With this series, we’d like to give you some perspective on the companies in our distinguished EVA Monster universe. This rare breed of quality-growth stocks is worthy of your attention, and getting to know these businesses may pay off handsomely down the road.

As a quick recap, EVA Monsters have three things in common:

- They earn high returns on the capital they employ.

- They have growth opportunities that allow them to reinvest most of their cash flows at high rates of return.

- They have a sustainable competitive advantage (that Warren Buffett calls “moat”), which prevents their competitors from taking away their extraordinary profitability.

These characteristics tend to result in a strong (double-digit) fundamental return potential, meaning that no valuation tailwind is necessary to get great investment results with EVA Monsters. (These case studies explain this pretty well.)

As Charlie Munger said:

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6 percent return – even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with one hell of a result.”

We also shared the math proof of why buying EVA Monster stocks at a fairish valuation makes perfect sense for long-term investors. (Look for the “math example” in this post to alleviate your doubts.)

To round off the short introduction, we (1) try to avoid overpaying for EVA Monsters, (2) closely monitor the fundamental performance and management’s capital allocation decisions throughout our holding period, and (3) hold our positions as long as the underlying investment thesis remains intact, ideally for decades, to let compounding do the heavy lifting.

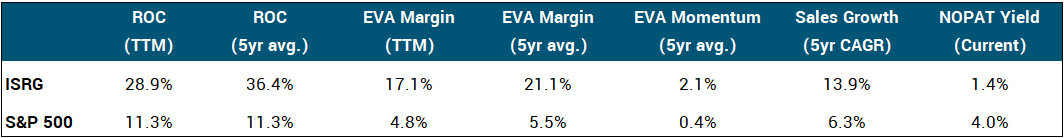

Without further ado, numbers prove that Intuitive Surgical (ISRG) is one of the top EVA Monsters that we have analyzed so far, so it is worthy of your close attention. This company has a deep moat, coupled with the tailwind of strong expected growth in the robotic surgery market.

Intuitive Surgical develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care. The company offers the da Vinci Surgical System to aid in complex robotic surgical procedures and the Ion endoluminal system, which extends its commercial offerings beyond surgery into diagnostic procedures, enabling minimally invasive biopsies in the lung. The company was incorporated in 1995 and is headquartered in Sunnyvale, California.

Intuitive Surgical has a truly interesting origin story. The research that eventually led to the development of the da Vinci system was carried out in the 1980s at Stanford. The prototype called SRI also caught the attention of the defense industry, which saw a new possible way to do “tele-surgery” on the battlefield. A physician named Dr. Frederic Moll became interested in the system and eventually, in 1995 he raised enough capital (together with two other founding partners) to acquire the rights to license the SRI device. This marked the birth of Intuitive Surgical.

Advanced robotic systems provide precise and powerful solutions with high-performance vision, expanding the capabilities of the care team to enhance minimally invasive care. Although the sales of these systems constitute the cornerstone of Intuitive Surgical’s revenue streams, they contribute only a relatively small portion to its overall revenue, accounting for 27% as of fiscal 2022. This primarily includes sales and leasing revenue from the da Vinci Surgical System, boasting an average selling price of approximately $1.5 million.

Crucially, Intuitive’s instruments and accessories have limited lifespans and will either expire or wear out with use during surgery, necessitating replacement. The company typically earns between $600 and $3,500 in instruments and accessories revenue per surgical procedure performed, depending on the type and complexity. In total, these contribute to 56% of companywide sales.

We believe that understanding Intuitive’s commercial success is best achieved by initially examining its value proposition for the various stakeholders within the healthcare system. Commencing with patients, two critical factors are procedure efficacy (a measure of the success of the surgery in resolving the underlying disease) and invasiveness (a measure of patient pain and disruption of regular activities, including the length of hospital stay and time to full recovery). Robotic surgeries represent the pinnacle of minimally invasive care, with the da Vinci Surgical System enabling surgeons to perform laparoscopy while comfortably seated at an ergonomic console, viewing an image of the surgical field.

We believe that surgeons are the stakeholders who benefit the most from the system, and they also play a crucial role in the platform’s rapid adoption. Although it is hospitals or governments that purchase the da Vinci system, Intuitive Surgical’s primary customer is the surgeon, who prefers not to be hunched over and wants to sit comfortably at the console while the robot uses force and controls precision.

Lastly, hospitals also benefit from the placement of robotic surgical systems, even though the cost per procedure is higher than open surgery and manual laparoscopy. The advantage stems from fewer complications and significantly reduced post-surgery hospitalization.

Intuitive benefits from switching costs, beginning with junior surgeons who become familiar with the da Vinci system simulators already in medical school. Additionally, hospitals that have invested in these platforms are unlikely to replace them with a theoretical competitor’s product and risk disruptions in their healthcare operations

In conclusion, Intuitive currently operates as a monopoly, and its ecosystem will likely remain very sticky even if new competitors emerge through the advancement of general robotics.

