In the previous part of The Compounder’s Path Series, we learned why a thoughtful screening process can serve as a compass to guide you through the labyrinth of the financial markets. We also noted that employing the right metrics can give you an advantage in the game, even though being a successful investor requires much more than mere number-crunching.

Let’s pick up where we left off and demonstrate why relying solely on a quantitative process is flawed, even when using a highly sophisticated screening framework that addresses accounting distortions. By the end of today’s article, you will understand why you must depend on comprehensive qualitative analysis and cannot avoid the rigorous task of getting to know your investment targets.

Couldn’t Keep a Lid on Success: Lessons from a Tonic Manufacturer’s Struggles

Let’s delve into the example of Fever-Tree, the once-shining early player in the premium tonic market. The company was among the pioneers in this space, with a compelling slogan: “If three-quarters of your drink is the mixer, mix with the best.” It makes a lot of sense; how often have you opted for cheap tonic water to mix with your gin, saving only a small amount compared to Fever-Tree or another premium brand?

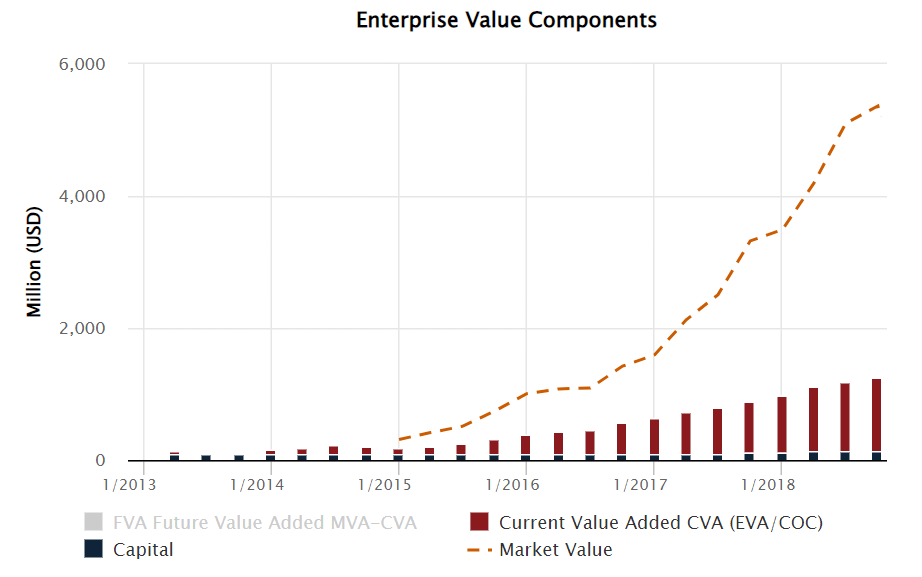

Initially, the numbers were impressive. In the four years following its 2014 IPO, Fever-Tree’s sales and Economic Value Added (EVA) generation soared. The firm boasted sky-high return on capital and EVA margin figures, propelling it to the forefront of quantitative quality-growth screeners. Notably, this led to an explosive increase in its share price, which surged more than 20-fold, creating significant wealth for early shareholders. Take a look:

