With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers show that Kering, the French-based multinational corporation specializing in luxury goods, exhibits EVA Monster characteristics and is thus worthy of your attention. (Shares are available directly on the Paris Stock Exchange under the ticker symbol KER, or as an ADR with the ticker symbol PPRUY on American OTC markets.)

Kering is the world’s second-largest personal luxury goods holding company after LVMH. Its flagship brand is Gucci, followed by other high-end fashion houses such as Saint Laurent (YSL), Bottega Veneta, Alexander McQueen, and Balenciaga. Its range of products includes handbags, shoes, and ready-to-wear clothing items designed and manufactured by the company. Besides its core offerings, the firm also markets sunglasses and optical glasses under its Kering Eyewear division. Kering SA (formerly called PPR or Pinault-Printemps-Redoute) was founded in 1963, and is based in Paris, France.

Kering has evolved into the second-largest luxury powerhouse following the acquisition of the Gucci Group in the early 2000s. Besides the namesake brand, the acquired portfolio included Saint Laurent, Bottega Veneta, and Balenciaga, among others. After a few strategic missteps (such as seizing a controlling stake in sportswear manufacturer Puma in 2007, which was almost entirely spun off in 2018), Kering has fully dedicated itself to developing its luxury houses.

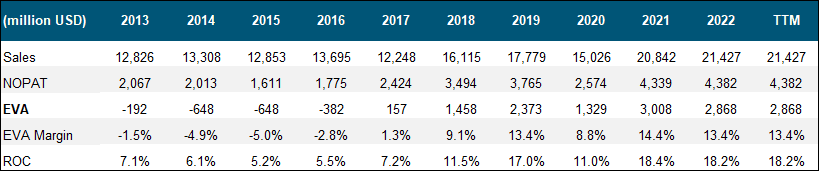

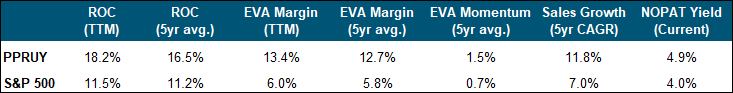

A quick glance at the EVA metrics reveals that the firm’s EVA trajectory has been on a steep ascent in the second half of the past decade. This clearly reflects the strengthened focus on its luxury houses, and we believe that the current double-digit EVA Margin and ROC levels are telltale signs of a moaty business.

Kering’s largest brand, Gucci is responsible for 55% of the top line, Saint Laurent makes up 14%, and its third biggest house is Bottega Veneta, with a 9% contribution. In economic profit terms, Gucci’s contribution comes in at ~70% of the company’s overall EVA generation. When we add YSL and Bottega Veneta, the three biggest brands make up ~90% of economic profits.

Kering’s overreliance on Gucci is one of the key risks associated with the company. The brand’s history is not without creative and operational hiccups, and the rapid growth of the recent past implies the risk of overexpansion and customer fatigue, the standard culprits of luxury brands.

Within the personal luxury goods segment, a few traits are required for a brand to carve out lasting pricing power and warrant a price tag often 10x higher than that of comparable items from premium brands. The handful of fashion houses that succeed in doing so possess a respectable heritage, often dating back more than a century. Besides that, it is quintessential to maintain the brand image by controlling the distribution network, while exclusivity must be ensured by a limited supply where price discounts are unthinkable.

As for the supporting megatrend, the personal luxury goods market is expected to grow in line with the seemingly unstoppable trend of the rising number of high-net-worth individuals (HNWIs) globally. While we view the company’s earlier forays into the commodity sportswear segment as a dead end, the strategic focus on building a pure-play luxury empire is bearing fruit.

Since 2005, the business has been led by François-Henri Pinault, the son of the empire’s founder. Overall, Kering has remained a family-controlled holding. While this structure could be a double-edged sword in general, we tend to believe that it is preferable for luxury companies. It is important to prioritize the sustainable, long-term growth of the fashion houses, thereby curbing supply and omitting price discounts at any cost. As a counterexample, a short-sighted management team could double sales in a matter of years, inflicting immense reputational damage.

The firm pays a semi-annual dividend, which tends to fluctuate with earnings, rendering the stock a rather hectic income source. That said, the dividend is not the main attraction here since Kering comfortably qualifies as a longevity moat type of EVA Monster with its seemingly unending EVA growth trajectory. (This is a rare breed!)

When it comes to the stock’s valuation, it is important to note that the firm’s profitability has markedly expanded in the second half of the past decade (as a result of tightening its luxury focus and revamping its major fashion houses). We believe this structural change to be permanent and hence view the current EVA Margin levels as sustainable.

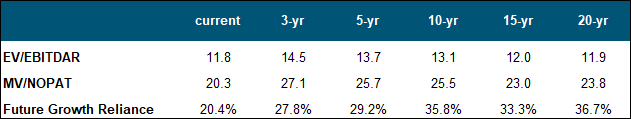

Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

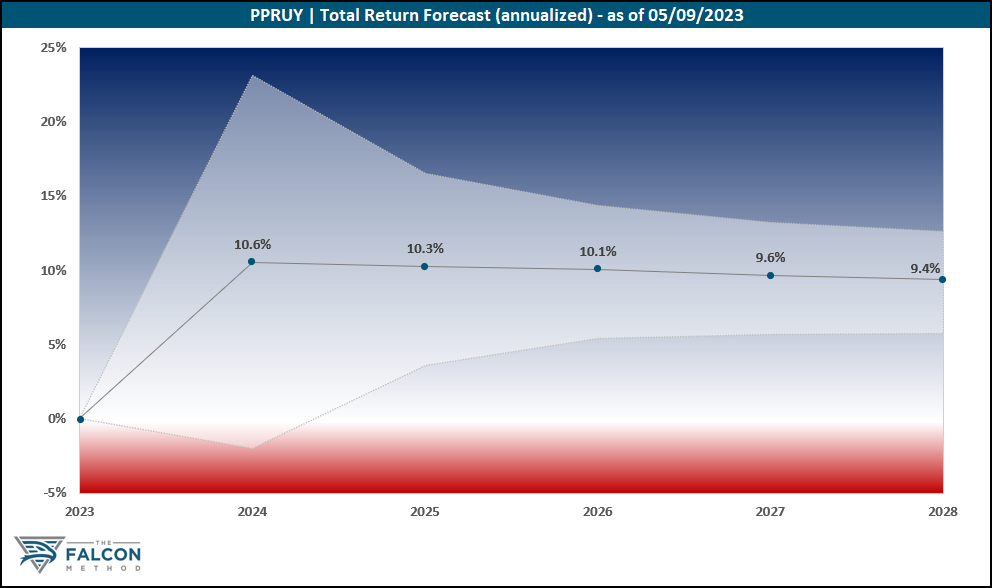

While Kering’s business appears superior to the market from both a quality and growth angle, the valuation component may act as a slight headwind from today’s price level. The “Key Data” table and the 5-year total return potential chart speak for themselves.

Overall, the FALCON Method can identify much better opportunities in the current market, so we are passing up on Kering for now.

The verdict

We love that the company’s target consumer segment is not particularly sensitive to economic cycles. The underlying HNWI growth megatrend is also a powerful tailwind.

Based on Kering’s recent reports, monitoring the Gucci brand’s trajectory in China remains the most important aspect for those interested in the stock. (China is crucially important to the overall growth thesis.)

While we really like the luxury segment, LVMH is our preferred conglomerate in the industry (because of its superior brand portfolio, operational track record, and product diversification). That said, we would also take a smaller (2-3%) position in Kering at the right price.

The company ranked 19th of our 60 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking five boasting total return potentials above 16% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!