Based on the company’s estimates, approximately 20 million soft tissue surgery procedures are performed each year, growing at a 2-4% annualized rate, thanks to an aging population and increased access to healthcare globally. Intuitive anticipates a total of 6 million “line-of-sight” procedures, implying the current robotically addressable portion with existing products and clearances. Despite the company’s annual procedure volume exceeding 2 million, the total addressable global market, several times the size, still offers ample growth opportunities.

In aggregate, a low-double-digit revenue growth rate appears realistic for the overall company.

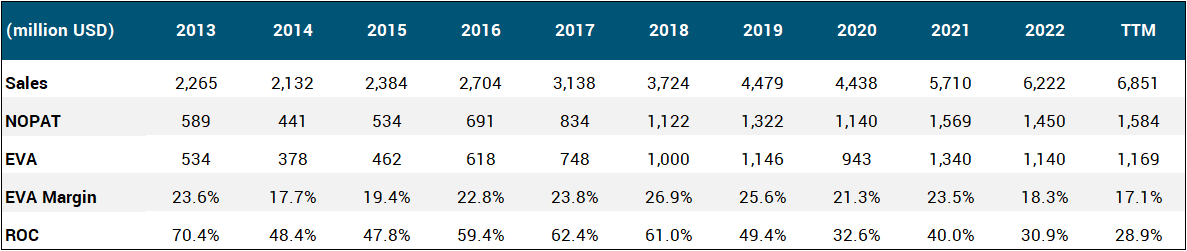

Turning to capital allocation, Intuitive typically reinvests around half of its internally generated cash, mainly into R&D and production capacity enhancements. These reinvestments have yielded exceptional returns, earmarked by ROC figures averaging between 30-50%. The company’s balance sheet is spotless, with zero debt and a healthy cash position.

As for capital distributions, the company has never paid a dividend and it does not expect to do so for the foreseeable future. Even though share repurchases are carried out frequently (spending a significant sum), the net effect on share count is completely muted by the firm’s stock-based compensation policy, which we believe to be very excessive.

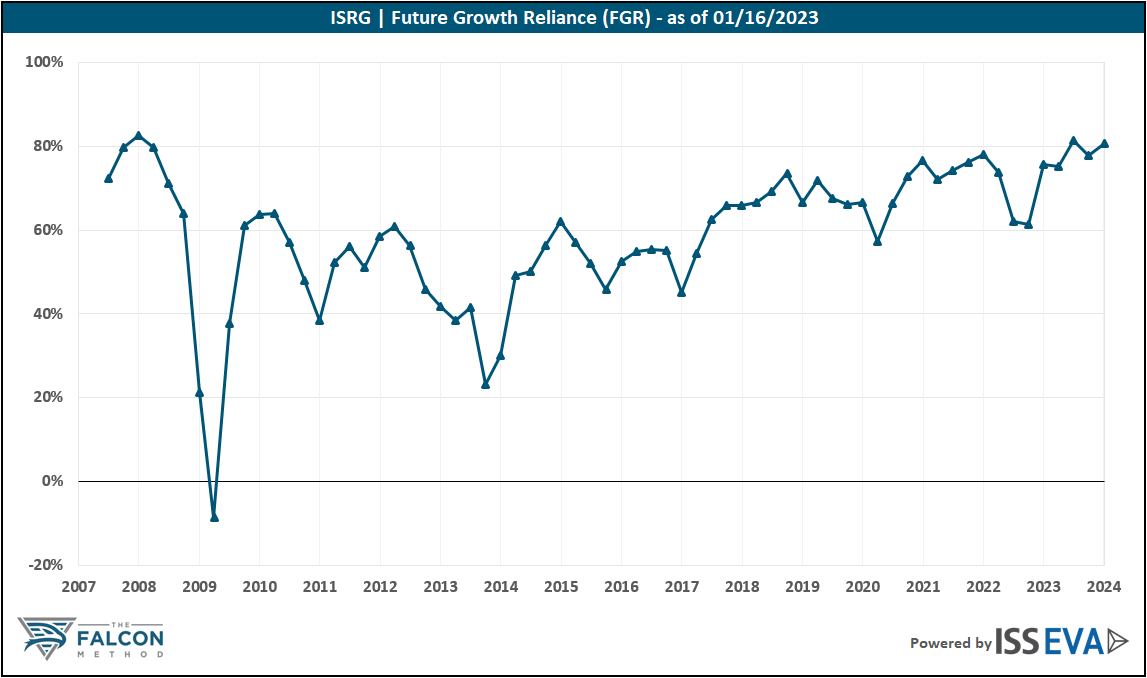

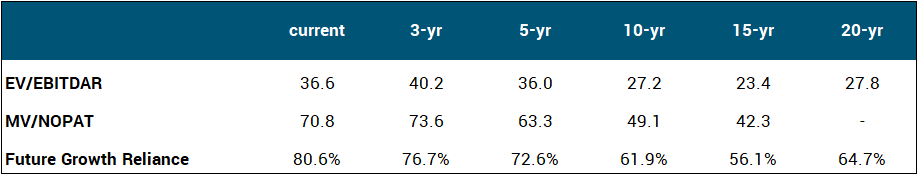

Looking at the stock’s valuation, the company has always been highly rated by the market and this is precisely the reason why we consider a comparison to historical figures rather meaningless. At the current share price, the market implies 27% EVA growth annually over the next 10 years, which is completely bonkers in our view. Please see below the valuation metrics of the EVA framework that remedy accounting distortions to give us a clearer picture on where the stock stands in a historical context.

