” type of transaction.

While challenges like the level of key personnel risk involved in this thesis do pose threats, we would be more than happy to own this business at the right price. The collection of moaty VMS businesses, paired with the head office’s corporate culture and approach to capital allocation makes us want to be an owner of this company. As for position sizing, we would be comfortable with a 2-3% exposure.

The company ranked 28th of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with all the highest-ranking ten boasting total return potentials above 12% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!