Summary

- “Religion stocks are not safe stocks. Irrational faith and false perception of safety come at a large cost: the hidden risk of reduction in the religion premium.” (Vitaliy Katsenelson).

- Two components of the total return equation are clearly against Coca-Cola investors. The dividend alone will not save them.

- Buying the stock today is like playing musical chairs and expecting the music to never stop (expecting investors to continue paying a lot for a little).

- See how Coca-Cola fares according to the FALCON Method.

Coca-Cola (NYSE:KO) is an iconic American company. Most people think it is one of the safest stocks to invest in and this conviction elevates it to religion stock status, meaning chronic overvaluation.

Religion stocks are not safe stocks. Irrational faith and false perception of safety come at a large cost: the hidden risk of reduction in the religion premium. The risk is hidden because it never showed itself in the past. Religion stocks by definition have had an incredibly consistent track record. … It is hard to predict how far the premium will inflate before it deflates – but it will deflate eventually. When it does, the damage to the portfolio can be enormous. -Vitaliy Katsenelson in his book Active Value Investing

Here’s what catches the eye

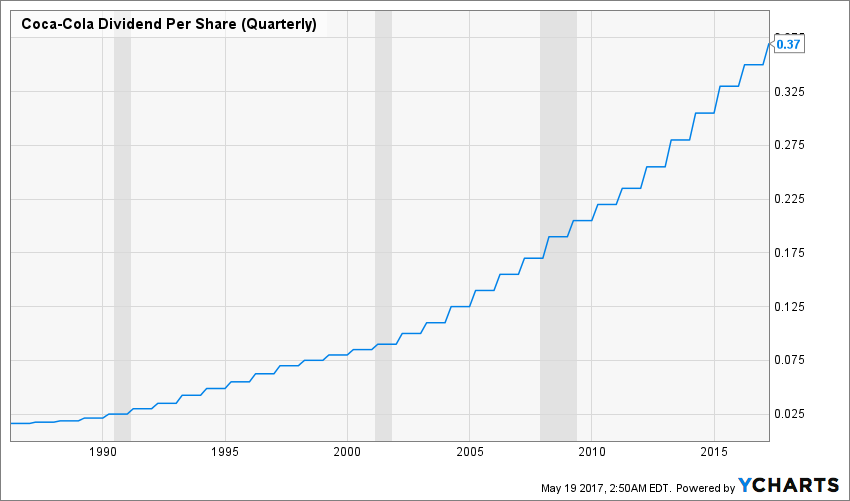

Coca-Cola is a dividend champion with 55 straight years of higher dividends. Not too many companies of this kind offer a dividend yield of nearly 3.4% these days when the S&P 500’s benchmark level is below 2%.

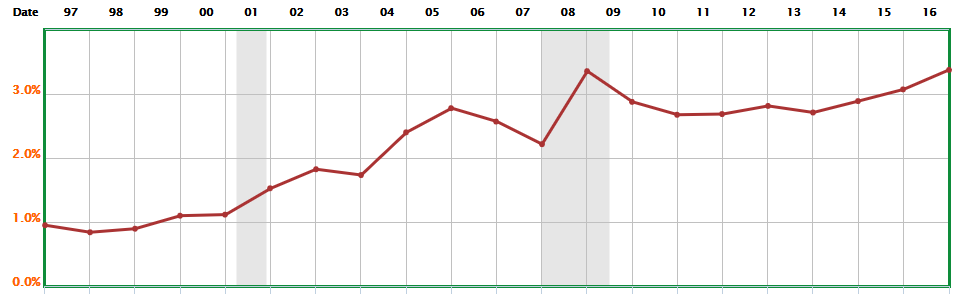

On the top of this the current yield is well above Coke’s historical average, so it could seem wise to scoop up these quality shares while they are on sale. But are they really on sale or do many investors miss an important point?

