With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

Without further ado, numbers prove that Rational AG (RTLLF) is a great EVA Monster candidate despite the no-moat nature of its industry, so it is worthy of your close attention. This market leader boasts stellar quantitative metrics, and our qualitative assessment also supports a wide-moat badge in its niche market.

Rational AG develops, produces, and sells professional cooking appliances for industrial kitchens worldwide, serving restaurants, communal catering clients, and retail chains. The company’s flagship offerings are the iCombi combi-steamers and iVario multifunctional cooking systems, designed to replace conventional cooking appliances such as stoves, grills, and ovens.

Siegfried Meister founded what is now Rational AG in 1973. For 44 years, he led his life’s work to success and remained true to his motto of focusing on customer benefit. Although he passed away in 2017, his values are still firmly embedded in the corporate culture today. His dear friend, Walter Kurtz, also played a crucial role in turning Rational into a success story, and he still holds a significant ownership stake in the business.

The majority of Rational’s top line (70% as of fiscal 2023) comes from the sales of its multifunctional cooking systems. The flagship product is called iCombi Pro, a combi-steamer with intelligent, software-controlled cooking paths, where heat is transferred by steam and hot air to achieve the desired result. The remaining portion of the company’s top line (30%) stems from aftermarket sales, including accessories, spare parts, and maintenance services for its cooking appliances.

Rational has long been a pioneer in its field, establishing the combi-steamer category almost 50 years ago. Ever since, the firm has remained the global market and technology leader in innovative solutions for thermal food preparation in the world’s professional kitchens, boasting a market share of around 50%, roughly five times greater than its closest competitor.

Even though the purchase of a combi-steamer represents a significant capital outlay for its clients, it is widely regarded as an investment with exceptional returns, resulting in payback periods of just a few months and ROI figures well over 100%, which explains the relentless demand for Rational’s appliances.

Additionally, Rational’s appliances have a reputation for reliability and German quality, coupled with a market-leading warranty program. The firm also offers a global service network with 24/7 availability, enabling it to minimize expensive downtime for its clients. Rational has stayed at the forefront of innovation for decades, allocating 5% of its sales on average toward R&D.

Overall, despite being a significant investment from its customers’ side, Rational’s ecosystem and its array of value-added offerings represent a lower total cost of ownership compared to traditional appliances and competitors. compared to traditional appliances and competitors.

As for the future, as prosperity increases worldwide, the restaurant and catering sector gains more importance because it materially contributes to the standard of living for the expanding global middle class. Consequently, the number of quality meals that need to be prepared every day around the world continues to grow. All of this results in the restaurant sector growing at a GDP-beating pace for years to come, serving as a baseline growth rate for appliance suppliers as well.

We argue that Rational will likely continue to outgrow the broader market, propelled by the powerful tailwind of combi-cookers replacing traditional technology in professional kitchens. Based on management’s estimates, there is ample untapped market potential for both of its product groups, with iCombi and iVario serving roughly 12% and 2% of their addressable markets, respectively.

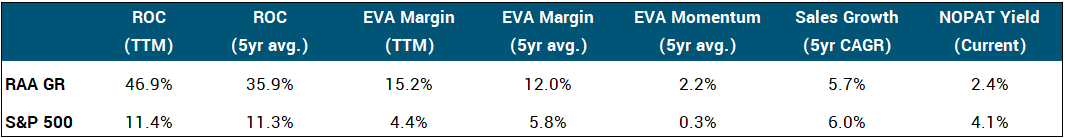

As for capital allocation, Rational typically operates with a very low reinvestment rate of 10-15%, while ROC figures have averaged a staggering 45%. The company also maintains a very solid balance sheet with more than sufficient liquidity and zero debt.

As for shareholder distributions, since the business requires minimal incremental capital to operate and grow, most of the surplus cash can be paid out as dividends. Although the firm has declared a payout every year since its IPO, the amount has been quite irregular because management adheres to a 70% payout ratio, regardless of the yearly profit. Special dividends have also been occasionally announced when there was no better use of cash.