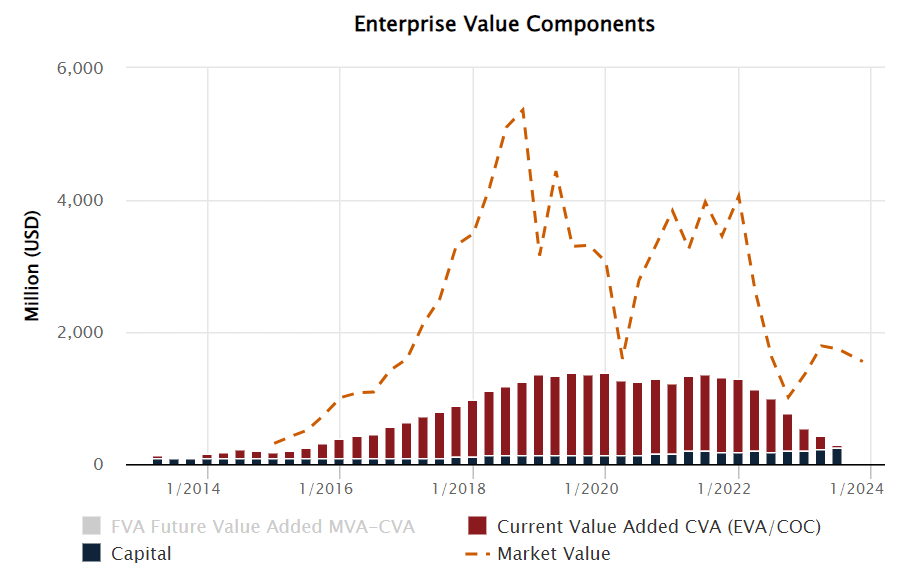

However, this is where the harsh reality set in. Competitors began flooding the market, and Fever-Tree’s brand turned out not to be a differentiating factor justifying a high price for its tonics. Inflationary pressures were the icing on the cake in a negative sense. Even though one could argue that these are transitory in effect, especially as the U.S. has become Fever-Tree’s biggest market and it continues to operate almost entirely from the UK, we contend that Fever-Tree’s declining quantitative performance revealed deeper issues beneath the surface.

As Fever-Tree’s EVA generation began to approach zero, just as one would expect in a fiercely competitive market with diminishing pricing power, it became evident that the company was seriously lacking in the competitive advantage department. To borrow a famous adage from Warren Buffett, “A rising tide floats all boats… only when the tide goes out do you discover who’s been swimming naked.” Take a look at what happened to the company’s EVA generation and how its market value plummeted as a result:

Here comes the million-dollar question: Could a thorough deep-dive analysis have predicted the demise of Fever-Tree’s competitive edge? In our view, starting with the right questions would have certainly helped steer us in the right direction.

- Does the firm have an enduring moat that protects its outstanding profitability from new market entrants?

- Does it possess a strong brand, along with a marketing budget that can bolster its brand power and translate into a widening moat over time?

- Does it maintain a distribution network and global bottling operation that would raise barriers to entry in the market?

- Are established beverage giants planning to enter the market with competing products, potentially outnumbering up-and-coming pure-play players like Fever-Tree due to their deep pockets and global distribution power?

We asked all these questions when Fever-Tree first appeared on our quantitative radar and anonymously concluded that the company’s moat was far from durable. Consequently, we decided against its inclusion in our EVA Monster universe.

The moral of the story is that exceptional quantitative metrics can be a symptom of a wide moat, but only the presence of durable forces that keep competitors at bay can lead to sustained above-average returns. Therefore, the cause-and-effect relationship should not be misunderstood. Just because you find a stock that ranks very high in your otherwise well-developed filtering system, it does not mean it will be a great investment. Far from it, you should never skip the qualitative deep-dive process before making an investment decision.

To help tilt the odds in your favor, you should aim to maintain a shortlisted “investable universe” of great companies that you closely follow. This way, you can form an educated opinion and make a contrarian bet when you have an unshakeable understanding of the underlying business, differentiating between temporary trouble and existential threats. This aligns with the saying that success occurs when opportunity meets preparation.

To quote Buffett again, “The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table.”

In summary, you need to have a clear understanding of the investment case. Too little information can be detrimental, while too much information, without distilling the key factors, can lead to unwanted information overload.

Here’s the most common pitfall: underestimating the effort required to form a qualitative opinion.

You might believe that understanding a company can happen overnight. Unfortunately, that’s not the case. In our experience, our team of three analysts spends several days conducting intensive research on a candidate before we form an opinion and construct our financial models based on well-informed inputs.

We believe that a minimal analysis entails reviewing the past few years’ annual reports, listening to management answering questions on various analyst calls, and assessing the competitive landscape and underlying secular trends to gain a comprehensive understanding of the business’s quality and growth characteristics. Our viewpoint and conviction about a company are then shaped through months of monitoring company-related news, listening to podcasts, reading research papers, and engaging in an ongoing analysis within the team to arrive at conclusions that define our target entry prices.

This can be a formidable task for individual investors, but we are here to assist you. In the last part of The Compounder’s Path Series, we will demonstrate how you can simplify your investment process and achieve the results you desire by dedicating a few hours to this topic each month. Stay tuned.