With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers prove that Monster Beverage (MNST), the best-in-class energy drink brand possesses true EVA Monster characteristics and is thus worthy of your close attention. As long as you agree with us that caffeinated beverages are not ripe for an inevitable downturn due to changes in consumer preferences, Monster could be a great addition to any quality-growth-focused portfolio.

Monster Beverage is one of the leading global players in the energy drink subsegment of the beverage industry, broadly regarded as Red Bull’s most significant competitor in the premium category. The firm relies on the Coca-Cola bottling system for production and distribution, as a byproduct of the beverage giant’s strategic investment to become Monster’s largest shareholder. The company was formerly known as Hansen Natural Corporation and changed its name to Monster Beverage Corporation in 2012.

The current leadership team has a more than respectable, lengthy background. The duo who originally led the consortium that purchased Monster’s predecessor entity is now mutually responsible for top-level decision-making (in a „co-CEO” structure). In our view, Rodney Sacks and Hilton Schlosberg have done an excellent job at creating and nurturing the premier brand image of Monster Energy, and their near-flawless execution was key to battling prominent rivals such as Red Bull.

The lion’s share of the firm’s revenue stems from its Monster Energy Drinks segment (92% of its fiscal 2022 sales). The company is responsible for the flavor development and branding of its flagship products, while the manufacturing and distribution processes are outsourced to the Coca-Cola bottling system globally.

Red Bull is broadly regarded as the creator of the energy drinks space in the early 80s, and it has remained the undisputed king of the category up until this day. The fact that the market leader stayed in private hands all the way speaks volumes about the profitability of the sector, as the firm was able to achieve this feat without relying on external shareholder capital.

Decades later, Monster emerged as the only viable competitor able to match Red Bull’s global reach, with the two forming an essential duopoly in the premium energy drinks space by now.

The firm is best described as a flavor and marketing powerhouse since it develops and manufactures the primary flavors for its flagship product lines in-house. Its ever-evolving palette ranges from traditional energy drinks to functional sports drinks, coffee, and tea derivatives, to its recently launched alcoholic beverage line. At the centerpiece of the company’s strategy is the flagship Monster brand, which certainly has a coolness factor to it, thanks to the company’s relentless marketing efforts.

Crucially, one of the most important components of Monster’s success formula is the strategic partnership with Coca-Cola, granting access to the beverage juggernaut’s global bottling and distribution network. This allows Monster’s new products to be scaled more quickly and eases retailer negotiations.

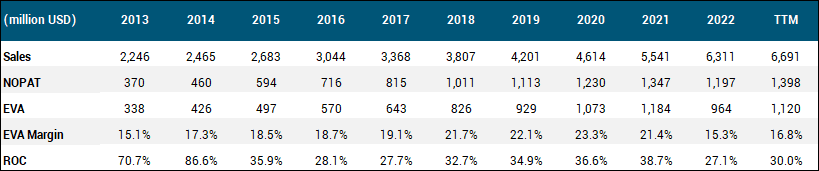

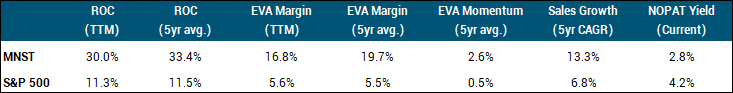

Thanks to its asset-light business model and pricing strength, the firm fares extremely favorably from a quantitative perspective, boasting enviable EVA Margin and ROC levels. Truth be told, we are finding it difficult to judge Monster’s moat from the qualitative aspect. If you believe that the energy drink category is here to stay (which we do), Monster undeniably has a sustainable competitive edge within the segment. However, compared to beverage titans such as Pepsi and Coke, the firm clearly plays in a lower league when it comes to scale and brand diversification.

As for the future, the global energy drinks market is estimated to grow at an 8%+ pace over this decade, fueled by humanity’s need for alternative sources of caffeine. Our back-of-the-napkin calculation revealed that even if we assume young adults in their 20s and 30s purchase all the energy drinks, it would still amount to roughly one can of Monster per week for the average U.S. consumer. This leaves plenty of room for organic volume increases, with pricing serving as a potential second growth lever.

Turning to capital allocation, the company boasts a reinvestment rate near 30%, and its capital-light nature allows it to achieve ROC figures constantly above 25%, which is more than respectable. A smaller portion of the money that’s being plowed back into the business goes toward organic reinvestments like advertising and flavor development, while the remainder is directed to bolt-on acquisitions aimed at diversifying Monster’s capabilities outside of energy drinks.

As for shareholder distributions, the firm has never paid a dividend and does not anticipate doing so in the foreseeable future. However, regular share repurchases are an important piece of the capital allocation puzzle, as Monster has cut its share count by nearly 8% over the past five years. On a sour note, the timing of buybacks signals very little opportunism, with the company regularly scooping up its shares at stretched valuation levels.