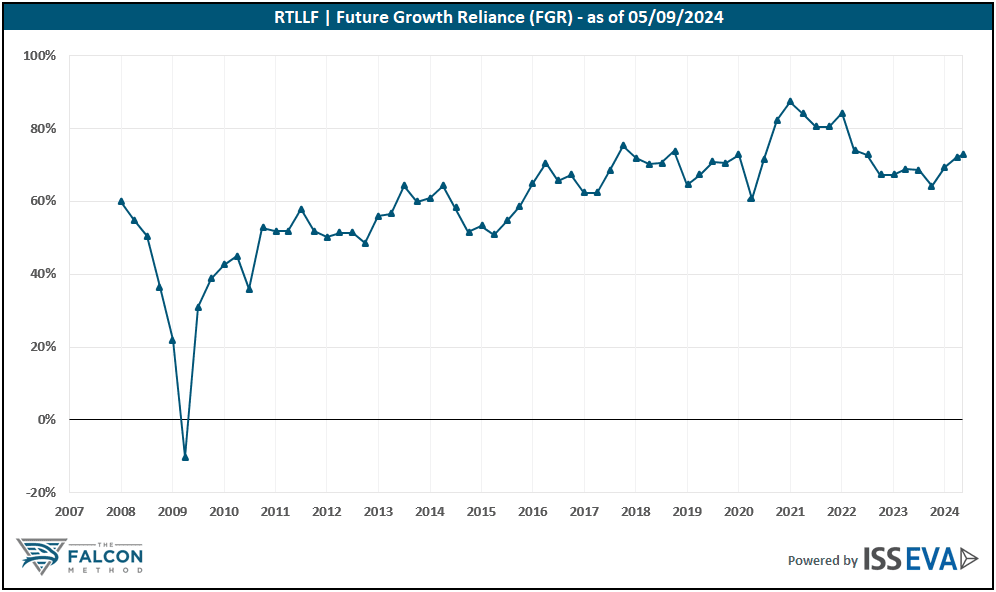

Looking at the stock’s valuation, Rational’s stock has always been extremely highly rated, except during market downturns like the 2008-09 recession or the COVID crisis in 2020. In other words, if you look solely at the growth characteristics of the business, you could have seldom bought this stock at a seemingly sensible valuation. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

At this price, the market anticipates a 20% EVA growth annually over the next 10 years, which is nearly impossible to justify. The 2.4% NOPAT Yield is also starkly below the market average of 4.0%.

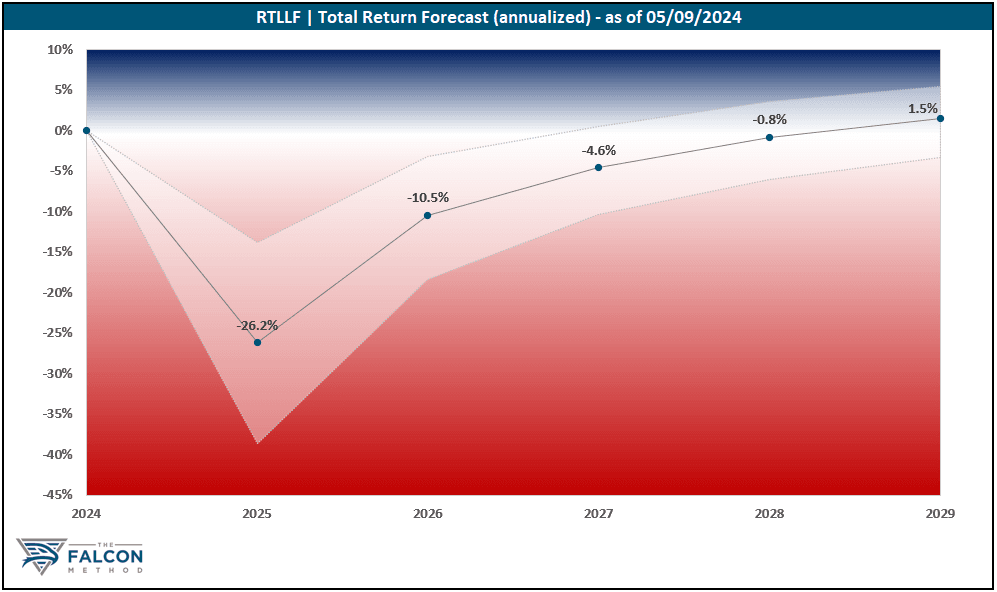

Overall, the time to get excited is not now. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Rational for now.

The verdict

When assessing the most influential risk factors surrounding this investment thesis, we must first mention that Rational is sensitive to short-term macroeconomic headwinds. An unfavorable macro landscape can reduce restaurants’ willingness to invest in new equipment, such as combi-steamers, while the pace of new openings is also subdued in times of economic turmoil.

The competitive landscape might also change. For now, most direct competitors are small, private companies lacking the firepower to match Rational’s R&D investments. However, meaningful industry consolidation could spawn better-capitalized entities that theoretically would be able to catch on in technological development.

Despite these possible threats, we would happily add this family-owned, disruption-proof EVA Monster to our FALCON Portfolio at a price where the valuation component becomes a tailwind, even though the ~10% fundamental return outlook barely surpasses our minimum requirement. Regarding position sizing, we remain cautious, aiming for a 2-3% exposure.

The company ranked 42nd of our 59 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 13% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!