Welcome to The Compounder’s Path, an exclusive 4-part series where we will demystify the art of making money in the stock market, offering you a step-by-step roadmap to harness the power of time, consistency, and a proper investment strategy. Whether you’re a novice or an experienced investor, we are certain that these key principles will significantly upgrade your financial library and take you to the next level.

We will cover:

- Why building your Investable Universe is crucial for success, and what is the best approach

- Why conventional accounting metrics are hugely misleading, supported by several case studies

- What metric is best suited to measure true shareholder value creation

- The importance of qualitative analysis alongside a quantitative screening process

- And how you can master all this in just a few hours every month

Embarking on a journey into the world of stock investing can often feel like stepping into a dense forest of endless possibilities. The vast array of companies and industries can be overwhelming, and even the most experienced investors could feel lost sometimes. Our goal is to guide you through this intricate maze, helping you to develop a system that you can count on through your journey to financial freedom.

Let’s get straight into it.

The Broader, the Better? Not Quite!

The very first step in your investing journey should be the establishment of a selection process, to arrive at a pool of companies that you are most interested in. This is what we call the birth of our “Investable Universe”, which contains the list of firms we want to gain a deeper understanding of. While the concept of building your Investable Universe sounds simple, there are many culprits along the way. Let’s check on what we believe investors get wrong most of the time.

Your initial instinct might be to cast a wide net, thinking that the broader the selection, the better your chances of finding the best opportunities. After all, if I search as broadly as possible, I should have the best chance of finding mispriced stocks that Mr. Market (temporarily) threw into the garbage bin.

In theory, this strategy sounds like a winner, and you’re not alone in believing it. However, you may have heard the saying that goes, “Jack of all trades, master of none.” In the world of stock investing, casting too wide a net can often leave you overwhelmed and confused, with no clear path to success.

Did you know that there are tens of thousands of public companies available globally? Narrowing the pool to one country, one sector, or one “theme” will still leave you with thousands of stocks.

That’s an enormous pool of potential investments, and even without going into details as to how much time you have to spend on familiarizing yourself with just one company, it is easy to acknowledge that your Universe should contain a maximum of 50-100 firms. In our experience, anything beyond that, you are surely left with either 1) an insurmountable amount of research, or 2) a very shallow understanding of every company inside the Universe.

Now that you understand why developing an Investable Universe is central to your investing success, let’s examine the most common pitfalls we see investors fall into repeatedly.

Pitfall #1: Relying on Gut Feeling

Imagine this: a friend enthusiastically tells you about a “hot” stock or a promising industry, and you think you’ve struck gold. With unwavering faith in your instincts, you dive headfirst into the investment, convinced that you’ve discovered the “diamond in the rough.” It sounds thrilling, but the reality is often different. Much different.

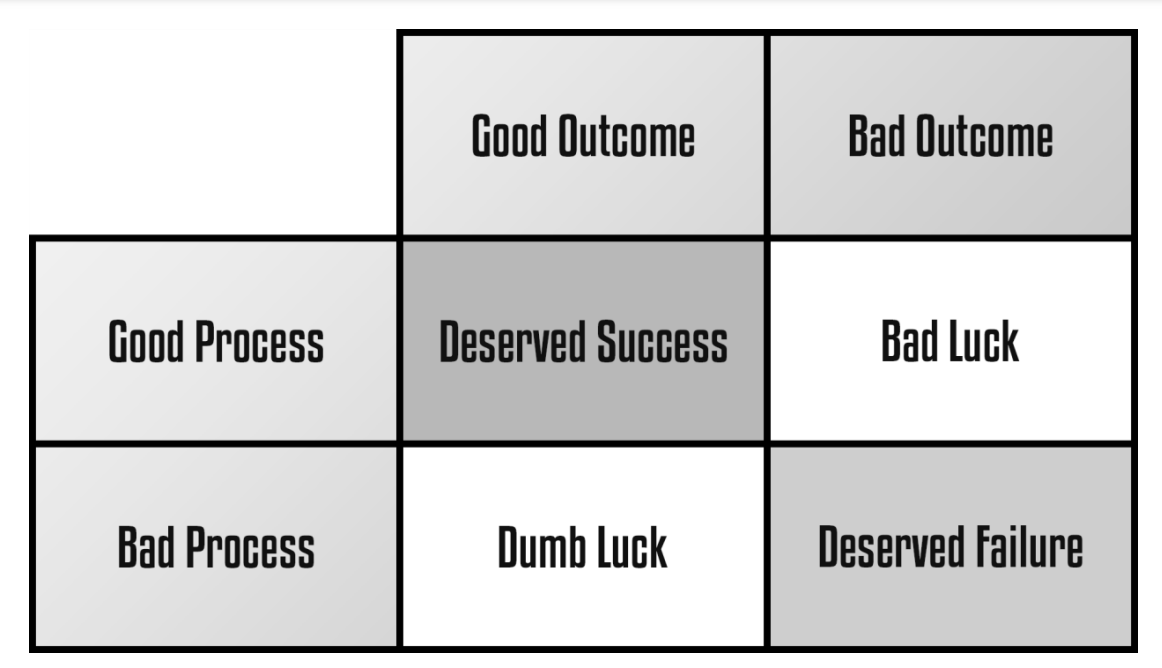

Take a look at this process-outcome matrix which always serves as a guiding post for us when we make investment decisions.