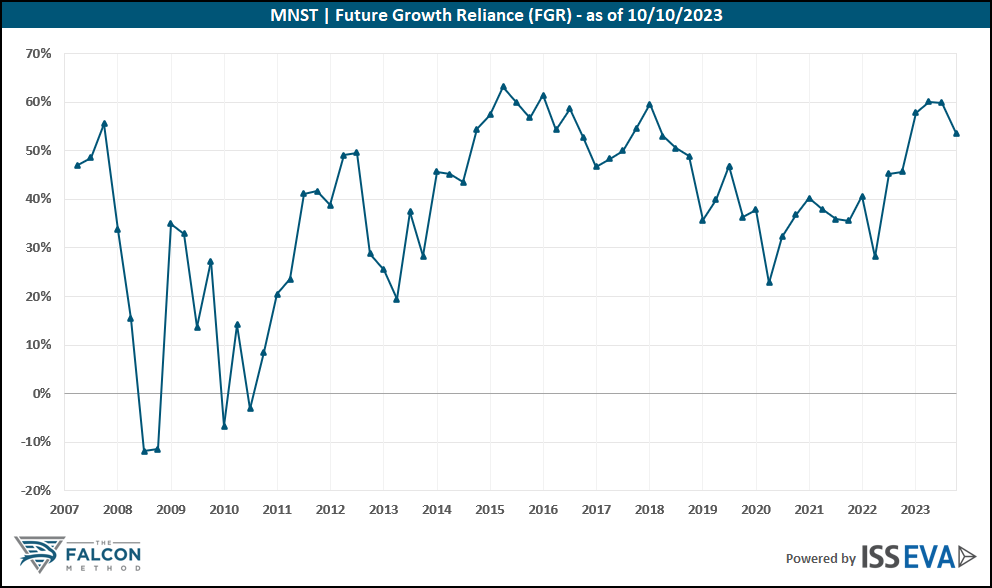

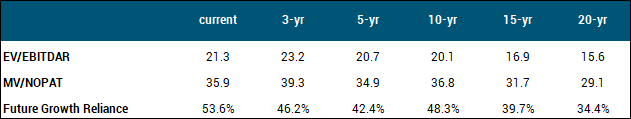

Looking at the stock’s valuation, Monster has always traded at a hefty premium to the market, and the current sentiment (albeit not ecstatic) still appears overly optimistic, even if we look at historical valuation figures. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture of where the stock stands in a historical context.

It is worth noting that 2022 has been the worst year for the company for a long time in terms of profitability, thanks to cost inflation and sourcing difficulties, but even after assuming a meaningful recovery in margins, the company’s NOPAT yield would still sit markedly below the market average (although its quality and growth characteristics might warrant a slight premium).

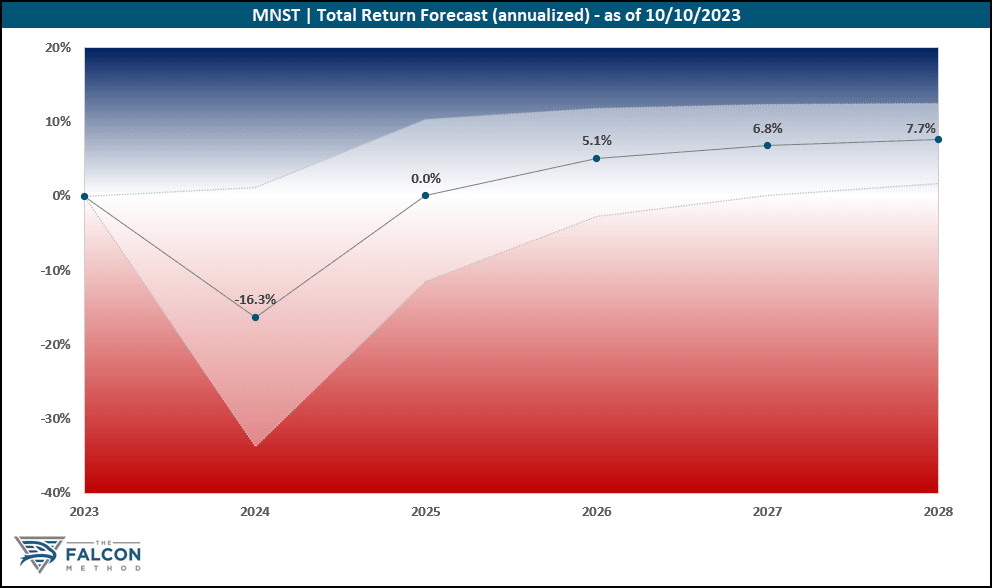

Overall, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Monster for now.

The verdict

The “alternative” beverage market is extremely competitive and the barriers to entry are quite low, which means that Monster has to continuously fend off new brands to protect its superior position.

On the regulatory front, the supposedly negative health effects of regular energy drink consumption could lead to potential proposals that aim to restrict the sale and/or advertising of energy drinks below a specified age or to restrain the venues in which Monster’s products can be sold. We cannot exclude the risk that the energy drink sector might someday be scrutinized as much as tobacco, which could pose difficulties in marketing and distribution.

The growing presence of health consciousness might also translate to shifting consumer preferences, which could dampen the growth trajectory of energy drinks as we know them today, with more focus on nutritiousness and health benefits

All in all, while we have identified numerous risks surrounding Monster’s business, we would be happy to build a position at the appropriate price. The firm has an unquestionably strong brand, attractive market dynamics with plenty of room for international expansion, and a great leadership team at the helm. On top of that, Monster makes money from small, everyday repeat purchases, and this sector is also less prone to cyclicality and downtrading in tough economic times. Nevertheless, we would shoot for a smaller, 2-3% exposure with this name.

The company ranked 30th of our 59 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 14% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!