This story started in May 2014 when I received a free dividend newsletter full of eye-catching titles. I was subscribed to all the free stuff on the internet at that time so I really had to filter out the noise if I wanted to keep my life together and not spend all the day with my inbox. Most of the time all I did was to scroll through such newsletters in a few moments and I hardly ever clicked on any of the articles included.

This time a title said that a company I’ve never heard of (Cracker Barrel) increased its dividend 33% but the market failed to notice it and the stock price had hardly moved. This grabbed my attention and I thought to myself: why not have a look at this story? I had a very simple investment process back then and I wanted to check how well this company fit. Here’s what I focused on.

This was the 12th annual dividend increase from Cracker Barrel in the previous 12 years which showed me that the management was serious about returning money to the shareholders. This dividend history clearly signaled that the willingness to pay a dividend is most certainly there

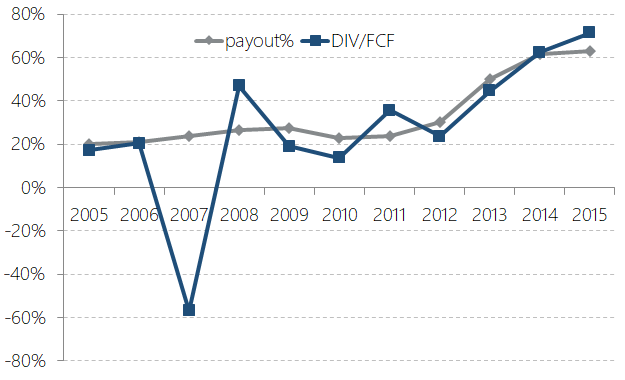

As a next step I wanted to explore how much cash this company was making so that I could gauge how safe the dividend seems to be. I came up with some quick and easy calculations the summary of which you can see on this chart:

At this point I started to become interested, since Cracker Barrel seemed to have a very well covered dividend, a decent history of paying and had just raised the dividend by 33% which told me that the management was more than optimistic about the company’s future. (So not only the willingness but the ability to pay was there as well.)

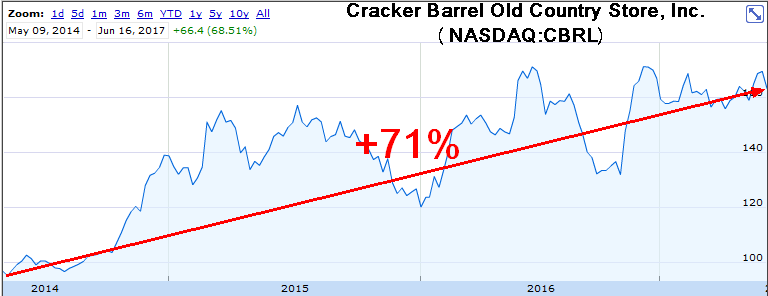

The stock’s current yield was above 4% that was much higher than the market average that time, and this 4% was most certainly higher than the average dividend yield of Cracker Barrel. The following chart told me I may have an opportunity for a bargain purchase here.

The dividend history was OK, the coverage was more than adequate, the current yield and the growth rates were spectacular and the stock seemed to be cheap in historical comparison. I pressed the BUY button at a price of $95.31.

And now comes the boring but profitable part of the story. This Cracker Barrel did nothing but kept raising its regular quarterly dividends and paid me a special dividend annually as well. The table below shows that by the beginning of August 2017 I will have recuperated more than 25% of my original investment in the form of dividends.

Since the total return has a price and a dividend component as well it is time to look at the stock price. At the time of this writing Cracker Barrel trades at $163.3, which means that I am sitting on an unrealized profit of 71.4%.

My plans for the future? As long as this company keeps raising its dividends and is paying me nearly 9% of my initial investment every year (regular and special dividends combined), I see absolutely no reason to sell. My investment method is about buying right and holding onto my cash cows thereafter until they become extremely overvalued. Cracker Barrel is far from that level at the moment so I’m in for some calm and lucrative dividend harvesting.

Get my FREE Guide on Investing!

Discover how to build passive income and wealth with the confidence that evidence-based investing can give you.