The truth is that while luck can certainly play a role in successful investments, relying solely on your gut feeling places you squarely in the “dumb luck” quadrant. Even a bad process will yield a good outcome sometimes, while it is also true that a good process will not always result in a runaway success. Understanding this concept has had a major impact on us.

Unfortunately, luck is not a reliable strategy for consistent success in the complex world of stock investing.

What you truly need is a well-defined process – a system backed by historically proven factors that can consistently deliver you the results you desire. You want to find yourself in the upper-left section of the matrix, where a good process leads (given that you provide enough time for a strategy to bear fruit) to your “deserved success”. Having a reproducible system is the only way that allows you to invest your hard-earned money with confidence, month after month.

Pitfall #2: Falling for the Illusion of Solo Superstars

It’s hard not to be starstruck by high-profile investors who seem to consistently hit home runs while venturing into the most obscure corners of markets. You might think of legendary investors like Mohnish Pabrai, known for his captivating Turkish adventures where admittedly, he managed to 3-5x his investments in just a few years. His successes are inspiring, and we often hear stories of similar, renowned investors’ extraordinary journeys.

But here’s the inside scoop: even he admits openly that he receives dozens of tips and ideas from his extensive network of value investors. This network is something that the average investor doesn’t have access to, making it (unfortunately) an uneven playing field. Not to mention that comparing yourself to the greatest minds in the field who have honed their craft through decades of experience may not serve your interest.

All in all, we firmly believe that trying to replicate the processes and portfolios of world-class asset managers is not a reliable path for the everyday investor (even if the financial media and some investment services would like you to believe this.)

On top of that, one aspect we haven’t touched on yet is the concept of survivorship bias. Have you ever wondered how many failures these investors have encountered before discovering their successes? For every multi-bagger, there are likely numerous investments that didn’t pan out as expected. But you don’t read about those, do you?

Consider the immense amount of time they’ve spent on researching ideas that ultimately provided no value. These failures are rarely publicized, and this skewed perspective can lead aspiring investors down a misleading path. While it’s essential to learn from successful investors, it’s equally crucial to recognize that behind every victory are countless attempts that didn’t hit the mark.

Pitfall #3: The Perils of a Selection Process That Produces an Ever-Changing Investable Universe

The reality is that researching new stock prospects thoroughly is a time-consuming endeavor. Imagine you’ve found a stock screener that perfectly aligns with your investment goals and spits out companies that become a part of your Investable Universe. You diligently run it every month, just after your paycheck hits your bank account.

But here’s the catch: every month, your screener spits out dozens of new candidates that meet your criteria. It’s like trying to sip from a firehose of information.

In our experience, evaluating these candidates comprehensively is no small feat. It can take several days or even weeks just to get to know the story behind each of these companies well enough to feel comfortable investing in them. You’ll find yourself buried in annual reports, presentations, earnings call transcripts, and more.

This level of in-depth analysis is a luxury that full-time investors can afford, but for those balancing investing with other responsibilities, it’s a challenging task. An alternative would be to update your Investable Universe every year, but if the 50-100 candidates are completely different than the year before, you are left with a daunting task once again.

The key takeaway here is that even a good selection process yields little value to you if its results are changing too frequently. The stability of the outcomes (in terms of companies worthy of your analysis) is an equally important aspect to consider.

When you’re inundated with too many analytical tasks and you’re unsure about some of the firms you’re considering, you’re not getting any closer to achieving true financial freedom in every sense of the word.

Let’s recap what we have covered so far as a successful recipe for stock selection:

You should establish your Investable Universe. With the help of this, you reduce the pool of candidates to a manageable number, ideally not more than 50-100 companies. More is not better. You need a list that doesn’t overwhelm you with countless options but instead offers a reasonable selection to work with effectively.

Rely on historically proven factors. Don’t confuse your gut feeling and the stock tips of friends with a true selection system. Your investments should be based on factors with a track record of success. Only this can ensure that you have a good process that is consistently reproducible, and will prove to be very valuable over the long term. Don’t confuse “dumb luck” (which every fool can enjoy once in a while) with “deserved success”.

Avoid drawing false conclusions from the successes of renowned investors. They have resources that are not available to the average investor, while the survivorship bias ensures that you only hear about their home-run investment, and not much about their countless failures.

Don’t underestimate the value of consistency. Your Investable Universe should remain relatively stable over time. Constantly changing stocks can disrupt your focus, and lead to an overwhelming amount of due diligence needed.

But there’s one more essential element to consider. Your Investable Universe is only as good as the indicators and metrics you use in your filtering process. When you’re sifting through the stock market to separate the wheat from the chaff, it’s crucial to have the right lenses on.

You might believe that financial metrics like operating margins, earnings per share (EPS) or free cash flow (FCF) growth, and price-to-earnings (P/E) multiples can form the foundation of a successful investment process. However, the reality is that these traditional accounting metrics can paint a completely false picture regarding true shareholder value creation, and are far from sufficient.

In the second part of The Compounder’s Path Series, we will prove why these traditional ratios do not provide the comprehensive insight you need. We’ll show you why it’s vital to employ the best and most fitting metrics available that show a true picture of a company’s economic profit generation, to make informed investment decisions and not squander your precious time.

Investing should be an empowering and enriching journey, and with the right tools and knowledge, you can take huge leaps towards achieving financial freedom. Stay tuned for more!