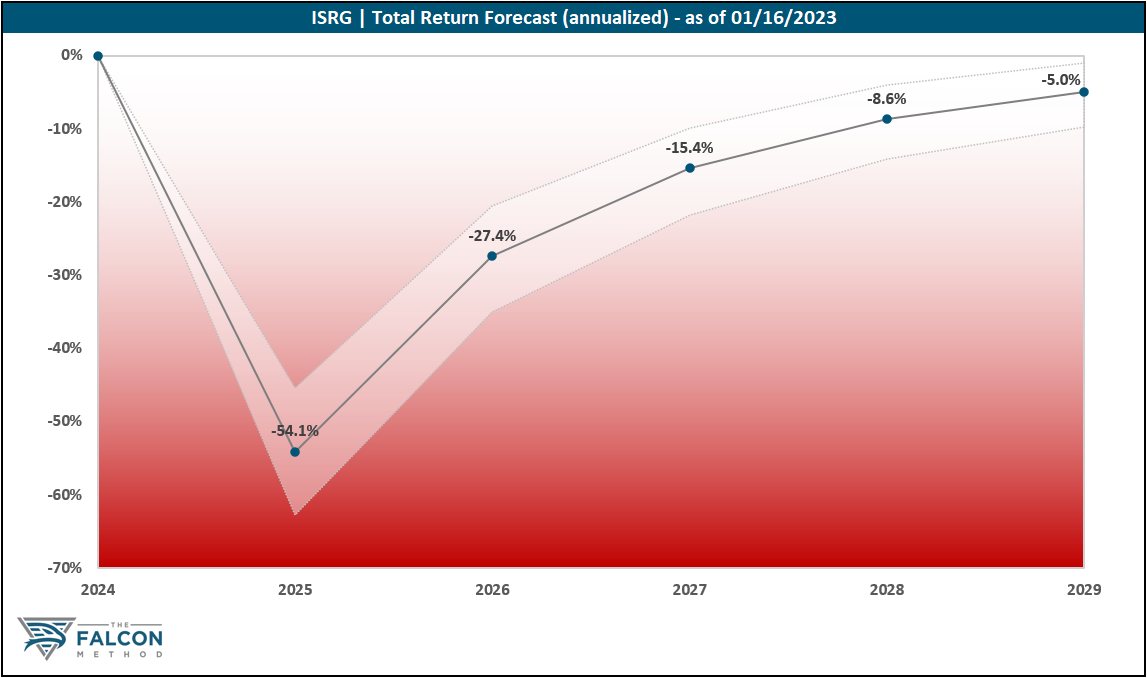

Put it shortly, we would not touch this stock with a 10-foot pole today due to overvaluation concerns. The “Key Data” table and the 5-year total return potential chart speak for themselves.

The FALCON Method can identify much better opportunities in the current market, so we are passing up on Intuitive Surgical for now.

The verdict

While the overall thesis seems bright at the moment, we see several risks that could lead to dark clouds gathering above Intuitive Surgical. One of the most prominent questions is how the future of the entire industry will unfold. If robotic surgery fails to establish itself as a good (preferably better) alternative to manual laparoscopy in a wide array of procedures, Intuitive’s growth could slow considerably.

Moreover, the company may face much tougher competition in the years ahead. Even though it has been the sole monarch for a long time, healthcare giants like Johnson & Johnson and Medtronic are looking to enter this lucrative field. The objective of both companies is none other than to democratize robotic surgery and make it more accessible to all hospitals, reaching those with fewer resources.

While challenges like the emergence of well-capitalized competitors (trying to copy the da Vinci robot) or increased regulatory scrutiny over the firm’s monopolistic position do pose threats, we would be glad to own this business at the right price. Although Intuitive is a great combination of the healthcare and technology megatrends, we are somewhat uncertain about the risks surrounding the business, so we would stay within a 3-5% exposure in our portfolio.

The company ranked 59th of our 59 EVA Monsters at the time of writing, based on its 5-year total return potential. (Businesses from 12 countries are represented on our EVA Monster list.)

It is safe to say that there are far more attractive EVA Monster stocks to buy in the current market, with the highest-ranking ten boasting total return potentials above 13% over our modeled 5-year timeframe. (You can always find the monthly Top 10 in the FALCON Method Newsletter along with our entry price recommendations.)

Want to learn more about our ranking methodology? Start with this blog post!