Dividend yield of Coca-Cola (KO); Source: FAST Graphs

The dividend is just one of the 3 building blocks of total return

Equity returns come from two sources: stock appreciation and dividends. Stock appreciation is mathematically driven by two variables: earnings growth and price-earnings change. So we have three components of total return: dividends, growth and the valuation multiple. Having already touched on the dividend part, let’s turn our attention to the other two.

The non-existent growth: If you look at the diluted earnings per share and the free cash flow per share data of the last 5 years the best word I can come up with is “stagnant.”

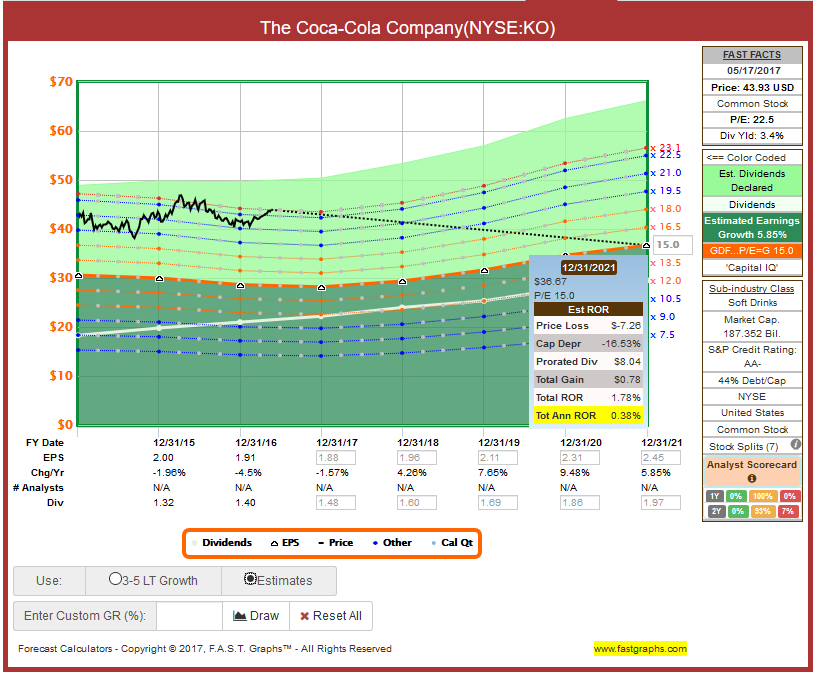

Source: FAST Graphs

The overextended valuation multiple: Currently you need to pay more than 23 times earnings for the shares of a company the growth characteristics of which leave a lot to be desired. Stocks with such a growth profile deserve a P/E multiple closer to 15 based on historical data. Can Coke’s multiple still shoot up to the 30s or 40s? Sure! Why not? But speculating on that would be reckless.

What can go wrong?

Let’s play with the numbers a little bit. Assume that Coke continues to pay its dividend, which seems to be a very safe bet. Assume that the company’s earnings don’t grow, and its P/E ratio declines to 15 (which is far from an irrational level) within five years. In this scenario, turning to the total return equation shows that over this five-year period the investor will receive 3.4 percent dividend + 0 percent earnings growth minus 8.2 percent P/E decline per year = -4.8 percent a year. (If the P/E ratio declines 8.2% every year it will land on 14.99 at the end of our five-year period.)

Now if you find this example too abstract (or shocking), take a look at the calculations below that include analyst estimates and a P/E multiple of 15 at the end of the period. The annualized total return is 0.38% in this scenario. It is really hard to win if two components of the total return equation are against you but you are still swimming against the tide since the dividend is the only factor you focus on.

Let’s see how a well-structured investment process could highlight these problems and prevent you from making a costly mistake!

A quick look at how Coca-Cola fares according to the FALCON Method

The FALCON Method is a structured stock selection process that serves the construction of a buy and hold portfolio with both an income and total return focus. The model is about 90% quantitative and 10% qualitative. The process includes the following steps.

Step1: Narrow down the field of stocks. I focus on a group of stocks that tend to outperform according to historical data. My minimum requirement is 20 years of immaculate dividend history, meaning there are no dividend cuts within this period. Coca-Cola easily PASSES, since it is a dividend champion with 55 straight years of higher dividends.

Step2: Check the valuation. I focus on the stocks that seem to be undervalued historically based on various metrics.

| current | 3yr | 5yr | 10yr | 15yr | 20yr | |

| P/E | 23.1 | 21.7 | 21.3 | 19.6 | 19.7 | 22.6 |

| P/FCF | 28.4 | 27.4 | 24.5 | 22.6 | 22.2 | 26.3 |

| P/EBITDA | 16.6 | 15.5 | 15.1 | 14.0 | 14.1 | 15.8 |

Source: S&P Capital IQ, FAST Graphs

Current figures are based on blended ratios, meaning a weighted average of the most recent actual reported earnings plus the closest quarterly forecast earnings.

You can see from the figures above that the historical averages of these multiples are rather high, showing that the religion premium is absolutely “normal” for Coke. However the current valuation ratios are even higher than the historical averages and investors are paying such prices for a company that has not shown any signs of growth (in earnings and cash flow) recently.

I believe valuation is not an exact science and we should think about certain ranges of these multiples rather than exact levels. However, no matter what glasses I put on, Coca-Cola cannot be categorized as undervalued today, and for my taste it is not even fairly valued. Coke FAILS the test of valuation, so the FALCON Method would not allow me to buy this stock at the current price. (I am still showing you the remaining steps, since they have some important messages.)

Step3: Three hurdles to filter them. I use absolute threshold criteria (dividend yield, free cash flow yield and shareholder yield) to determine whether a stock is good enough to invest my capital or I should pass up the opportunity. I deliberately define low limits with all the 3 indicators, since my experience shows that meeting all 3 low requirements together usually disqualifies a very large chunk of stocks on my list, but leaves just enough of them to continue the analysis. So this is a very tough combined filter in spite of seeming to be a bit lenient on the single factors.

| Dividend Yield | Free Cash Flow Yield | Shareholder Yield |

| 3.4% | 3.6% | 5.1% |

Source: Morningstar, based on TTM data

Most investors find Coca-Cola attractive because of its high dividend yield and immaculate dividend history. However you should notice that the company is paying out nearly all its free cash flow as dividends meaning that the coverage looks awful with a FCF payout ratio of about 95%. I would never invest in a stock offering a 3.6% FCF yield. This is what the absolute hurdles are for and these figures point towards a very clear FAIL at this step as well.

Step4: Rank the survivors. I am using a multifactor quantitative ranking the factors of which are mostly Chowder-like numbers of different timeframes. Coke ranks 114th of the 322 stocks of the FALCON Method – surely not an opportunity I would get excited about at the moment.

Step5: Enter the human. This step involves some qualitative judgment, but it is far from a Buffett-like deep analysis since not too many of us can carry that out at such a level and with that kind of confidence.

Religion stocks often pass the quality test with flying colors, as past success was driven by a strong sustainable competitive advantage. -Vitaliy Katsenelson in his book Active Value Investing

There is no question about the quality of the Coca-Cola Company. Valuation is an entirely different matter. I would not recommend buying Coke at the current levels. The company should either start showing some growth or the price should reflect the no-growth scenario. Until one of these happens, there are much better opportunities out there.

Takeaway

Coke has been commanding a religion premium for ages. Will this continue indefinitely? Buying the stock today is like playing musical chairs and expecting the music to never stop (expecting investors to continue paying a lot for a little). Buying Coke at these levels is more like gambling than investing since two components of the total return equation are clearly against you. The all-round stock selection process of the FALCON Method prevents us from making such mistakes and directs our attention to the most attractive dividend paying stocks in any kind of market.

Get my FREE Guide on Investing!

Discover how to build passive income and wealth with the confidence that evidence-based investing can give you.